Region:Asia

Author(s):Geetanshi

Product Code:KRAD4046

Pages:100

Published On:December 2025

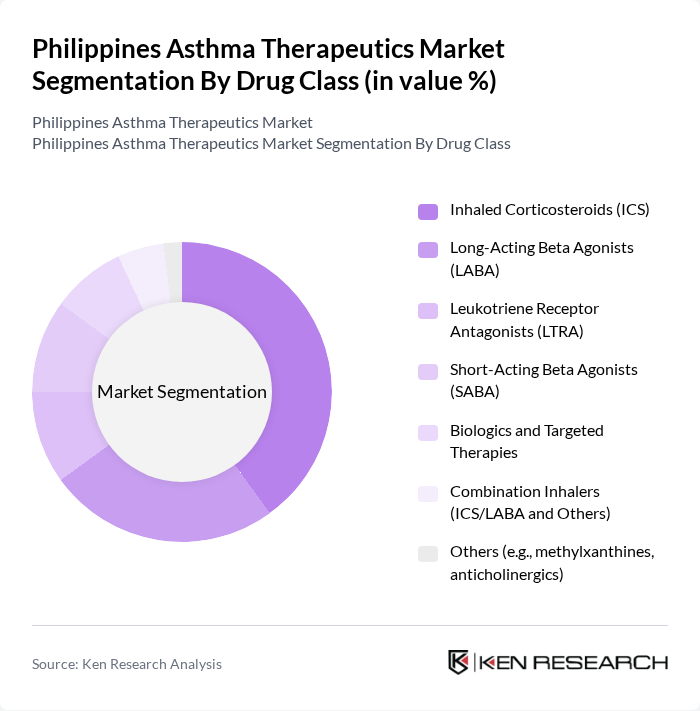

By Drug Class:The drug class segmentation includes various categories of medications used in asthma management. Inhaled Corticosteroids (ICS) are widely recognized in clinical guidelines as first?line controller therapy for persistent asthma because of their proven effectiveness in reducing airway inflammation and exacerbations. Long-Acting Beta Agonists (LABA) are also clinically significant and are typically used in fixed-dose combination with ICS for moderate to severe persistent asthma, improving symptom control and reducing the risk of severe attacks. The market is increasingly seeing the adoption of Biologics and Targeted Therapies, particularly for severe eosinophilic or allergic asthma not controlled on high?dose ICS/LABA, reflecting a broader global trend towards phenotype? and biomarker?driven personalized medicine.

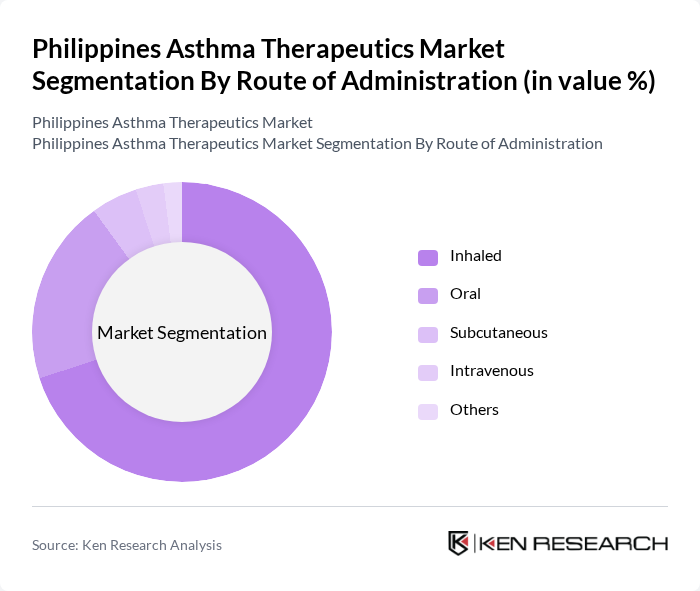

By Route of Administration:The route of administration for asthma therapeutics is crucial in determining patient compliance and treatment efficacy. Inhaled medications appropriately dominate clinical practice because they deliver drug directly to the airways, allowing rapid symptom relief at lower systemic doses and are the foundation of guideline?recommended asthma care. Oral medications remain significant as adjuncts or alternatives, particularly leukotriene receptor antagonists and systemic corticosteroids for acute exacerbations or specific patient profiles, while subcutaneous and intravenous routes are mainly used for biologics and severe cases managed in specialist settings, which are gradually expanding in higher?level centers in the Philippines.

The Philippines Asthma Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as GlaxoSmithKline Philippines Inc., AstraZeneca Pharmaceuticals (Philippines) Inc., Novartis Healthcare Philippines, Inc., Sanofi Philippines Inc., MSD Philippines Inc. (Merck Sharp & Dohme), Boehringer Ingelheim Philippines, Inc., Pfizer, Inc. Philippines, Cipla Philippines (through regional subsidiaries/partners), Mylan Philippines Inc. (a Viatris company), Teva Pharmaceuticals Asia-Pacific (Philippines presence via distributors), UCB Philippines, Inc., Sandoz Philippines (Novartis division / generics), Chiesi Philippines Inc., Hikma Pharmaceuticals (Philippines presence via distributors), Local Generic Respiratory Manufacturers (e.g., Unilab, Pascual Laboratories) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the asthma therapeutics market in the Philippines appears promising, driven by ongoing advancements in treatment technologies and increased public awareness. The government’s commitment to improving healthcare access through initiatives like the Universal Health Care Act is expected to enhance patient outcomes. Additionally, the integration of digital health solutions and personalized medicine will likely reshape asthma management, making it more effective and accessible for patients across the country.

| Segment | Sub-Segments |

|---|---|

| By Drug Class | Inhaled Corticosteroids (ICS) Long-Acting Beta Agonists (LABA) Leukotriene Receptor Antagonists (LTRA) Short-Acting Beta Agonists (SABA) Biologics and Targeted Therapies Combination Inhalers (ICS/LABA and Others) Others (e.g., methylxanthines, anticholinergics) |

| By Route of Administration | Inhaled Oral Subcutaneous Intravenous Others |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Severity of Asthma | Mild Intermittent Mild Persistent Moderate Persistent Severe Persistent |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies Online Pharmacies Drug Stores and Independent Pharmacies Others |

| By Geographic Region | Luzon Visayas Mindanao Others |

| By Treatment Objective | Long-Term Controller Medications Rescue/Reliever Medications Preventive/Prophylactic Therapies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers (Pulmonologists) | 100 | Doctors, Specialists in Respiratory Medicine |

| Pharmacists | 80 | Community Pharmacists, Hospital Pharmacists |

| Asthma Patients | 150 | Patients with Asthma, Caregivers |

| Healthcare Administrators | 60 | Hospital Administrators, Health Policy Makers |

| Insurance Providers | 50 | Health Insurance Analysts, Underwriters |

The Philippines Asthma Therapeutics Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the increasing prevalence of asthma, higher diagnosis rates, and urban pollution, among other factors.