Region:Asia

Author(s):Shubham

Product Code:KRAD5516

Pages:99

Published On:December 2025

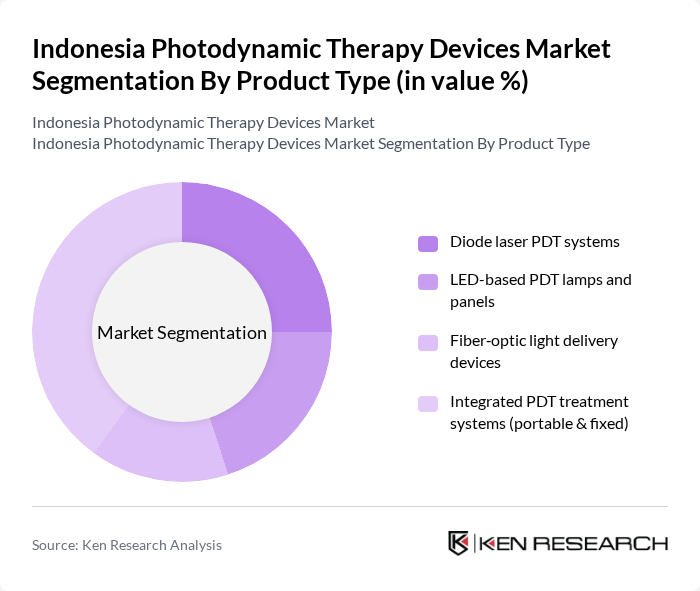

By Product Type:The product type segmentation includes various devices utilized in photodynamic therapy. The dominant sub-segment is the integrated PDT treatment systems, which are favored for combining light sources, control units, and applicators in a single platform and for their versatility across oncology and dermatology indications. Diode laser PDT systems and LED-based PDT lamps are also significant, particularly in dermatology and aesthetic medicine, where they are used for actinic keratosis, acne, and cosmetic skin rejuvenation. The market is witnessing a trend towards compact and portable systems that support outpatient and day-care settings, driven by growing procedural volumes in ambulatory clinics and a shift from inpatient to office-based treatments.

By Light Source:The light source segmentation encompasses various technologies used in photodynamic therapy. Laser-based light sources dominate the market due to their high irradiance, wavelength selectivity, and effectiveness in precisely targeting tumors and lesions in oncology and certain deep or localized indications. LED-based light sources are gaining traction for their uniform illumination, lower cost, favorable safety profile, and ease of integration into dermatology and aesthetic platforms, making them widely used for skin cancer in situ, actinic keratosis, and acne. Other light sources, including broadband lamps and specialized fiber?optic or endoscopic systems, are present but hold a smaller market share, typically serving niche or procedure?specific applications.

The Indonesia Photodynamic Therapy Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Boston Scientific Corporation, biolitec AG, Lumenis Be Ltd., Candela Corporation, Modulight Corporation, Coherent Corp., Theralase Technologies Inc., IRIDEX Corporation, Lumibird Medical, ShangHai Apolo Medical Technology Co., Ltd., Sun Pharmaceutical Industries Ltd. (PDT drugs and light activation support), Bausch + Lomb, Cutera Inc., Candela Medical Thailand & Indonesia distribution network, Local Indonesian distributors of PDT and aesthetic laser devices contribute to innovation, geographic expansion, and service delivery in this space.

The future of the photodynamic therapy market in Indonesia appears promising, driven by increasing healthcare investments and a growing focus on innovative treatment modalities. As the government enhances healthcare infrastructure, more facilities are likely to adopt advanced technologies. Additionally, the integration of artificial intelligence in treatment planning is expected to optimize patient outcomes. These trends indicate a shift towards more personalized and efficient healthcare solutions, positioning photodynamic therapy as a key player in the evolving medical landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Diode laser PDT systems LED-based PDT lamps and panels Fiber?optic light delivery devices Integrated PDT treatment systems (portable & fixed) |

| By Light Source | Laser-based light sources LED-based light sources Other light sources |

| By Application | Oncology (solid tumors and palliative cancer care) Dermatology (actinic keratosis, acne, non-melanoma skin cancer) Ophthalmology and other specialty indications Aesthetic and cosmetic dermatology |

| By End-User | Public hospitals Private hospitals Dermatology and aesthetic clinics Cancer treatment centers Research and academic institutions |

| By Distribution Channel | Direct sales to hospitals and clinics Local medical device distributors Online and e?procurement platforms Tender?based institutional procurement |

| By Region | Java (Jakarta, West Java, Central Java, East Java, Banten, Yogyakarta) Sumatra Kalimantan and Sulawesi Bali & Nusa Tenggara Papua & Maluku |

| By Treatment Setting | Outpatient hospital departments Ambulatory/day?care centers Specialty clinics Home?based / portable PDT use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Clinics Using PDT | 60 | Oncologists, Clinic Administrators |

| Dermatology Practices Implementing PDT | 50 | Dermatologists, Practice Managers |

| Hospitals with PDT Equipment | 40 | Procurement Officers, Medical Directors |

| Medical Device Distributors | 40 | Sales Managers, Product Specialists |

| Regulatory Bodies and Health Authorities | 40 | Regulatory Affairs Officers, Policy Makers |

The Indonesia Photodynamic Therapy Devices Market is valued at approximately USD 12 million, reflecting a five-year historical analysis and benchmarking against regional cancer photodynamic therapy markets in the Asia Pacific region.