Region:Asia

Author(s):Geetanshi

Product Code:KRAC8196

Pages:86

Published On:November 2025

By Type:The market is segmented into various types of orthotics, including Rigid Orthotics, Soft Orthotics, Functional Orthotics, Custom-Made Orthotics, Prefabricated Orthotics, Pediatric Orthotics, Diabetic Orthotics, Sports Orthotics, and Others. Each type serves specific needs, with varying levels of customization and application. Custom-made orthotics represent a significant segment, reflecting the growing demand for personalized orthotic solutions tailored to individual patient requirements.

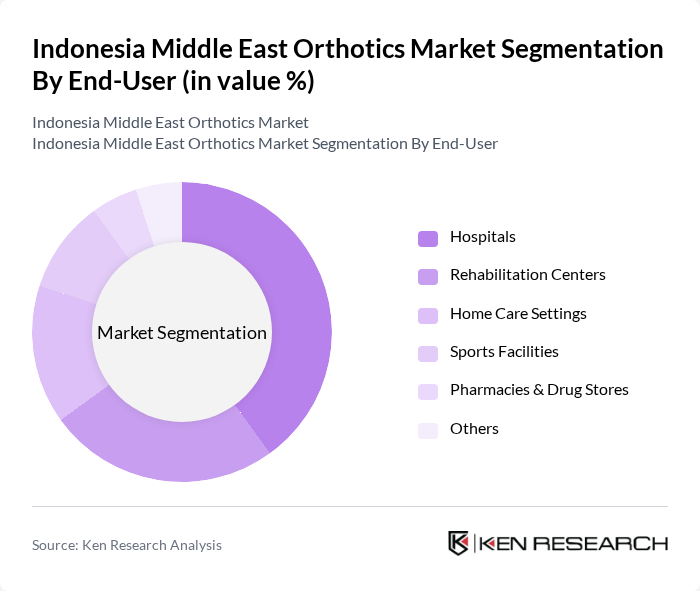

By End-User:The end-user segmentation includes Hospitals, Rehabilitation Centers, Home Care Settings, Sports Facilities, Pharmacies & Drug Stores, and Others. Each segment plays a crucial role in the distribution and utilization of orthotic devices, catering to different patient needs and healthcare settings. Hospitals and rehabilitation centers remain the primary distribution channels, accounting for the majority of orthotic device utilization in clinical and therapeutic environments.

The Indonesia Middle East Orthotics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Otto Bock HealthCare, Hanger Clinic, Össur, Fillauer LLC, Breg, Inc., Medi GmbH & Co. KG, DJO Global (Enovis), Scheck & Siress, Comfort Orthopedic, Tynor Orthotics Pvt. Ltd., Trulife, RSLSteeper, Thuasne, Aetrex Worldwide, Inc., AFO Orthotics contribute to innovation, geographic expansion, and service delivery in this space. Tynor Orthotics Pvt. Ltd. has notably expanded its global footprint through major e-commerce platforms, supplying orthopedic-grade solutions across urban and semi-urban regions.

The Indonesia Middle East orthotics market is poised for significant transformation, driven by technological advancements and demographic shifts. The integration of smart technologies and 3D printing is expected to enhance product customization and efficiency. Additionally, the increasing geriatric population will necessitate more tailored solutions. As healthcare policies evolve, there will be a greater emphasis on accessibility and affordability, paving the way for innovative distribution channels and improved patient care in the orthotics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Rigid Orthotics Soft Orthotics Functional Orthotics Custom-Made Orthotics Prefabricated Orthotics Pediatric Orthotics Diabetic Orthotics Sports Orthotics Others |

| By End-User | Hospitals Rehabilitation Centers Home Care Settings Sports Facilities Pharmacies & Drug Stores Others |

| By Application | Mobility Assistance Post-Surgical Recovery Pain Management Sports Rehabilitation Diabetic Foot Care Arthritis Management Others |

| By Material | Thermoplastics Carbon Fiber Foam Metal Gel Others |

| By Distribution Channel | Direct Sales Online Retail Medical Supply Stores Pharmacies & Drug Stores Hospitals and Clinics Supermarkets & Hypermarkets Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Research and Development Local Manufacturing Incentives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Clinics | 45 | Orthopedic Surgeons, Clinic Managers |

| Rehabilitation Centers | 50 | Physical Therapists, Rehabilitation Directors |

| Hospitals with Orthotic Departments | 60 | Healthcare Administrators, Procurement Officers |

| Patients Using Orthotic Devices | 75 | Patients, Caregivers |

| Manufacturers of Orthotic Products | 40 | Product Managers, Sales Directors |

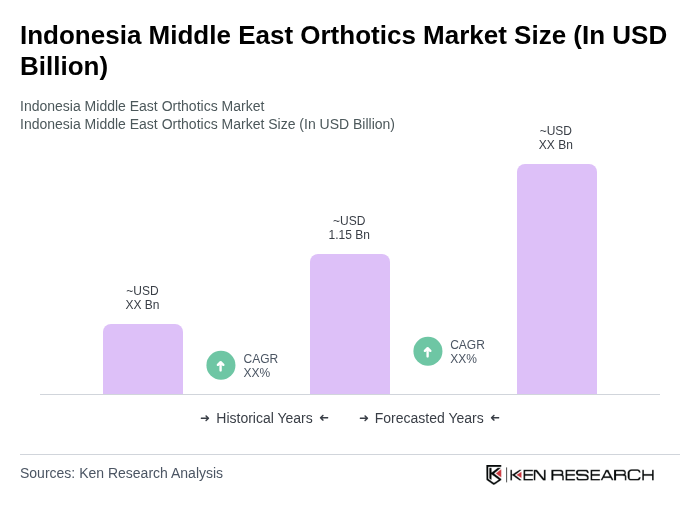

The Indonesia Middle East Orthotics Market is valued at approximately USD 1.15 billion, reflecting a significant growth driven by the increasing prevalence of orthopedic disorders, advancements in technology, and a rising geriatric population.