Region:Asia

Author(s):Shubham

Product Code:KRAA8497

Pages:88

Published On:November 2025

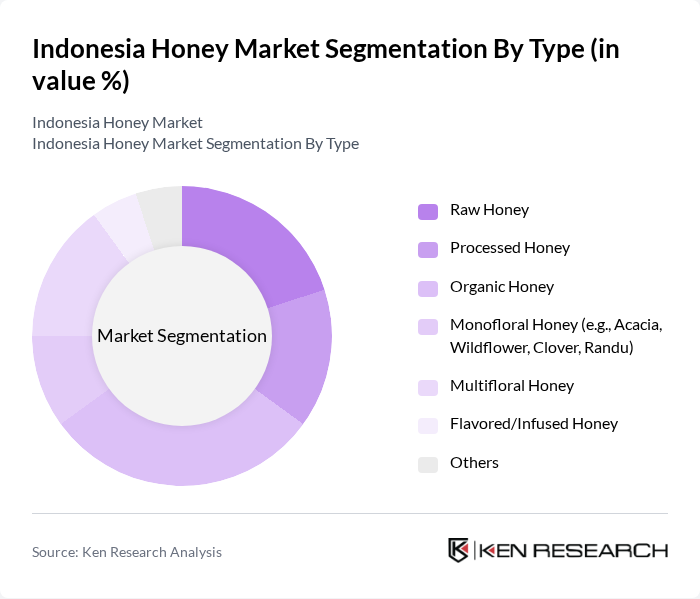

By Type:The market is segmented into Raw Honey, Processed Honey, Organic Honey, Monofloral Honey (e.g., Acacia, Wildflower, Clover, Randu), Multifloral Honey, Flavored/Infused Honey, and Others. Organic Honey is gaining traction due to increasing consumer preference for natural and chemical-free products, with demand for Monofloral Honey also rising, driven by unique flavors and perceived health benefits. Specialty and raw honey are particularly sought after by wellness brands and boutique food manufacturers, reflecting a shift toward premium and traceable products.

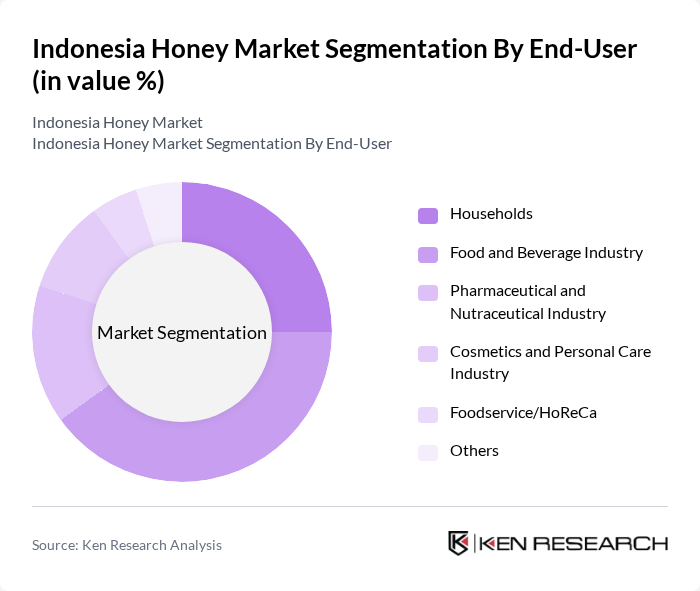

By End-User:The market is segmented by end-users, including Households, Food and Beverage Industry, Pharmaceutical and Nutraceutical Industry, Cosmetics and Personal Care Industry, Foodservice/HoReCa, and Others. The Food and Beverage Industry is the leading segment, driven by the increasing incorporation of honey in various food products and beverages, as well as the growing trend of health-conscious eating. Household consumption remains robust, supported by the perception of honey as a natural health product.

The Indonesia Honey Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Madu Pramuka, PT. Madu TJ (Tresno Joyo), PT. Air Mancur, PT. Natura Nusantara (NASA), PT. Madu Uray, PT. Madu Hutan Lestari, PT. Madu Bina Apiari Indonesia, PT. Madu Nusantara, PT. Madu Sehat Alami, PT. Madu Al Shifa Indonesia, PT. Madu Sumbawa Asli, PT. Madu Hutan Borneo, PT. Madu Kencana, PT. Madu Alam Asri, PT. Madu Citra Rasa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian honey market appears promising, driven by increasing health awareness and the growing popularity of natural sweeteners. As e-commerce continues to expand, local producers are likely to benefit from enhanced distribution channels. Additionally, the trend towards sustainable and organic products is expected to gain momentum, encouraging innovation in honey production. With government support and rising consumer demand, the market is poised for significant growth, fostering opportunities for both local and international players.

| Segment | Sub-Segments |

|---|---|

| By Type | Raw Honey Processed Honey Organic Honey Monofloral Honey (e.g., Acacia, Wildflower, Clover, Randu) Multifloral Honey Flavored/Infused Honey Others |

| By End-User | Households Food and Beverage Industry Pharmaceutical and Nutraceutical Industry Cosmetics and Personal Care Industry Foodservice/HoReCa Others |

| By Packaging Type | Glass Jars Plastic Bottles Sachets/Sticks Bulk Packaging (Drums, Tins) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Specialty Health Stores Traditional Markets Direct Sales (Farmers/Beekeepers) Others |

| By Region | Java Sumatra Bali Sulawesi Kalimantan Papua Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Income Level (Low, Middle, High) Urban vs Rural Others |

| By Product Form | Liquid Honey Honeycomb Honey Powder Honey Sticks/Sachets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Honey Producers | 60 | Beekeepers, Farm Owners |

| Retail Market Insights | 50 | Retail Managers, Product Buyers |

| Consumer Preferences | 100 | Health-Conscious Consumers, Organic Product Shoppers |

| Export Market Analysis | 40 | Export Managers, Trade Analysts |

| Regulatory Impact Assessment | 40 | Policy Makers, Industry Regulators |

The Indonesia Honey Market is valued at approximately USD 2 million, reflecting a contraction in recent years due to fluctuating domestic production and volatile export demand. However, growth is driven by increasing health consciousness and demand for natural sweeteners.