Region:Asia

Author(s):Geetanshi

Product Code:KRAA6015

Pages:85

Published On:January 2026

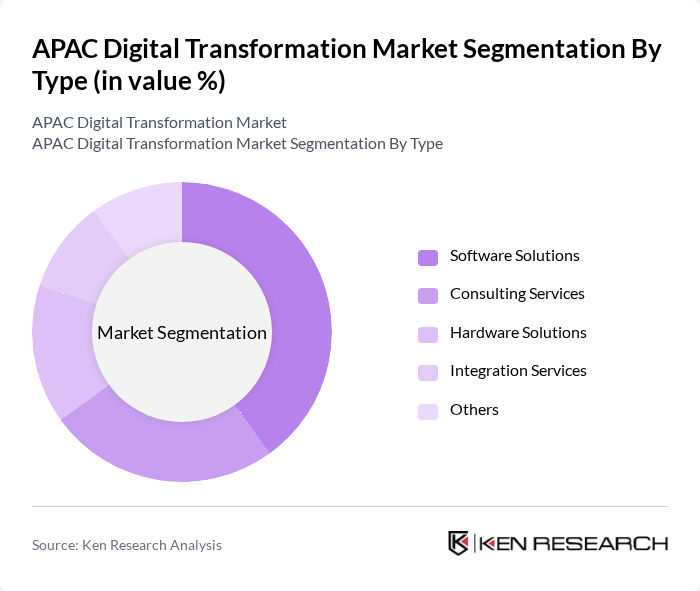

By Type:The digital transformation market is segmented into various types, including Cloud Services, AI Solutions, Big Data Analytics, IoT Solutions, and Others. Among these, Cloud Services dominate the market due to their scalability, cost-effectiveness, and ability to support remote work and collaboration. The increasing reliance on cloud infrastructure for data storage and processing is driving significant growth in this segment.

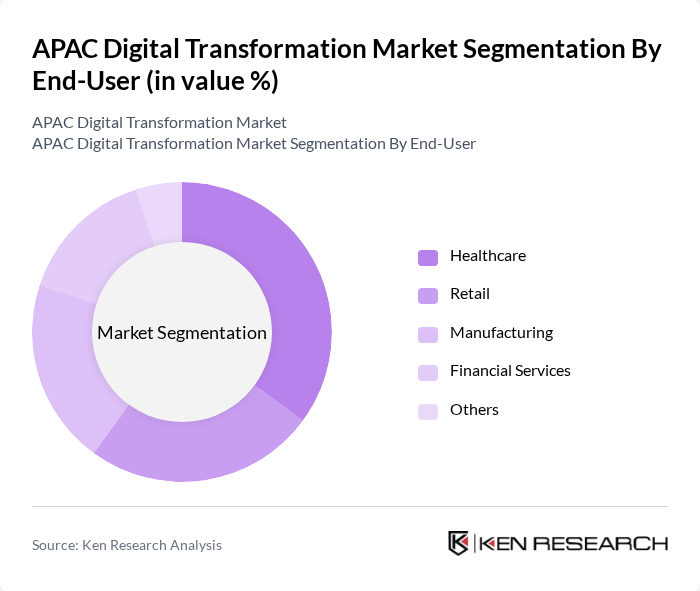

By End-User:The end-user segmentation includes Healthcare, Retail, Manufacturing, Financial Services, and Others. The Healthcare sector is leading this market segment, driven by the need for digital solutions to enhance patient care, streamline operations, and improve data management. The COVID-19 pandemic has further accelerated the adoption of digital technologies in healthcare, making it a critical area for investment.

The APAC Digital Transformation Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM, Microsoft, SAP, Oracle, Cisco Systems, Accenture, Infosys, Tata Consultancy Services, Wipro, Capgemini, Deloitte, Fujitsu, HCL Technologies, NTT Data, and Tech Mahindra contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC digital transformation market is poised for significant evolution, driven by advancements in generative AI and the increasing importance of APIs as core business enablers. With **90 percent** of IT leaders anticipating a rise in the use of Large Language Models, organizations are expected to leverage these technologies to enhance operational efficiency. Additionally, the focus on digital agility and sustainable practices will shape the landscape, as companies invest in responsible supply chain management and talent development to navigate future challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud Services AI Solutions Big Data Analytics IoT Solutions Others |

| By End-User | Healthcare Retail Manufacturing Financial Services Others |

| By Region | North Asia Southeast Asia South Asia Oceania |

| By Technology | Cloud Computing Artificial Intelligence Blockchain Machine Learning Others |

| By Application | Customer Relationship Management Supply Chain Management Human Resource Management Financial Management Others |

| By Investment Source | Private Investments Government Funding Venture Capital Corporate Investments Others |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Digital Transformation | 100 | Healthcare IT Managers, Chief Information Officers |

| Financial Services Technology Adoption | 80 | Banking Executives, Digital Strategy Leaders |

| Manufacturing Automation Initiatives | 70 | Operations Managers, Technology Directors |

| Retail Sector Digital Strategies | 90 | Retail Managers, E-commerce Directors |

| SME Digital Transformation Challenges | 60 | Small Business Owners, IT Consultants |

The APAC Digital Transformation Market is valued at approximately USD 1 trillion. This growth is fueled by increased internet and smartphone penetration, along with the adoption of cloud, AI, and IoT technologies across various sectors.