Region:Asia

Author(s):Dev

Product Code:KRAC2711

Pages:98

Published On:October 2025

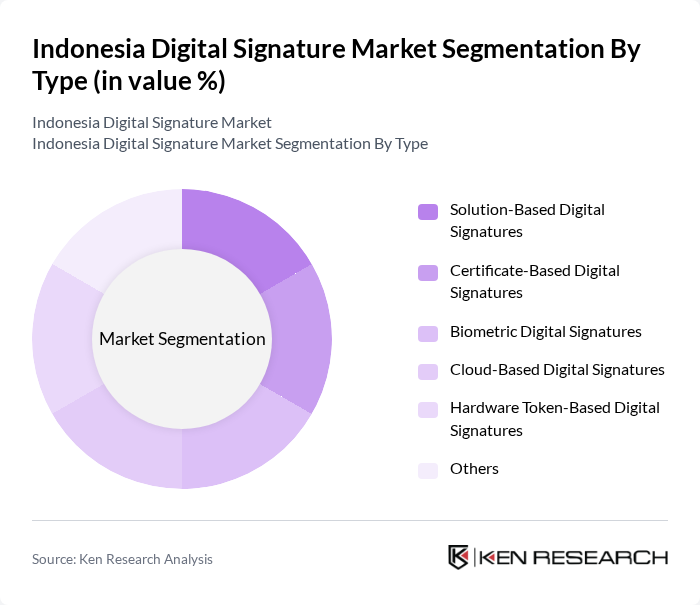

By Type:The market is segmented into various types of digital signatures, including Solution-Based Digital Signatures, Certificate-Based Digital Signatures, Biometric Digital Signatures, Cloud-Based Digital Signatures, Hardware Token-Based Digital Signatures, and Others. Among these, Solution-Based Digital Signatures currently hold the largest revenue share, driven by their customization, control, scalability, and cost-effectiveness. These solutions enable organizations to tailor signing processes, ensure data security, and achieve regulatory compliance. Certificate-Based Digital Signatures remain significant due to their widespread acceptance and legal recognition, especially for high-assurance use cases . The increasing demand for secure online transactions and identity verification continues to drive growth in these sub-segments.

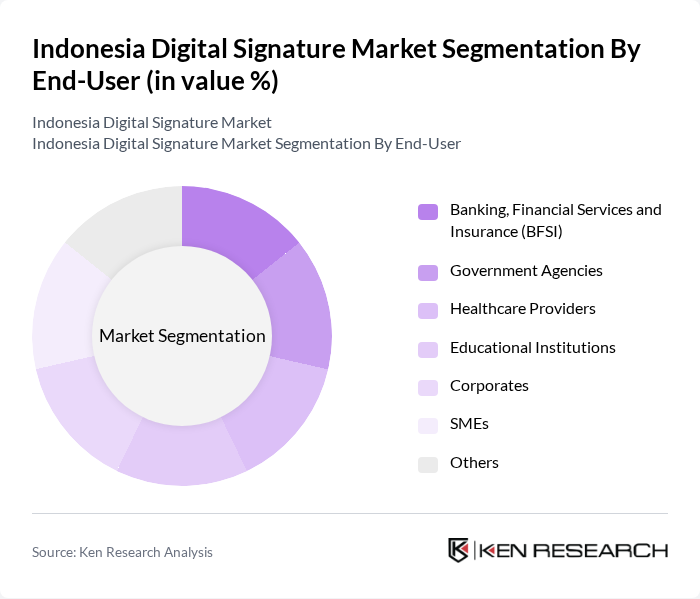

By End-User:The end-user segmentation includes Banking, Financial Services and Insurance (BFSI), Government Agencies, Healthcare Providers, Educational Institutions, Corporates, SMEs, and Others. The BFSI sector is the dominant segment, driven by the need for secure transactions, regulatory compliance, and rapid digital transformation. The increasing digitalization of banking services, expansion of online financial transactions, and regulatory requirements for KYC and AML are propelling demand for digital signatures in this sector. Government agencies are also significant adopters, leveraging digital signatures for secure e-government services and document management .

The Indonesia Digital Signature Market is characterized by a dynamic mix of regional and international players. Leading participants such as PrivyID, VIDA (PT Indonesia Digital Identity), Peruri Digital Security, DOKU, DocuSign, Adobe Sign, Digisign (PT Solusi Net Internusa), eSign (PT Telekomunikasi Indonesia Tbk), V-Key, SignNow, GlobalSign, OneSpan, SignEasy, Katalis Digital, and Signaturit contribute to innovation, geographic expansion, and service delivery in this space .

The future of the digital signature market in Indonesia appears promising, driven by increasing digitalization and government support. As more businesses recognize the importance of secure online transactions, the adoption of digital signatures is expected to rise significantly. Additionally, advancements in technology, such as blockchain integration and mobile solutions, will further enhance the market landscape. The focus on cybersecurity will also drive demand, ensuring that digital signatures become a standard practice in various sectors, including finance and e-commerce.

| Segment | Sub-Segments |

|---|---|

| By Type | Solution-Based Digital Signatures Certificate-Based Digital Signatures Biometric Digital Signatures Cloud-Based Digital Signatures Hardware Token-Based Digital Signatures Others |

| By End-User | Banking, Financial Services and Insurance (BFSI) Government Agencies Healthcare Providers Educational Institutions Corporates SMEs Others |

| By Application | Contract Management Document Verification E-Government Services Financial Transactions Identity Verification Others |

| By Industry Vertical | Banking and Financial Services Insurance Real Estate Legal Services Telecommunications Others |

| By Deployment Mode | Cloud-Based On-Premises Hybrid |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| By Geographic Distribution | Urban Areas Rural Areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Services Sector | 100 | Compliance Officers, IT Managers |

| Healthcare Providers | 70 | Administrative Heads, IT Directors |

| Government Agencies | 60 | Policy Makers, Legal Advisors |

| SMEs and Startups | 80 | Business Owners, Operations Managers |

| Legal Firms | 50 | Partners, Senior Associates |

The Indonesia Digital Signature Market is valued at approximately USD 35 million, driven by the increasing adoption of digital transactions, e-commerce growth, and the need for secure online communications.