Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3792

Pages:89

Published On:October 2025

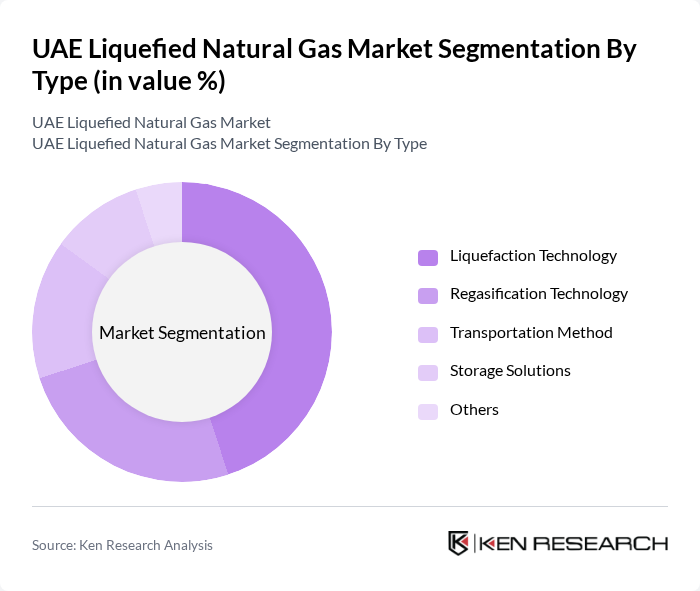

By Type:The market can be segmented into various types, including Liquefaction Technology, Regasification Technology, Transportation Method, Storage Solutions, and Others. Each of these subsegments plays a crucial role in the overall LNG supply chain, with specific technologies and methods being adopted based on efficiency, cost-effectiveness, and environmental considerations. The Liquefaction Technology subsegment is currently leading the market due to the increasing demand for LNG exports and the need for advanced technologies to optimize production processes. The Ruwais LNG project exemplifies this trend, featuring state-of-the-art liquefaction trains that will be powered by clean energy sources including nuclear and renewable energy, representing a technological leap in liquefaction efficiency and environmental performance.

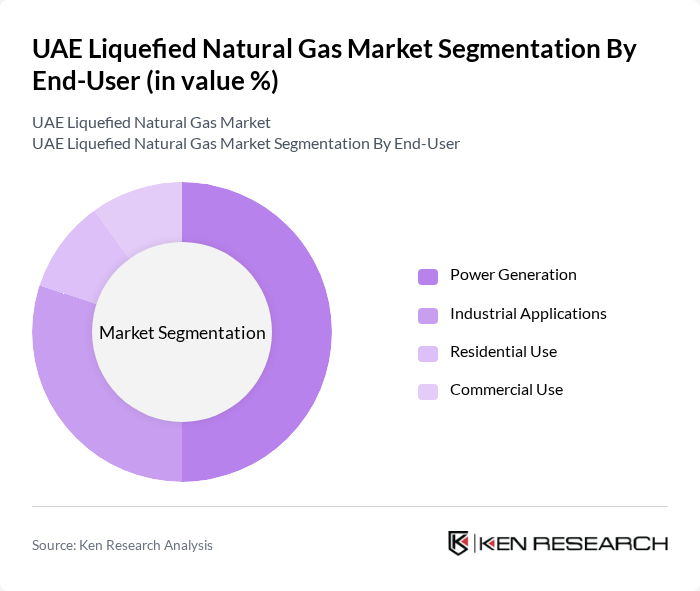

By End-User:The end-user segmentation includes Power Generation, Industrial Applications, Residential Use, and Commercial Use. Power Generation is the dominant segment, driven by the increasing need for reliable and cleaner energy sources in the UAE. The shift towards natural gas for power generation is supported by government policies aimed at reducing carbon emissions and enhancing energy security. The industrial applications segment is also experiencing growth, particularly with the expansion of the Al Ruwais Industrial City, which serves as a major hub for petrochemical and energy-intensive industries requiring consistent LNG supply.

The UAE Liquefied Natural Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi National Oil Company (ADNOC), ADNOC LNG, QatarEnergy, Shell, TotalEnergies, ExxonMobil, Chevron, Eni, BP (British Petroleum), Gazprom, Petronas, Oman LNG LLC, Kuwait Petroleum Corporation (KPC), and Saudi Aramco contribute to innovation, geographic expansion, and service delivery in this space.

The UAE liquefied natural gas market is poised for significant transformation as it adapts to global energy trends and domestic policy shifts. With a focus on sustainability and cleaner energy sources, the demand for LNG is expected to rise, supported by government initiatives and infrastructure investments. The integration of advanced technologies in LNG processing and storage will enhance operational efficiency, while strategic partnerships will facilitate market expansion. Overall, the UAE is likely to solidify its position as a leading LNG exporter in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquefaction Technology Regasification Technology Transportation Method Storage Solutions Others |

| By End-User | Power Generation Industrial Applications Residential Use Commercial Use |

| By Application | Power Plants Marine Fuel Chemical Production Others |

| By Distribution Channel | Direct Sales Distributors Online Platforms |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| By Market Maturity | Emerging Markets Established Markets Niche Markets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 100 | Energy Managers, Plant Operators |

| Industrial LNG Users | 80 | Procurement Managers, Operations Directors |

| Export and Trading Companies | 70 | Trade Analysts, Business Development Managers |

| Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

| Research Institutions | 50 | Energy Researchers, Academic Experts |

The UAE Liquefied Natural Gas market is valued at approximately USD 13 billion, driven by increasing demand for cleaner energy sources and strategic initiatives to diversify the energy portfolio while reducing carbon emissions.