Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0003

Pages:88

Published On:August 2025

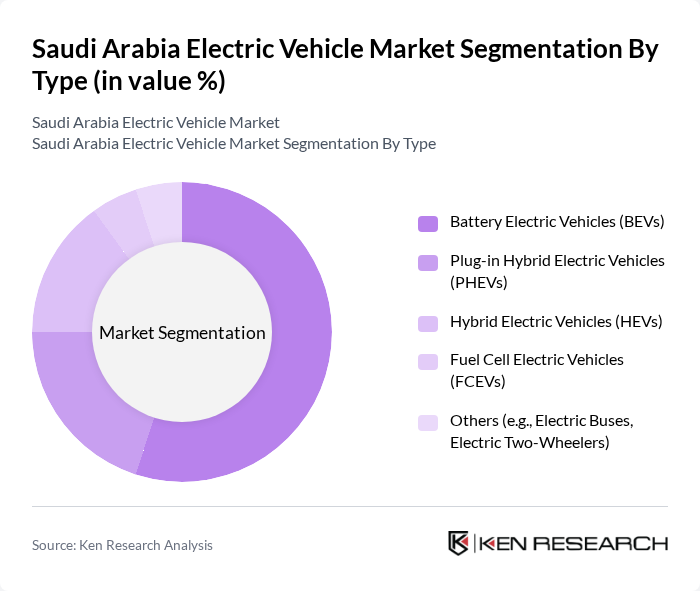

By Type:The electric vehicle market can be segmented into various types, including Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs), Fuel Cell Electric Vehicles (FCEVs), and Others (e.g., Electric Buses, Electric Two-Wheelers). Among these, Battery Electric Vehicles (BEVs) are currently leading the market due to their zero-emission capabilities and advancements in battery technology, which have improved range and charging times. The growing consumer preference for fully electric options, coupled with government incentives and the entry of luxury brands, has further propelled the demand for BEVs .

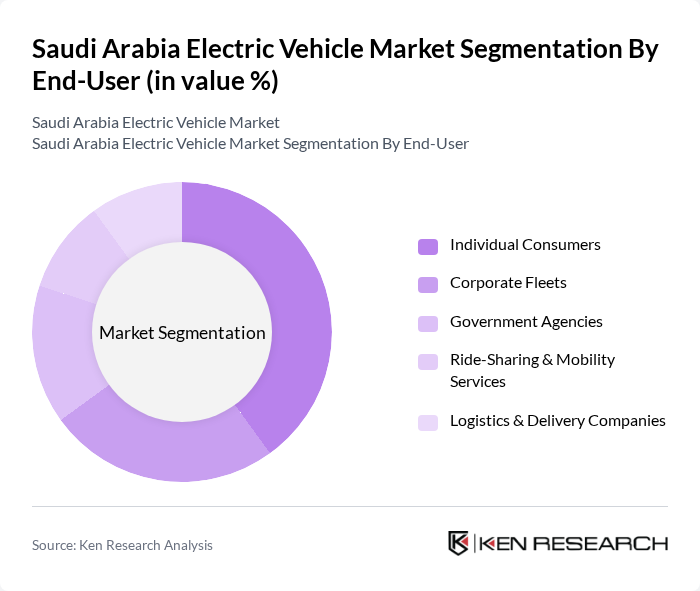

By End-User:The electric vehicle market is segmented by end-users, including Individual Consumers, Corporate Fleets, Government Agencies, Ride-Sharing & Mobility Services, and Logistics & Delivery Companies. Individual Consumers are the dominant segment, driven by increasing environmental awareness, the availability of a growing variety of models, and luxury EV adoption. Corporate Fleets are also gaining traction as companies seek to enhance their sustainability profiles and reduce operational costs through electric vehicle adoption, with commercial fleet electrification accelerating in logistics and delivery sectors .

The Saudi Arabia Electric Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lucid Motors, Inc., Tesla, Inc., Ceer (Saudi EV Company, PIF-backed), BYD Company Limited, Hyundai Motor Company, Kia Corporation, Nissan Motor Corporation, BMW AG, General Motors Company, Volkswagen AG, Ford Motor Company, NIO Inc., Xpeng Motors, Geely Auto Group, MG Motor (SAIC Motor Corporation Limited) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the electric vehicle market in Saudi Arabia appears promising, driven by increasing government initiatives and consumer demand for sustainable transportation. As the nation invests heavily in infrastructure and technology, the market is expected to witness significant growth. The integration of smart technologies and autonomous features in EVs will further enhance their appeal. Additionally, partnerships with renewable energy sources will likely play a crucial role in supporting the transition to electric mobility, ensuring a cleaner and more efficient transportation ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Battery Electric Vehicles (BEVs) Plug-in Hybrid Electric Vehicles (PHEVs) Hybrid Electric Vehicles (HEVs) Fuel Cell Electric Vehicles (FCEVs) Others (e.g., Electric Buses, Electric Two-Wheelers) |

| By End-User | Individual Consumers Corporate Fleets Government Agencies Ride-Sharing & Mobility Services Logistics & Delivery Companies |

| By Sales Channel | Direct Sales Dealerships Online Platforms Authorized Importers/Distributors |

| By Price Range | Budget Segment Mid-Range Segment Premium/Luxury Segment |

| By Charging Type | Home Charging Public Charging Fast Charging (DC) Super Charging |

| By Vehicle Size/Class | Compact Cars Sedans SUVs Commercial Vehicles (Light/Medium/Heavy) |

| By Policy Support | Subsidies Tax Exemptions Grants for Infrastructure Development Local Content Requirements |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Awareness and Attitudes | 150 | General Public, Potential EV Buyers |

| Automotive Industry Stakeholders | 80 | Manufacturers, Distributors, Dealers |

| Government and Regulatory Bodies | 40 | Policy Makers, Regulatory Officials |

| Charging Infrastructure Providers | 60 | Infrastructure Developers, Energy Companies |

| Environmental and Sustainability Experts | 40 | Researchers, NGO Representatives |

The Saudi Arabia Electric Vehicle market is valued at approximately USD 850 million, driven by government initiatives to reduce carbon emissions, investments in charging infrastructure, and increasing consumer awareness of sustainable transportation options.