Region:Asia

Author(s):Shubham

Product Code:KRAD5464

Pages:91

Published On:December 2025

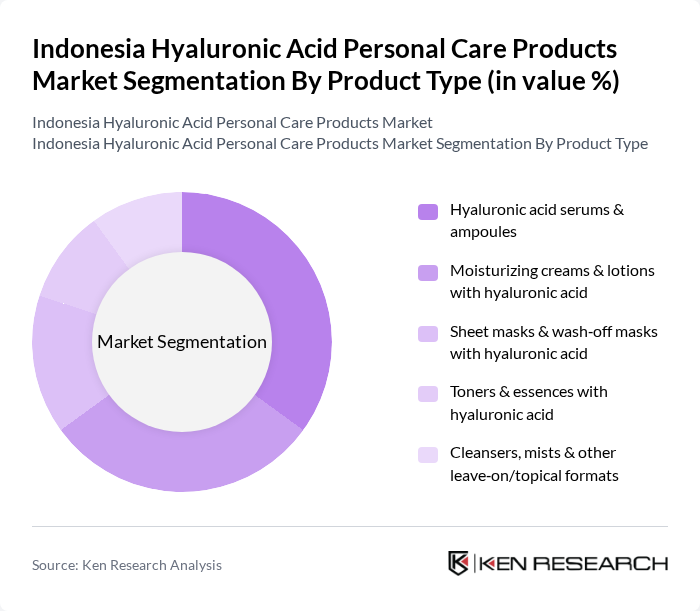

By Product Type:The product type segmentation includes various forms of hyaluronic acid products, each catering to different consumer needs. The market is primarily driven by the popularity of hyaluronic acid serums and moisturizing creams, which are favored for their hydrating, barrier-supporting, and plumping properties and are widely positioned for anti-aging, brightening, and intensive moisturizing benefits. Sheet masks and toners are also gaining traction, particularly among younger consumers influenced by K?beauty and multi?step skincare routines, who are seeking quick and effective skincare solutions that layer multiple hydrating ingredients including hyaluronic acid. The demand for cleansers and other topical formats such as facial mists and essences is growing as consumers become more aware of ingredient-led skincare and the importance of a comprehensive, stepwise skincare routine that maintains skin barrier function and addresses dehydration.

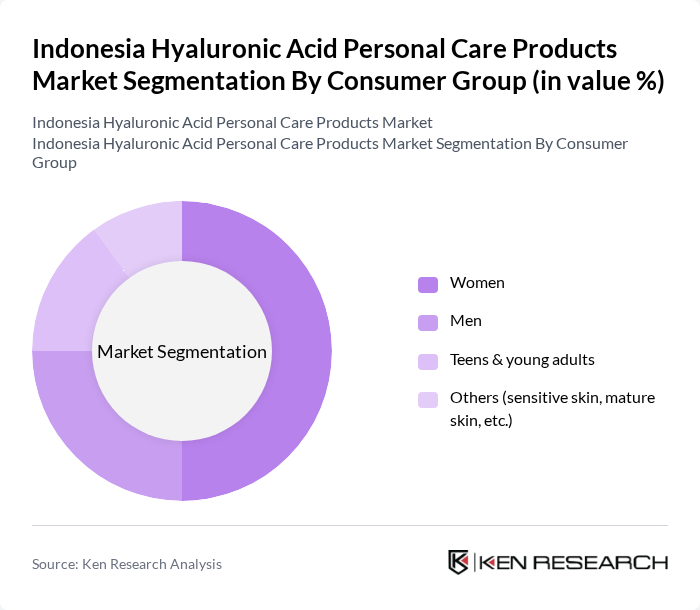

By Consumer Group:The consumer group segmentation highlights the diverse demographics engaging with hyaluronic acid products. Women represent the largest consumer base, driven by a strong interest in skincare and beauty routines, ingredient-conscious purchasing, and a high uptake of multi-step facial care that incorporates hydrating actives. Men are increasingly adopting these products, particularly serums and moisturizers, as societal norms around male grooming evolve and brands actively promote simple yet effective routines targeted to male skin concerns such as dullness, oil imbalance, and early aging. Additionally, teens and young adults are becoming significant consumers, attracted by social media-driven trends, K?beauty and local brand campaigns, and the marketing of hydrating and anti-aging benefits at earlier ages, while niche groups such as those with sensitive, acne-prone, or mature skin are also catered to with specialized low-irritant or barrier-repair formulations that combine hyaluronic acid with soothing or exfoliating actives.

The Indonesia Hyaluronic Acid Personal Care Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Mandom Indonesia Tbk (Biore, Gatsby, etc.), PT Unilever Indonesia Tbk (Pond’s, Vaseline, etc.), PT L’Oréal Indonesia (L’Oréal Paris, Garnier, etc.), PT Procter & Gamble Home Products Indonesia (Olay, etc.), PT Paragon Technology and Innovation (Wardah, Emina, Make Over), PT Mustika Ratu Tbk, PT Martina Berto Tbk (Sariayu Martha Tilaar), PT AVO Innovation Technology (Avoskin), PT Social Bella Indonesia (Somethinc, Glowinc, etc.), PT ERHA Skincare (ERHA Dermatology Clinics & products), PT Kellos Beaute International (Whitelab), PT Bio Beauty Lab (Skin Bae and related HA products), PT Kalbe Farma Tbk – cosmetics & dermatology division, PT Kimia Farma Tbk – skincare & dermocosmetic lines, PT Sensatia Botanicals contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian hyaluronic acid personal care market appears promising, driven by evolving consumer preferences and technological advancements. As consumers increasingly seek personalized skincare solutions, brands are likely to invest in innovative formulations that cater to specific skin types. Additionally, the rise of social media as a marketing tool will continue to shape consumer behavior, encouraging brands to engage with their audience through targeted campaigns and influencer partnerships, enhancing brand loyalty and market penetration.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Hyaluronic acid serums & ampoules Moisturizing creams & lotions with hyaluronic acid Sheet masks & wash?off masks with hyaluronic acid Toners & essences with hyaluronic acid Cleansers, mists & other leave?on/topical formats |

| By Consumer Group | Women Men Teens & young adults Others (sensitive skin, mature skin, etc.) |

| By Distribution Channel | Online platforms (marketplaces & brand e?commerce) Supermarkets/Hypermarkets Specialty beauty stores Pharmacies & drugstores Beauty clinics, med?spas & others |

| By Packaging Type | Pump bottles & droppers Tubes Jars Sachets & single?use packs Others (airless, refill pouches, etc.) |

| By Price Range | Premium Mass/mid?range Economy Others (dermatologist/clinic brands) |

| By Ingredient & Formulation Type | Pure / single?focus hyaluronic acid formulations Multi?functional blends (HA with niacinamide, ceramides, etc.) Natural & clean?label hyaluronic acid products Others (encapsulated, cross?linked, etc.) |

| By Brand Type | Local Indonesian brands International & K?beauty/J?beauty brands Clinic/dermatologist & private?label brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Hyaluronic Acid Products | 120 | Retail Managers, Beauty Advisors |

| Consumer Preferences in Skincare | 140 | Skincare Enthusiasts, General Consumers |

| Dermatological Insights on Product Efficacy | 100 | Dermatologists, Skincare Specialists |

| Market Trends in Personal Care | 80 | Market Analysts, Industry Experts |

| Distribution Channels for Personal Care Products | 70 | Supply Chain Managers, Distributors |

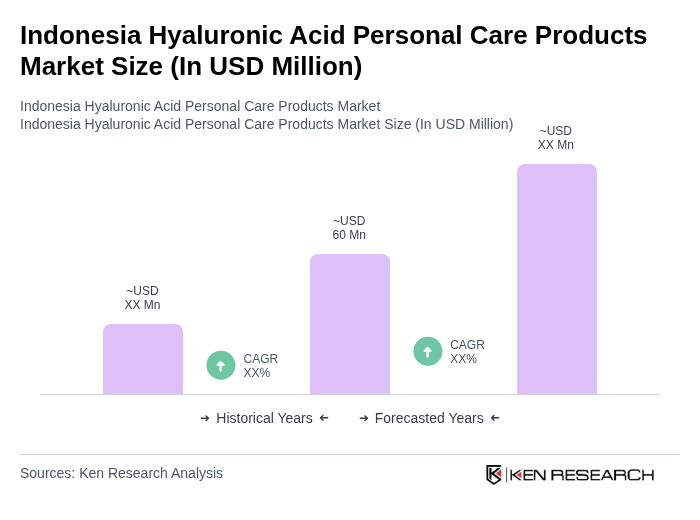

The Indonesia Hyaluronic Acid Personal Care Products Market is valued at approximately USD 60 million, driven by increasing consumer awareness of skincare benefits and the rising popularity of products featuring active ingredients like hyaluronic acid.