Region:Asia

Author(s):Shubham

Product Code:KRAB2615

Pages:94

Published On:October 2025

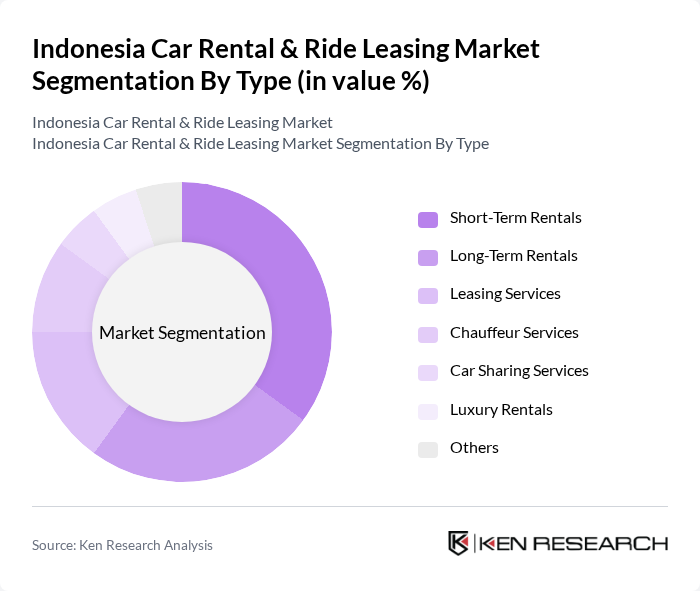

By Type:The market is segmented into Short-Term Rentals, Long-Term Rentals, Leasing Services, Chauffeur Services, Car Sharing Services, Luxury Rentals, and Others. Short-Term Rentals are particularly popular among tourists and business travelers seeking flexibility, while Long-Term Rentals and Leasing Services are favored by corporate clients and expatriates. Chauffeur Services cater to premium and executive segments, and Car Sharing Services are emerging in urban areas, driven by digital platforms and younger consumers .

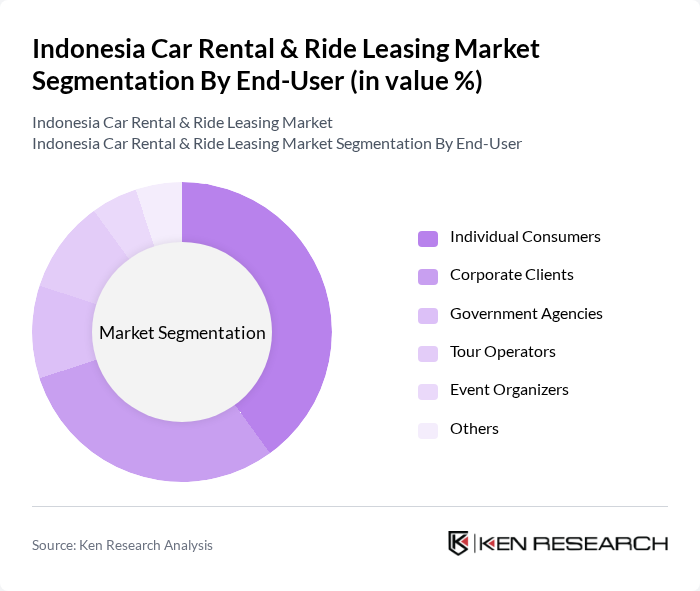

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, Government Agencies, Tour Operators, Event Organizers, and Others. Individual Consumers represent the largest segment, reflecting the growing trend of personal mobility and the convenience of renting vehicles for short trips, vacations, and daily commuting. Corporate Clients drive demand for long-term rentals and leasing services, while government agencies and tour operators contribute to fleet contracts and specialized packages .

The Indonesia Car Rental & Ride Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bluebird Group, Grab Holdings Inc., Gojek, TRAC Astra, Hertz Indonesia, Avis Indonesia, Sixt Indonesia, Rent Car Indonesia, Orix Indonesia, Jakarta Car Rental, Bali Car Rental, Klook, Traveloka, Zoomcar Indonesia, Indorent contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia car rental and ride leasing market appears promising, driven by technological advancements and evolving consumer preferences. The integration of mobile applications for seamless booking and payment processes is expected to enhance customer convenience. Additionally, the shift towards electric vehicles aligns with global sustainability trends, encouraging operators to adopt greener fleets. As urbanization continues and tourism flourishes, the market is poised for significant growth, presenting opportunities for innovative service offerings and strategic partnerships.

| Segment | Sub-Segments |

|---|---|

| By Type | Short-Term Rentals Long-Term Rentals Leasing Services Chauffeur Services Car Sharing Services Luxury Rentals Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Tour Operators Event Organizers Others |

| By Vehicle Type | Economy Cars SUVs Vans Luxury Cars Electric Vehicles Others |

| By Rental Duration | Daily Rentals Weekly Rentals Monthly Rentals Annual Rentals Others |

| By Payment Model | Pay-Per-Use Subscription-Based Prepaid Rentals Postpaid Rentals Others |

| By Distribution Channel | Online Platforms Offline Agencies Direct Corporate Contracts Travel Agencies Others |

| By Customer Segment | Business Travelers Leisure Travelers Local Residents Tourists Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Car Rental Services | 120 | Rental Agency Managers, Urban Transport Planners |

| Ride Leasing User Experience | 90 | Frequent Riders, Ride-sharing Service Users |

| Tourism Impact on Car Rentals | 60 | Tour Operators, Travel Agency Executives |

| Fleet Management Practices | 50 | Fleet Managers, Operations Directors |

| Consumer Preferences in Mobility | 100 | General Consumers, Young Professionals |

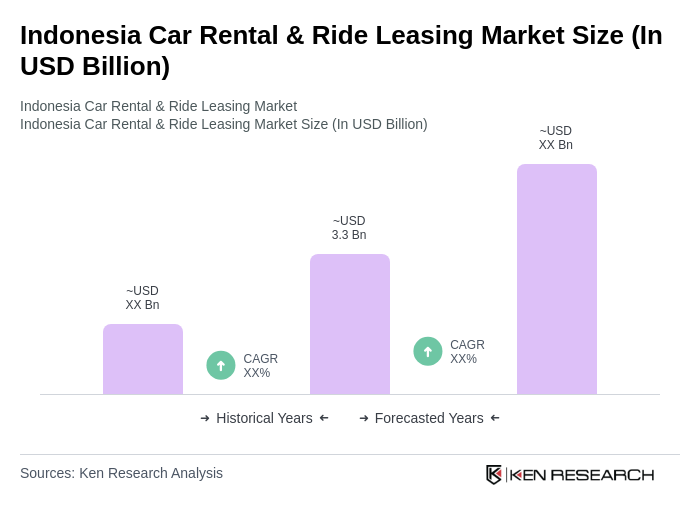

The Indonesia Car Rental & Ride Leasing Market is valued at approximately USD 3.3 billion, driven by increasing demand for convenient transportation, urbanization, digital booking platforms, and a rebound in tourism.