Region:Asia

Author(s):Rebecca

Product Code:KRAC9665

Pages:85

Published On:November 2025

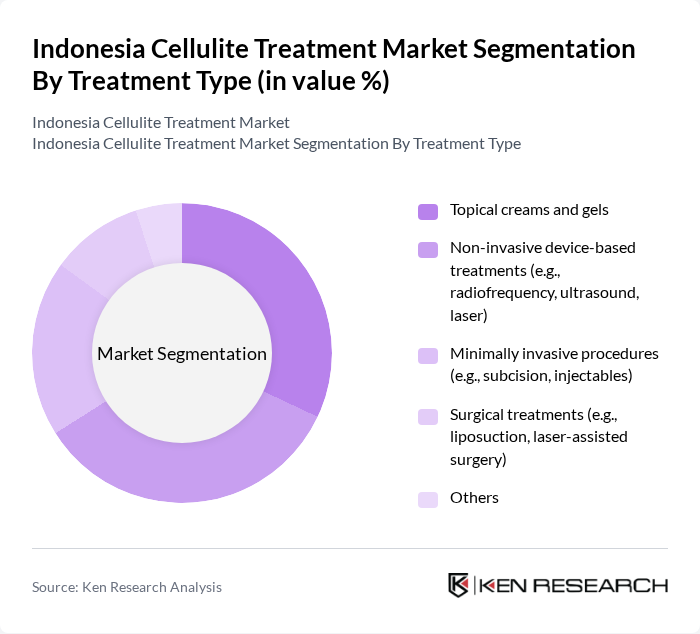

By Treatment Type:The treatment type segmentation includes various methods employed to address cellulite concerns. The subsegments are topical creams and gels, non-invasive device-based treatments, minimally invasive procedures, surgical treatments, and others. Each of these methods caters to different consumer preferences and treatment needs. Topical creams and gels remain popular for their affordability and ease of use, while non-invasive device-based treatments such as radiofrequency, ultrasound, and laser technologies are increasingly favored for their efficacy and minimal downtime. Minimally invasive procedures and surgical treatments are typically selected by consumers seeking more pronounced or longer-lasting results .

The non-invasive device-based treatments segment is currently dominating the market due to their effectiveness and minimal recovery time. Treatments such as radiofrequency and ultrasound are gaining popularity among consumers seeking quick results without the need for surgery. Additionally, the increasing availability of advanced technologies in aesthetic clinics has made these treatments more accessible, further driving their adoption. The trend towards non-invasive options reflects a broader consumer preference for less invasive procedures that offer significant results with reduced downtime .

By Demographics:The demographic segmentation encompasses various consumer characteristics, including age group, gender, income level, urban versus rural distribution, and others. Understanding these demographics helps in tailoring marketing strategies and treatment offerings to meet the specific needs of different consumer segments. The market is primarily driven by urban, middle- to high-income women aged 26-45, who are more likely to seek aesthetic improvements and have access to advanced treatments. Urbanization and increased health consciousness are key factors influencing demand .

The age group of 26-35 is the leading demographic segment, accounting for a significant portion of the market. This group is often more concerned with body image and aesthetics, driving demand for cellulite treatments. Additionally, women represent the majority of consumers, reflecting societal beauty standards and the increasing focus on personal appearance. The urban population also dominates the market, as urban areas tend to have better access to aesthetic clinics and disposable income to spend on cosmetic procedures .

The Indonesia Cellulite Treatment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Klinik Kecantikan Bamed, The Clinic Beauté, Erha Clinic, Miracle Aesthetic Clinic, Jakarta Aesthetic Clinic, Skin+ Clinic, ZAP Clinic, Siloam Hospitals, RSIA Bunda Jakarta, Klinik Kecantikan dr. Affandi, Klinik Kecantikan dr. Siti, Klinik Kecantikan dr. Rina, Klinik Kecantikan dr. Andi, Klinik Kecantikan dr. Tania, Klinik Kecantikan dr. Dwi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cellulite treatment market in Indonesia appears promising, driven by increasing consumer awareness and technological advancements. As the beauty and wellness industry continues to expand, more individuals are likely to seek effective cellulite solutions. Additionally, the integration of online consultation services is expected to enhance accessibility, allowing consumers to explore treatment options conveniently. This trend, coupled with a growing preference for non-invasive procedures, will likely shape the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Treatment Type | Topical creams and gels Non-invasive device-based treatments (e.g., radiofrequency, ultrasound, laser) Minimally invasive procedures (e.g., subcision, injectables) Surgical treatments (e.g., liposuction, laser-assisted surgery) Others |

| By Demographics | Age group (18-25, 26-35, 36-45, 46+) Gender (Female, Male) Income level (Low, Middle, High) Urban vs. Rural Others |

| By Treatment Duration | Single-session treatments Multi-session/maintenance treatments Others |

| By Treatment Location | Aesthetic clinics Dermatology centers Hospitals Spas & wellness centers At-home treatments Others |

| By Product Type | Creams and lotions Devices and equipment Supplements Others |

| By Consumer Behavior | First-time users Repeat customers Others |

| By Marketing Channel | Online marketing Offline marketing Social media promotions Influencer partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insights on Cellulite Treatments | 100 | Women aged 25-45, who have sought cellulite treatments |

| Expert Opinions from Dermatologists | 40 | Board-certified dermatologists and cosmetic surgeons |

| Market Trends from Spa Owners | 50 | Owners and managers of beauty and wellness spas |

| Consumer Behavior Analysis | 80 | Potential consumers interested in beauty treatments |

| Industry Insights from Health Professionals | 40 | Health and wellness consultants, beauty industry analysts |

The Indonesia Cellulite Treatment Market is valued at approximately USD 170 million, reflecting a significant growth driven by increasing consumer awareness of body aesthetics, rising disposable incomes, and the popularity of non-invasive treatment options.