Region:Asia

Author(s):Shubham

Product Code:KRAD5353

Pages:96

Published On:December 2025

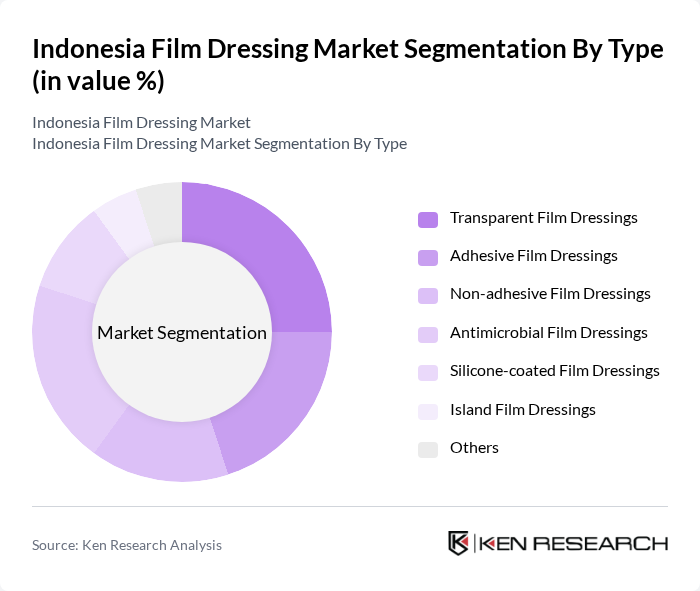

By Type:The film dressing market can be segmented into various types, including Transparent Film Dressings, Adhesive Film Dressings, Non-adhesive Film Dressings, Antimicrobial Film Dressings, Silicone-coated Film Dressings, Island Film Dressings, and Others. Each type serves specific needs in wound management, with varying levels of adhesion, permeability, and antimicrobial properties.

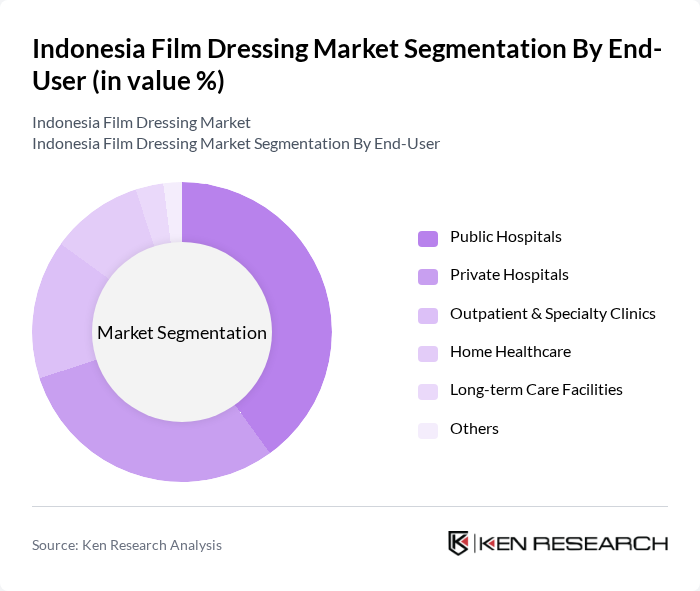

By End-User:The end-user segmentation includes Public Hospitals, Private Hospitals, Outpatient & Specialty Clinics, Home Healthcare, Long-term Care Facilities, and Others. Each segment reflects the diverse settings in which film dressings are utilized, catering to different patient demographics and healthcare needs.

The Indonesia Film Dressing Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Smith & Nephew plc, Johnson & Johnson (including Ethicon), Paul Hartmann AG, Mölnlycke Health Care AB, Coloplast A/S, ConvaTec Group plc, Medline Industries, LP, B. Braun Melsungen AG, Winner Medical Co., Ltd., Lohmann & Rauscher GmbH & Co. KG, BSN medical GmbH (Essity), PT Oneject Indonesia, PT Jayamas Medica Industri Tbk (OneMed), PT Phapros Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia film dressing market appears promising, driven by technological advancements and a growing focus on patient-centric care. As healthcare providers increasingly adopt digital health technologies, the integration of telemedicine and remote monitoring will enhance wound management. Additionally, the shift towards biodegradable materials aligns with global sustainability trends, appealing to environmentally conscious consumers. These developments are expected to foster innovation and improve patient outcomes, ultimately expanding the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Transparent Film Dressings Adhesive Film Dressings Non-adhesive Film Dressings Antimicrobial Film Dressings Silicone-coated Film Dressings Island Film Dressings Others |

| By End-User | Public Hospitals Private Hospitals Outpatient & Specialty Clinics Home Healthcare Long-term Care Facilities Others |

| By Application | IV Site & Catheter Securement Post-operative Surgical Incisions Minor Cuts, Lacerations, and Abrasions Pressure Ulcers and Diabetic Foot Ulcers (Secondary Dressing) Burns and Donor Sites Others |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies & Drug Stores Medical Supply Stores Online Channels (E-pharmacies & Marketplaces) Others |

| By Region | Java Sumatra Bali & Nusa Tenggara Kalimantan Sulawesi Papua & Maluku |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Others |

| By Product Formulation | Semi-permeable Polyurethane Film Dressings Silicone-based Film Dressings Antimicrobial-coated Film Dressings Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Feature Film Production | 120 | Producers, Directors, Production Managers |

| Documentary Filmmaking | 80 | Documentary Filmmakers, Editors, Cinematographers |

| Advertising Film Projects | 70 | Creative Directors, Account Managers, Production Coordinators |

| Film Dressing Suppliers | 60 | Sales Managers, Product Development Specialists |

| Film Industry Associations | 50 | Policy Makers, Industry Analysts, Marketing Executives |

The Indonesia Film Dressing Market is valued at approximately USD 140 million, driven by factors such as the increasing prevalence of chronic wounds, rising surgical procedures, and expanding healthcare infrastructure.