Region:Asia

Author(s):Rebecca

Product Code:KRAB4162

Pages:85

Published On:October 2025

By Type:The market is segmented into various types of plant-based dairy alternatives, including soy milk, almond milk, coconut milk, oat milk, cashew milk, rice milk, plant-based yogurt, plant-based cheese, and others. Among these,soy milkhas traditionally been the leading sub-segment due to its high protein content and versatility in culinary applications. However, consumer preferences are shifting, withalmond milk, oat milk, and coconut milkgaining traction, particularly among health-conscious consumers seeking low-calorie and allergen-friendly options. Plant-based yogurt and cheese are also registering strong retail growth, reflecting broader acceptance of alternative dairy formats.

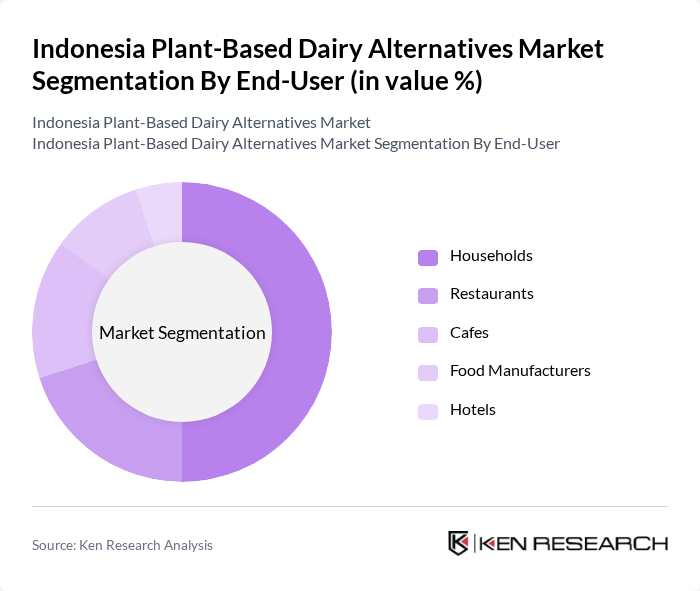

By End-User:The end-user segmentation includes households, restaurants, cafes, food manufacturers, and hotels.Householdsrepresent the largest segment, driven by the increasing adoption of plant-based diets among families and the availability of plant-based dairy alternatives in modern retail channels. Restaurants and cafes are also significant contributors, as they adapt their menus to include plant-based options to cater to the growing demand from health-conscious consumers. The rise of e-commerce and convenience stores further supports the accessibility and adoption of plant-based dairy products among all end-user groups.

The Indonesia Plant-Based Dairy Alternatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Greenfields Indonesia, PT. Nutrifood Indonesia, PT. Nutrisoy Indonesia, PT. Danone Indonesia (Alpro), PT. So Good Food, PT. Sarihusada Generasi Mahardhika, PT. Frisian Flag Indonesia, PT. Ultra Jaya Milk Industry, PT. Indolakto, PT. Nestlé Indonesia, PT. Oatly Indonesia, PT. Cisarua Mountain Dairy, PT. Bina Karya Prima, PT. Bina Karya Sejahtera, PT. Bina Karya Mandiri, PT. Silk Indonesia, PT. V-Soy Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the plant-based dairy alternatives market in Indonesia appears promising, driven by increasing health consciousness and environmental sustainability trends. As consumer preferences shift towards healthier and more sustainable options, companies are likely to innovate and diversify their product offerings. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility, allowing consumers to explore a wider range of plant-based products. This evolving landscape presents significant opportunities for growth and market penetration in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Soy Milk Almond Milk Coconut Milk Oat Milk Cashew Milk Rice Milk Plant-Based Yogurt Plant-Based Cheese Others |

| By End-User | Households Restaurants Cafes Food Manufacturers Hotels |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Health Food Stores Convenience Stores Traditional Markets |

| By Packaging Type | Cartons Bottles Pouches Tetra Pak |

| By Price Range | Premium Mid-Range Economy |

| By Flavor | Original Vanilla Chocolate Strawberry Others |

| By Nutritional Content | High Protein Low Sugar Fortified (e.g. Calcium, Vitamin D, B12) Lactose-Free Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 120 | Health-Conscious Consumers, Vegan Diet Adopters |

| Distribution Channel Analysis | 80 | Wholesale Distributors, Supply Chain Managers |

| Product Development Feedback | 60 | Product Managers, R&D Specialists |

| Market Trend Evaluation | 60 | Market Analysts, Industry Experts |

The Indonesia Plant-Based Dairy Alternatives Market is valued at approximately USD 540 million, reflecting a significant growth trend driven by increasing health consciousness, lactose intolerance awareness, and a rise in veganism and vegetarianism among consumers.