Region:Asia

Author(s):Shubham

Product Code:KRAA4735

Pages:86

Published On:September 2025

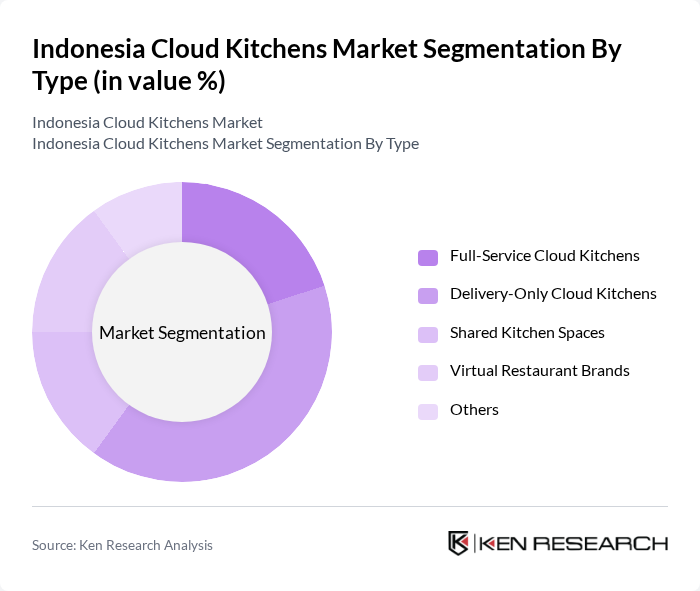

By Type:The market is segmented into various types, including Full-Service Cloud Kitchens, Delivery-Only Cloud Kitchens, Shared Kitchen Spaces, Virtual Restaurant Brands, and Others. Among these, Delivery-Only Cloud Kitchens are currently leading the market due to their operational efficiency and lower overhead costs. The trend towards online food ordering has significantly boosted their popularity, as they cater directly to the growing demand for convenience among consumers.

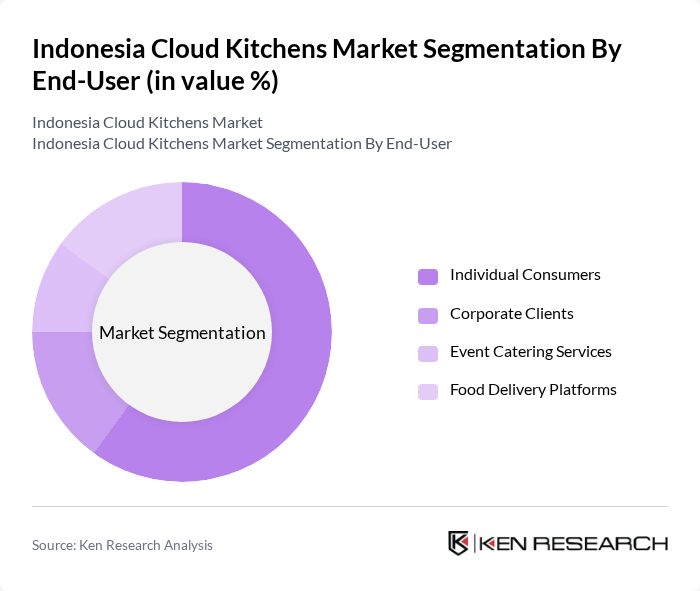

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, Event Catering Services, and Food Delivery Platforms. Individual Consumers dominate the market, driven by the increasing trend of online food ordering and the convenience it offers. The rise of mobile applications and food delivery platforms has made it easier for consumers to access a variety of cuisines, further propelling this segment's growth.

The Indonesia Cloud Kitchens Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gojek, GrabFood, Kitchenette, CloudKitchens, Eatlah, Rebel Foods, Tasty Cloud, Warung Pintar, Kopi Kenangan, MakanLuar, Dapoer Cinde, Roti Bakar 88, Nasi Goreng Kambing, Ayam Penyet Ria, Sate Taichan contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cloud kitchen market in Indonesia appears promising, driven by technological advancements and evolving consumer preferences. As more consumers prioritize convenience and health-conscious options, cloud kitchens are likely to adapt by offering diverse and customizable menus. Additionally, the integration of AI and data analytics will enhance operational efficiency, allowing operators to optimize their services. The market is expected to witness increased investment in technology and infrastructure, paving the way for innovative solutions that cater to the growing demand for food delivery services.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-Service Cloud Kitchens Delivery-Only Cloud Kitchens Shared Kitchen Spaces Virtual Restaurant Brands Others |

| By End-User | Individual Consumers Corporate Clients Event Catering Services Food Delivery Platforms |

| By Cuisine Type | Asian Cuisine Western Cuisine Fast Food Healthy Options Others |

| By Service Model | Subscription-Based Services Pay-Per-Order Services Meal Kits |

| By Distribution Channel | Online Delivery Platforms Direct Orders via Websites Mobile Applications |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value Pricing |

| By Customer Segment | Millennials Families Working Professionals Health-Conscious Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cloud Kitchen Operators | 100 | Founders, Operations Managers |

| Food Delivery Platforms | 80 | Business Development Managers, Logistics Coordinators |

| Consumer Preferences | 150 | Frequent Online Food Buyers, Urban Residents |

| Regulatory Bodies | 30 | Policy Makers, Food Safety Inspectors |

| Market Analysts | 50 | Industry Analysts, Research Consultants |

The Indonesia Cloud Kitchens Market is valued at approximately USD 1.2 billion, driven by the increasing demand for food delivery services, urbanization, and the rise of digital platforms facilitating online ordering.