Region:Asia

Author(s):Geetanshi

Product Code:KRAA9024

Pages:98

Published On:November 2025

By Infrastructure Segment:The infrastructure segment of the market includes transportation, utilities, social, extraction, and manufacturing infrastructure. Transportation infrastructure—comprising roads, highways, railways, airports, and ports—remains the largest segment due to Indonesia’s focus on improving logistics and connectivity for economic growth. Utilities infrastructure, including water supply, sewage, power generation and distribution, and gas, is critical for supporting urban expansion and sustainability. Social infrastructure such as hospitals, schools, and housing is expanding to meet the needs of a growing population and improve living standards. Extraction infrastructure (mining, oil & gas facilities) and manufacturing infrastructure (industrial parks, factories) are also important, with moderate growth driven by industrialization and resource development.

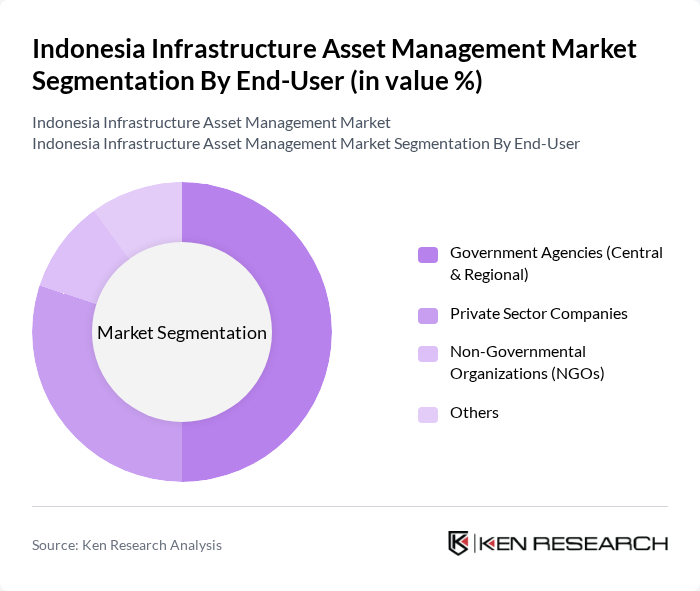

By End-User:The end-user segmentation includes government agencies, private sector companies, non-governmental organizations (NGOs), and others. Government agencies are the primary users of infrastructure asset management services, responsible for public infrastructure development and maintenance. Private sector companies play an increasingly significant role, especially in PPPs and project execution. NGOs contribute to social infrastructure projects, focusing on community development and sustainability. The “Others” category includes multilateral organizations and local community groups involved in infrastructure initiatives.

The Indonesia Infrastructure Asset Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Waskita Karya (Persero) Tbk, PT Jasa Marga (Persero) Tbk, PT Adhi Karya (Persero) Tbk, PT Pembangunan Perumahan (Persero) Tbk, PT Wijaya Karya (Persero) Tbk, PT Hutama Karya (Persero), PT Kereta Api Indonesia (Persero), PT Angkasa Pura I (Persero), PT Angkasa Pura II (Persero), PT Perusahaan Gas Negara Tbk, PT PLN (Persero), PT Sarana Multi Infrastruktur (Persero), PT Transjakarta, PT Citra Marga Nusaphala Persada Tbk, PT Pembangunan Infrastruktur Nasional, PT PP Properti Tbk, PT Summarecon Agung Tbk, PT Astra Infra, PT Nusantara Infrastructure Tbk, PT SMI (Sarana Multi Infrastruktur) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's infrastructure asset management market appears promising, driven by ongoing urbanization and government initiatives. In the future, the integration of smart technologies and sustainable practices is expected to reshape asset management strategies. Enhanced collaboration between public and private sectors will likely lead to innovative financing solutions, addressing funding gaps. As the government prioritizes infrastructure development, the market is poised for growth, with a focus on efficiency, sustainability, and resilience in asset management practices.

| Segment | Sub-Segments |

|---|---|

| By Infrastructure Segment | Transportation Infrastructure (Roads, Highways, Railways, Airports, Ports) Utilities Infrastructure (Water Supply, Sewage, Power Generation & Distribution, Gas) Social Infrastructure (Hospitals, Schools, Housing) Extraction Infrastructure (Mining, Oil & Gas Facilities) Manufacturing Infrastructure (Industrial Parks, Factories) |

| By End-User | Government Agencies (Central & Regional) Private Sector Companies Non-Governmental Organizations (NGOs) Others |

| By Region | Java Sumatra Kalimantan Sulawesi Bali and Nusa Tenggara |

| By Technology | Asset Management Software & Platforms Geographic Information Systems (GIS) Drones and Aerial Imaging Predictive Maintenance Tools IoT & Sensor Networks Others |

| By Application | Infrastructure Planning & Design Asset Monitoring & Condition Assessment Risk Management & Compliance Performance Optimization & Lifecycle Management Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support | Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Transportation Infrastructure Management | 100 | Infrastructure Managers, Project Directors |

| Utility Asset Management | 80 | Operations Managers, Regulatory Affairs Specialists |

| Public-Private Partnership Projects | 70 | Government Officials, Financial Analysts |

| Social Infrastructure Development | 60 | Community Development Officers, Urban Planners |

| Investment in Smart Infrastructure | 90 | Technology Officers, Strategic Planners |

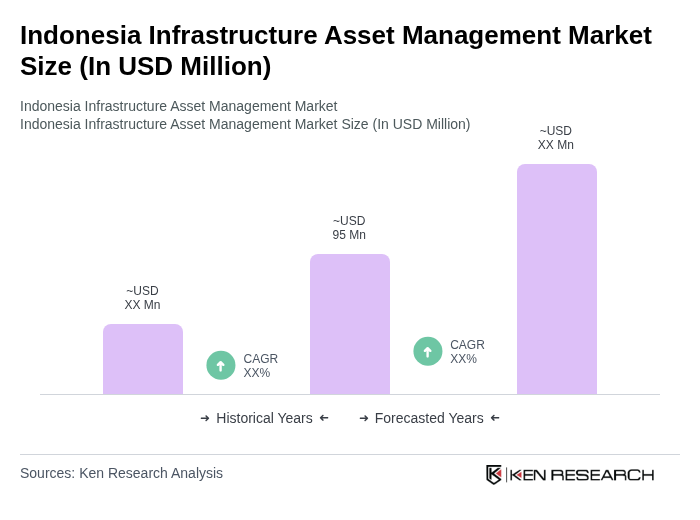

The Indonesia Infrastructure Asset Management Market is valued at approximately USD 95 million, reflecting a five-year historical analysis. This growth is driven by urbanization, government initiatives, and the demand for efficient public asset management.