Region:Asia

Author(s):Shubham

Product Code:KRAB4382

Pages:94

Published On:October 2025

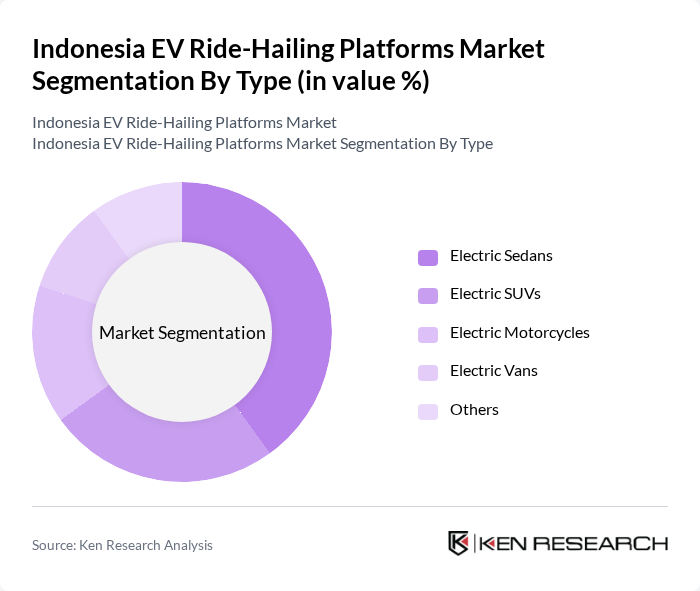

By Type:The market is segmented into various types of electric vehicles used in ride-hailing services. The subsegments include Electric Sedans, Electric SUVs, Electric Motorcycles, Electric Vans, and Others. Among these, Electric Sedans are currently leading the market due to their popularity among consumers for personal and corporate use. The growing trend of urban mobility and the need for efficient transportation solutions have made Electric Sedans a preferred choice for ride-hailing services.

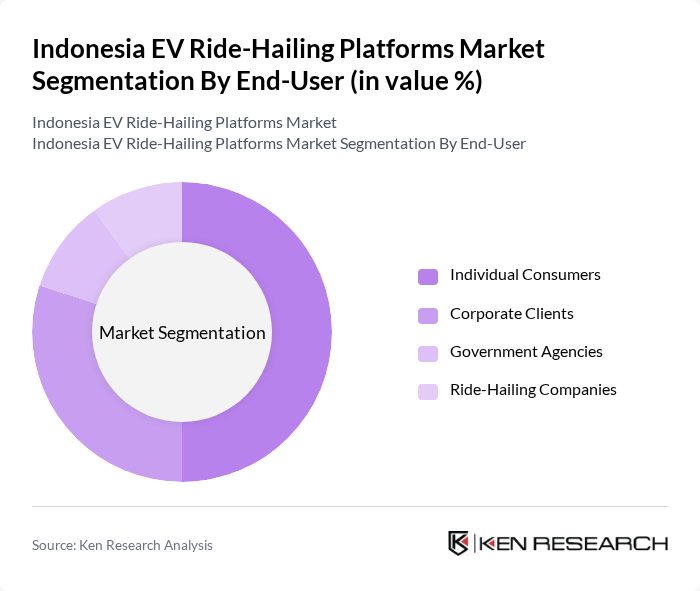

By End-User:The market is segmented based on the end-users of electric ride-hailing services, which include Individual Consumers, Corporate Clients, Government Agencies, and Ride-Hailing Companies. Individual Consumers dominate the market as they increasingly prefer electric ride-hailing services for their convenience and eco-friendliness. The growing awareness of environmental issues and the desire for sustainable transportation options are driving this trend among individual users.

The Indonesia EV Ride-Hailing Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gojek, Grab, Bluebird Group, Maxim, OVO, Anterin, Uber Indonesia, TaniHub, Migo, Nadiem Makarim's Ventures, Tada, Ride Indonesia, GrabKios, DANA, LinkAja contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's EV ride-hailing market appears promising, driven by increasing government support and consumer demand for sustainable transportation. As infrastructure improves and charging networks expand, the adoption of electric vehicles is expected to rise significantly. Additionally, advancements in battery technology and cost reductions will likely enhance the viability of EVs. The market is poised for growth, with a focus on integrating smart mobility solutions and enhancing user experiences, ensuring a competitive edge in the evolving transportation landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Sedans Electric SUVs Electric Motorcycles Electric Vans Others |

| By End-User | Individual Consumers Corporate Clients Government Agencies Ride-Hailing Companies |

| By Service Type | Ride-Sharing Carpooling On-Demand Rentals Subscription Services |

| By Charging Infrastructure | Fast Charging Stations Standard Charging Stations Home Charging Solutions |

| By Fleet Size | Small Fleets Medium Fleets Large Fleets |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas |

| By Policy Support | Subsidies Tax Exemptions Grants for Infrastructure Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Current EV Ride-Hailing Users | 150 | Active riders, EV owners |

| Potential EV Ride-Hailing Users | 100 | Non-EV riders, urban commuters |

| Ride-Hailing Platform Operators | 80 | Operations Managers, Business Development Heads |

| EV Manufacturers and Suppliers | 60 | Product Managers, Sales Directors |

| Government and Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

The Indonesia EV Ride-Hailing Platforms Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by urbanization, government initiatives, and increased consumer awareness regarding environmental sustainability.