Region:Middle East

Author(s):Rebecca

Product Code:KRAC3987

Pages:87

Published On:October 2025

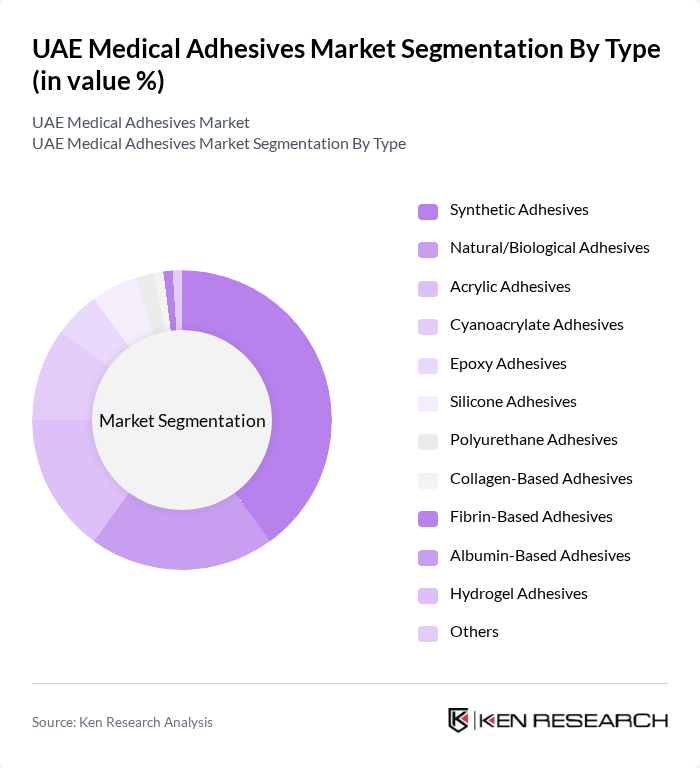

By Type:The market is segmented into various types of medical adhesives, each catering to specific applications and user needs. The dominant sub-segment is synthetic adhesives, particularly acrylics, which are widely used due to their strong bonding properties and versatility in medical applications such as device attachment and wound closure. Natural and biological adhesives are gaining traction for their biocompatibility and lower risk of adverse reactions, especially in sensitive applications. Cyanoacrylate adhesives remain important for rapid wound closure, while silicone and polyurethane adhesives are favored for flexible and durable bonds in wearable devices and implants. Epoxy adhesives are used in specialized device assembly. The segmentation reflects global trends, where synthetic resins, especially acrylics, hold the largest share, followed by natural and cyanoacrylate variants.

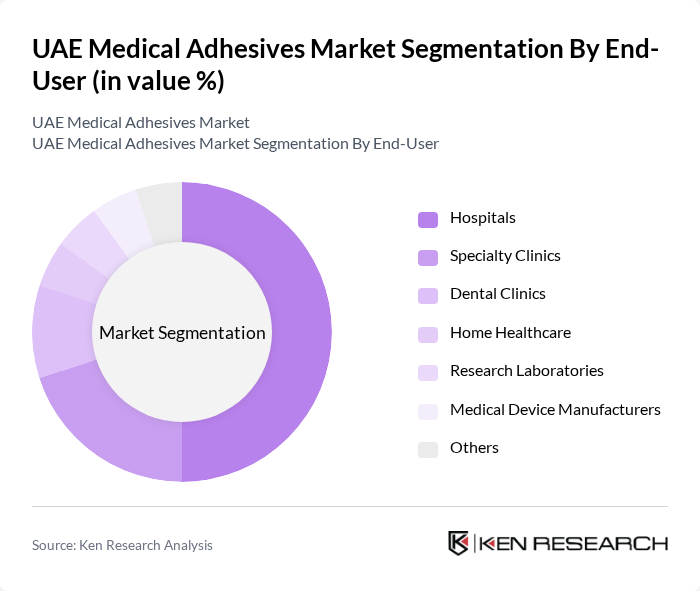

By End-User:The end-user segmentation includes hospitals, specialty clinics, dental clinics, home healthcare, research laboratories, and medical device manufacturers. Hospitals are the leading end-user segment, driven by the high volume of surgical procedures and the need for effective wound management solutions. Specialty clinics and dental clinics are also significant users, particularly for specific applications like dental surgeries and outpatient procedures. The rise of home healthcare and wearable medical devices is gradually increasing the share of non-hospital settings, though hospitals remain the dominant channel.

The UAE Medical Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Henkel AG & Co. KGaA, B. Braun Melsungen AG, Medtronic plc, Johnson & Johnson (Ethicon, DePuy Synthes), Stryker Corporation, ConvaTec Group PLC, Smith & Nephew plc, Coloplast A/S, H.B. Fuller Company, Nitto Denko Corporation, Medline Industries, LP, Tesa SE, Mölnlycke Health Care AB, and Avery Dennison Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE medical adhesives market appears promising, driven by ongoing advancements in adhesive technologies and a growing emphasis on patient-centric healthcare solutions. As healthcare infrastructure expands, particularly in underserved areas, the demand for innovative adhesive products is expected to rise. Additionally, the increasing adoption of minimally invasive surgical techniques will further propel the market, as these procedures often require specialized adhesives for optimal results and patient recovery.

| Segment | Sub-Segments |

|---|---|

| By Type | Synthetic Adhesives Natural/Biological Adhesives Acrylic Adhesives Cyanoacrylate Adhesives Epoxy Adhesives Silicone Adhesives Polyurethane Adhesives Collagen-Based Adhesives Fibrin-Based Adhesives Albumin-Based Adhesives Hydrogel Adhesives Others |

| By End-User | Hospitals Specialty Clinics Dental Clinics Home Healthcare Research Laboratories Medical Device Manufacturers Others |

| By Application | Surgical Procedures Wound Management Orthopedic Applications Dental Applications Medical Device Assembly Ostomy Care Drug Delivery Systems Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Pharmacies Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Price Range | Low Price Mid Price High Price |

| By Brand | Established Brands Emerging Brands Private Labels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Surgical Adhesives Usage in Hospitals | 60 | Surgeons, Operating Room Managers |

| Wound Care Adhesives in Clinics | 50 | Wound Care Specialists, General Practitioners |

| Dental Adhesives in Dental Practices | 40 | Dentists, Dental Assistants |

| Market Trends in Medical Adhesives | 55 | Healthcare Administrators, Procurement Officers |

| Regulatory Impact on Adhesive Products | 45 | Regulatory Affairs Managers, Compliance Officers |

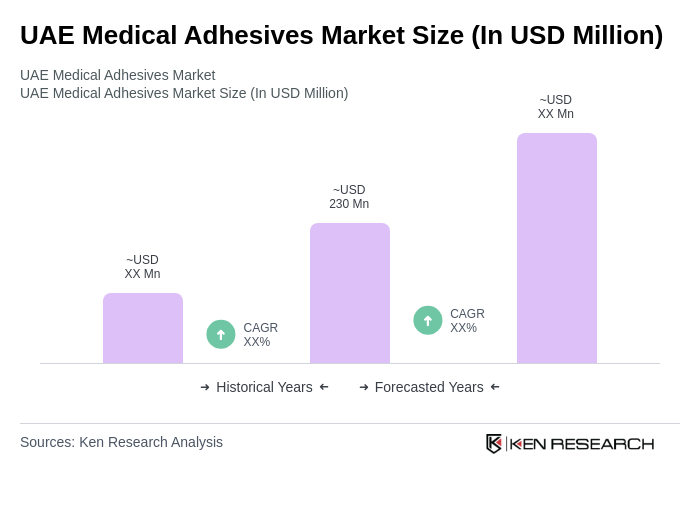

The UAE Medical Adhesives Market is valued at approximately USD 230 million, based on a five-year historical analysis. This figure reflects the market's significant role within the broader UAE adhesives market, which was valued at USD 231.82 million in 2022.