Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3857

Pages:94

Published On:November 2025

By Type:The hazardous waste management market can be segmented into various types, including Chemical Waste, Medical Waste, Electronic Waste (E-Waste), Industrial Hazardous Waste (including Oil & Gas Waste), Construction and Demolition Hazardous Waste, Hazardous Household Waste, Sludge and Contaminated Soils, and Others. Each of these subsegments plays a crucial role in the overall market dynamics .

The Industrial Hazardous Waste (including Oil & Gas Waste) subsegment dominates the market due to the significant volume of waste generated by the oil and gas sector, which is a major contributor to Kuwait's economy. This subsegment is characterized by stringent regulations and the need for specialized treatment methods, driving demand for advanced waste management solutions. The increasing focus on environmental sustainability and compliance with international standards further enhances the growth of this subsegment .

By End-User:The hazardous waste management market can also be segmented by end-user, which includes the Oil & Gas Sector, Manufacturing Sector, Healthcare Sector, Construction Sector, Municipalities, and Others. Each of these sectors has unique waste management needs and regulatory requirements .

The Oil & Gas Sector is the leading end-user in the hazardous waste management market, accounting for a significant portion of the waste generated in Kuwait. This sector's operations produce various hazardous materials that require specialized disposal and treatment methods. The stringent regulations and the need for compliance with environmental standards further drive the demand for effective waste management solutions in this sector .

The Kuwait Hazardous Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Environmental Protection Company (KEPC), Gulf Engineering Company (Waste Management Division), Al-Durra National Environmental Consultancy, Ecovert FM Kuwait (Hazardous Waste Services), National Cleaning Company K.S.C., Al-Mansour Waste Management, Green Planet Environmental Services, United Waste Management Company, Kuwait Waste Collection & Recycling Company, Al-Bahar Environmental Services, EnviroServe Kuwait, Al-Fawz Environmental Services, Kuwait Recycling Company, Al-Majd Environmental Services, Sustainable Waste Solutions Kuwait contribute to innovation, geographic expansion, and service delivery in this space.

The future of the hazardous waste management market in Kuwait appears promising, driven by increasing industrial activities and a growing emphasis on environmental sustainability. The government is expected to enhance regulatory frameworks, encouraging investments in waste management technologies. Additionally, the shift towards a circular economy will likely foster innovation in waste recycling and treatment solutions. As public awareness continues to rise, businesses will increasingly prioritize sustainable practices, creating a more robust market landscape for hazardous waste management services.

| Segment | Sub-Segments |

|---|---|

| By Type | Chemical Waste Medical Waste Electronic Waste (E-Waste) Industrial Hazardous Waste (including Oil & Gas Waste) Construction and Demolition Hazardous Waste Hazardous Household Waste Sludge and Contaminated Soils Others |

| By End-User | Oil & Gas Sector Manufacturing Sector Healthcare Sector Construction Sector Municipalities Others |

| By Waste Treatment Method | Incineration Landfilling (Engineered Landfills) Recycling and Resource Recovery Chemical/Physical Treatment Biological Treatment Others |

| By Source of Waste Generation | Industrial Sources Commercial Sources Residential Sources Healthcare Facilities Oil & Gas Operations Others |

| By Disposal Method | On-Site Disposal Off-Site Disposal Treatment and Disposal (Integrated Facilities) Export for Treatment/Disposal Others |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Waste Management Projects Public-Private Partnership Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Hazardous Waste Management | 100 | Plant Managers, Environmental Compliance Officers |

| Medical Waste Disposal Services | 60 | Healthcare Facility Administrators, Waste Management Coordinators |

| Electronic Waste Recycling | 50 | IT Managers, Sustainability Officers |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Inspectors |

| Consulting Firms in Waste Management | 45 | Environmental Consultants, Project Managers |

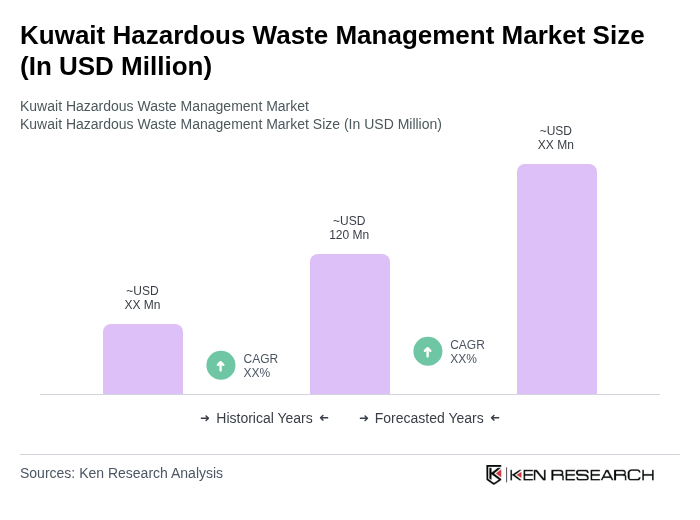

The Kuwait Hazardous Waste Management Market is valued at approximately USD 120 million, driven by increasing industrial activities, stringent environmental regulations, and heightened public awareness regarding sustainable waste management practices.