Region:Asia

Author(s):Shubham

Product Code:KRAB5573

Pages:90

Published On:October 2025

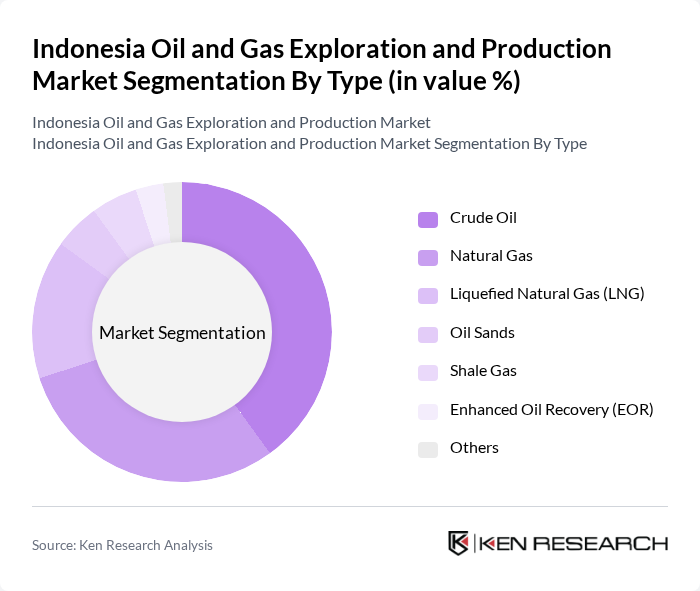

By Type:The market is segmented into various types, including Crude Oil, Natural Gas, Liquefied Natural Gas (LNG), Oil Sands, Shale Gas, Enhanced Oil Recovery (EOR), and Others. Each of these subsegments plays a crucial role in meeting the energy demands of the country and contributing to economic growth.

The Crude Oil segment dominates the market due to Indonesia's historical reliance on oil as a primary energy source. The country has significant reserves, and the demand for crude oil remains high, particularly for refining and export purposes. Natural Gas follows closely, driven by its increasing use in power generation and industrial applications. The Liquefied Natural Gas (LNG) segment is also growing, supported by international demand and Indonesia's strategic position as a key exporter in the Asia-Pacific region.

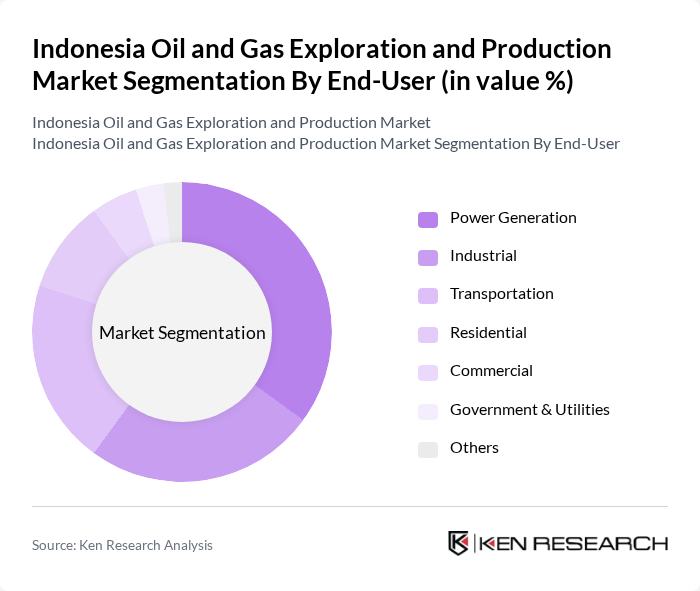

By End-User:The market is segmented by end-user applications, including Power Generation, Industrial, Transportation, Residential, Commercial, Government & Utilities, and Others. Each segment reflects the diverse applications of oil and gas in various sectors of the economy.

The Power Generation segment is the largest end-user, driven by the increasing demand for electricity in Indonesia. Natural gas is increasingly being utilized in power plants due to its lower emissions compared to coal. The Industrial segment also plays a significant role, as oil and gas are essential for various manufacturing processes. Transportation is another critical segment, with oil products being the primary fuel source for vehicles, further solidifying the importance of this sector in the overall market.

The Indonesia Oil and Gas Exploration and Production Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pertamina, TotalEnergies, Chevron, ExxonMobil, ConocoPhillips, Medco Energi, Eni S.p.A., Repsol, Santos, INPEX Corporation, Husky Energy, Petronas, Talisman Energy, AWE Limited, Oil Search Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's oil and gas exploration and production market appears promising, driven by a combination of increasing domestic energy needs and foreign investment. As the government continues to implement favorable policies and incentives, the sector is likely to attract more international players. Additionally, the integration of advanced technologies will enhance operational efficiency, allowing for better resource management. However, companies must remain vigilant regarding regulatory compliance and environmental sustainability to ensure long-term viability in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Oil Natural Gas Liquefied Natural Gas (LNG) Oil Sands Shale Gas Enhanced Oil Recovery (EOR) Others |

| By End-User | Power Generation Industrial Transportation Residential Commercial Government & Utilities Others |

| By Application | Exploration Production Refining Distribution Storage Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| By Regulatory Compliance | Environmental Regulations Safety Standards Local Content Requirements Tax Compliance Others |

| By Distribution Channel | Direct Sales Distributors Online Platforms Retail Outlets Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Cost-Plus Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil Exploration Companies | 100 | CEOs, Exploration Managers |

| Gas Production Firms | 80 | Production Managers, Operations Directors |

| Regulatory Bodies | 50 | Policy Makers, Regulatory Analysts |

| Environmental Consultants | 60 | Environmental Managers, Compliance Officers |

| Investment Analysts in Oil & Gas | 70 | Financial Analysts, Investment Managers |

The Indonesia Oil and Gas Exploration and Production Market is valued at approximately USD 30 billion, driven by the country's abundant natural resources, rising energy demand, and significant foreign investments in exploration activities.