Region:Asia

Author(s):Geetanshi

Product Code:KRAD3925

Pages:81

Published On:November 2025

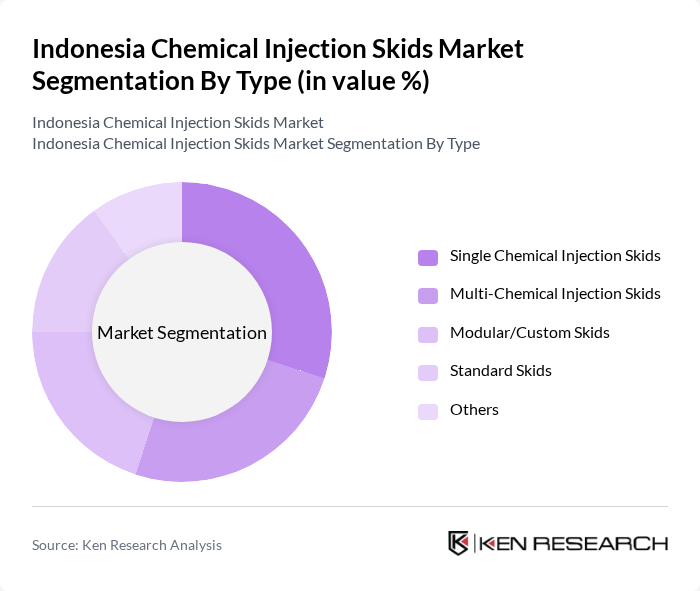

By Type:The market is segmented into various types of chemical injection skids, including Single Chemical Injection Skids, Multi-Chemical Injection Skids, Modular/Custom Skids, Standard Skids, and Others. Each type serves specific applications and industries, catering to the diverse needs of end-users. Single skids are typically used for dedicated dosing tasks, while multi-chemical and modular skids offer flexibility for complex processes and integration with automation systems. Standard skids are preferred for routine operations with established protocols, and custom skids address unique project requirements in specialized industries.

The **Single Chemical Injection Skids** segment leads the market, driven by their reliability, ease of installation, and effectiveness in oil and gas applications. Operators favor these skids for straightforward dosing tasks, corrosion inhibition, and scale control, especially in upstream and midstream operations. The growing focus on process safety and operational efficiency continues to boost demand for single skids, while modular and multi-chemical skids gain traction in large-scale petrochemical and water treatment projects.

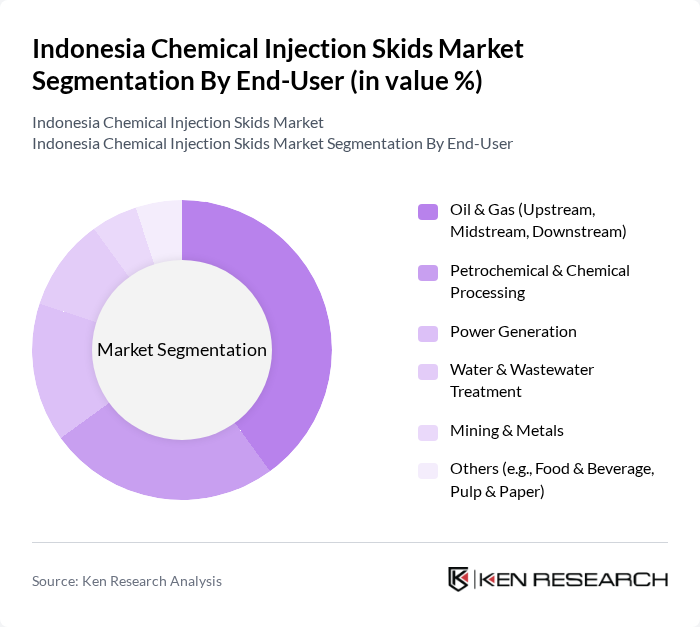

By End-User:The market is segmented based on end-users, including Oil & Gas (Upstream, Midstream, Downstream), Petrochemical & Chemical Processing, Power Generation, Water & Wastewater Treatment, Mining & Metals, and Others. Oil & Gas remains the primary consumer, followed by petrochemical plants and water treatment facilities. Power generation and mining sectors utilize skids for process optimization and environmental compliance, while other industries such as food & beverage and pulp & paper adopt skids for specialized dosing requirements.

The **Oil & Gas sector** dominates end-user demand for chemical injection skids, accounting for the largest market share due to extensive application in corrosion control, scale prevention, and enhanced oil recovery. Continuous exploration and production activities, coupled with stringent safety and environmental requirements, drive sustained investment in advanced skid systems. Petrochemical and chemical processing industries also represent significant demand, particularly for multi-chemical and modular skids supporting complex dosing operations.

The Indonesia Chemical Injection Skids Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Petrosea Tbk, PT. Rekayasa Industri, PT. Tripatra Engineers and Constructors, PT. Timas Suplindo, PT. Technics Offshore Jaya, PT. Pertamina (Persero), PT. Chandra Asri Petrochemical Tbk, PT. Pupuk Kaltim, PT. Medco Energi Internasional Tbk, PT. Elnusa Tbk, Schlumberger Indonesia, Halliburton Indonesia, Baker Hughes Indonesia, PT. Saipem Indonesia, PT. Inti Karya Persada Tehnik (IKPT) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia chemical injection skids market appears promising, driven by technological advancements and a growing emphasis on sustainability. As industries increasingly adopt automation and IoT integration, the demand for efficient and eco-friendly chemical management solutions will rise. Furthermore, the government's continued investment in infrastructure and energy projects will likely create new opportunities for market players, fostering innovation and enhancing operational efficiencies across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Single Chemical Injection Skids Multi-Chemical Injection Skids Modular/Custom Skids Standard Skids Others |

| By End-User | Oil & Gas (Upstream, Midstream, Downstream) Petrochemical & Chemical Processing Power Generation Water & Wastewater Treatment Mining & Metals Others (e.g., Food & Beverage, Pulp & Paper) |

| By Application | Corrosion Inhibition Scale Inhibition Demulsification Biocide Injection Others (e.g., Defoaming, Hydrate Inhibition) |

| By Material | Stainless Steel Carbon Steel Duplex/Super Duplex Steel Plastic/Composite Others |

| By Region | Java Sumatra Kalimantan Sulawesi Papua & Others |

| By Distribution Channel | Direct Sales Distributors/Integrators EPC Contractors Online Sales Others |

| By Service Type | Installation & Commissioning Maintenance & Repair Engineering & Consulting Aftermarket Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Chemical Injection | 100 | Operations Managers, Chemical Engineers |

| Water Treatment Facilities | 60 | Plant Managers, Environmental Compliance Officers |

| Pharmaceutical Manufacturing | 50 | Quality Control Managers, Production Supervisors |

| Food & Beverage Industry | 40 | Process Engineers, Safety Managers |

| Industrial Chemical Applications | 70 | Procurement Managers, Technical Sales Representatives |

The Indonesia Chemical Injection Skids Market is valued at approximately USD 145 million, reflecting strong demand for efficient chemical handling solutions in key industries such as oil and gas, petrochemicals, and water treatment.