Region:Asia

Author(s):Dev

Product Code:KRAB5450

Pages:83

Published On:October 2025

By Type:The market is segmented into various types, including Digital Savings Accounts, Personal Loans, Business Loans, Payment Solutions, Investment Products, Insurance Products, and Others. Among these, Personal Loans have emerged as the leading sub-segment, driven by the increasing need for quick and accessible credit solutions among consumers. The rise of e-commerce and online shopping has also contributed to the demand for payment solutions, making it a significant player in the market.

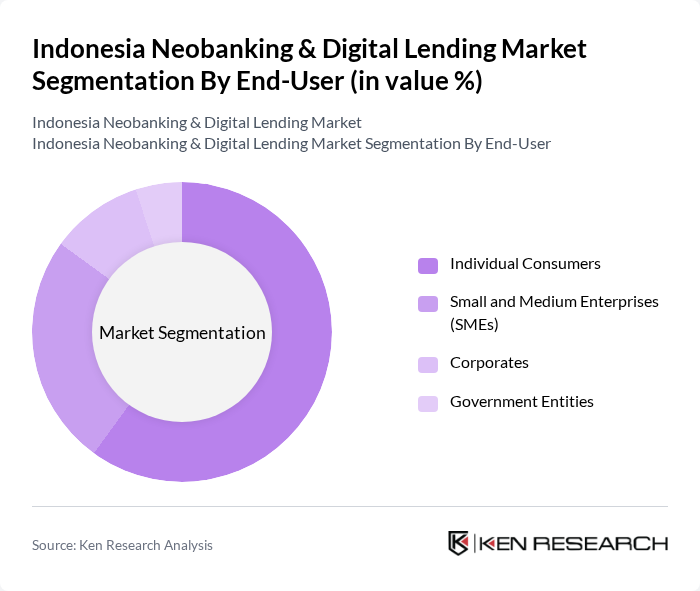

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Individual Consumers dominate this segment, as they are increasingly turning to digital platforms for personal finance management and loans. The convenience and accessibility of digital lending solutions cater to the needs of a diverse consumer base, making it a critical area of growth.

The Indonesia Neobanking & Digital Lending Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Jago, Bank Negara Indonesia, Bank Mandiri, Bank Central Asia, KoinWorks, Investree, Kredit Pintar, Akulaku, Modalku, Bank Sinarmas, Bank BTPN, Bank Permata, Bank OCBC NISP, Bank CIMB Niaga, Bank DBS Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's neobanking and digital lending market appears promising, driven by technological advancements and evolving consumer behaviors. As digital literacy improves, more individuals are expected to embrace online banking solutions. Additionally, the integration of AI and machine learning will enhance customer experiences and operational efficiencies. The government's commitment to financial inclusion will further stimulate market growth, creating a conducive environment for innovation and expansion in the neobanking sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Savings Accounts Personal Loans Business Loans Payment Solutions Investment Products Insurance Products Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Customer Segment | Millennials Gen Z Professionals Unbanked Population |

| By Distribution Channel | Mobile Applications Web Platforms Third-party Integrations |

| By Service Model | B2C (Business to Consumer) B2B (Business to Business) |

| By Loan Type | Secured Loans Unsecured Loans Microloans |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Users | 150 | Millennials, Gen Z Consumers |

| Small Business Digital Lending | 100 | Small Business Owners, Financial Managers |

| Fintech Adoption Trends | 80 | Tech-Savvy Consumers, Early Adopters |

| Regulatory Impact on Neobanking | 60 | Compliance Officers, Regulatory Analysts |

| Consumer Preferences in Digital Lending | 90 | Loan Applicants, Financial Advisors |

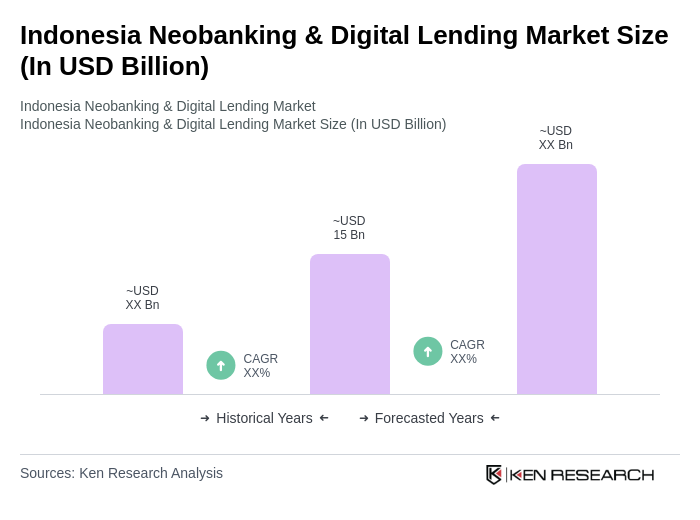

The Indonesia Neobanking & Digital Lending Market is valued at approximately USD 15 billion, driven by the increasing adoption of digital financial services, smartphone penetration, and a growing unbanked population seeking accessible financial solutions.