Region:Asia

Author(s):Geetanshi

Product Code:KRAD5980

Pages:100

Published On:December 2025

By Drug Class:The bronchodilators market can be segmented into various drug classes, including Short-acting beta-agonists (SABAs), Long-acting beta-agonists (LABAs), Anticholinergic bronchodilators (SAMAs/LAMAs), Methylxanthines (e.g., theophylline), Combination bronchodilator therapies, and Others. Among these, SABAs are particularly popular due to their rapid onset of action, making them the first-line treatment for acute asthma attacks.

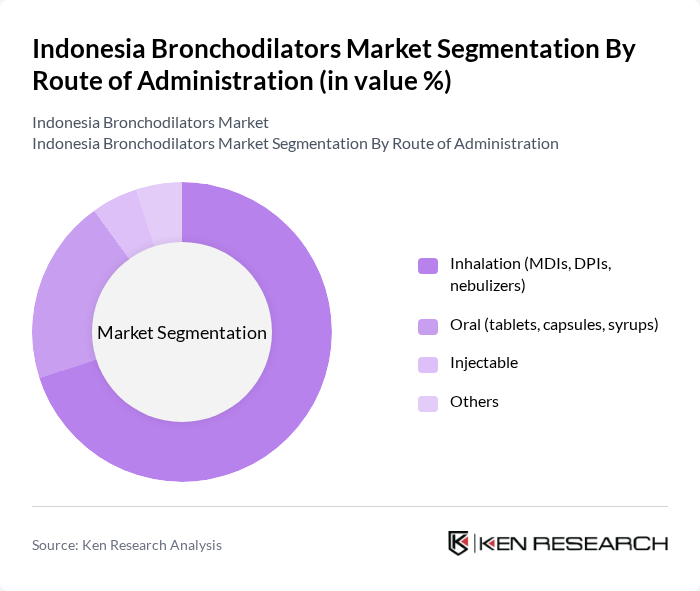

By Route of Administration:The bronchodilators market is also categorized by the route of administration, which includes Inhalation (MDIs, DPIs, nebulizers), Oral (tablets, capsules, syrups), Injectable, and Others. Inhalation methods are the most widely used due to their direct delivery to the lungs, resulting in faster therapeutic effects and fewer systemic side effects.

The Indonesia Bronchodilators Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Kalbe Farma Tbk, PT Kimia Farma Tbk, PT Indofarma Tbk, PT Dexa Medica, PT Soho Global Health Tbk, PT Phapros Tbk, PT Sandoz Indonesia, PT Boehringer Ingelheim Indonesia, PT AstraZeneca Indonesia, PT GlaxoSmithKline Indonesia, PT Novartis Indonesia, PT Sanofi Indonesia, PT Bayer Indonesia, PT Guardian Pharmatama, PT Otto Pharmaceutical Industries contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia bronchodilators market is poised for significant transformation, driven by technological advancements and evolving patient needs. The integration of digital health technologies, such as mobile health applications, is expected to enhance patient engagement and adherence to treatment. Additionally, the increasing focus on personalized medicine will likely lead to tailored therapies that cater to individual patient profiles, improving treatment outcomes and expanding market reach. These trends indicate a promising future for the bronchodilator market in Indonesia.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Short-acting beta-agonists (SABAs) Long-acting beta-agonists (LABAs) Anticholinergic bronchodilators (SAMAs/LAMAs) Methylxanthines (e.g., theophylline) Combination bronchodilator therapies Others |

| By Route of Administration | Inhalation (MDIs, DPIs, nebulizers) Oral (tablets, capsules, syrups) Injectable Others |

| By Indication | Asthma Chronic Obstructive Pulmonary Disease (COPD) Other obstructive airway diseases |

| By End-User | Public hospitals Private hospitals Specialized respiratory clinics Primary care centers and Puskesmas Home-care settings Others |

| By Distribution Channel | Hospital pharmacies Retail pharmacies / apotek Online pharmacies / e-commerce platforms Government procurement (JKN/BPJS channels) Others |

| By Patient Demographics | Pediatric patients Adult patients Geriatric patients Others |

| By Region | Java Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Papua & Maluku |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers (Pulmonologists) | 100 | Respiratory Specialists, General Practitioners |

| Pharmacy Sector Insights | 80 | Pharmacists, Pharmacy Managers |

| Hospital Procurement Departments | 70 | Procurement Officers, Supply Chain Managers |

| Patient Experience Surveys | 120 | Patients using bronchodilators, Caregivers |

| Market Access and Policy Experts | 60 | Health Economists, Policy Analysts |

The Indonesia Bronchodilators Market is valued at approximately USD 85 million, reflecting a five-year historical analysis. This growth is driven by the rising prevalence of respiratory diseases and increased healthcare expenditure.