Region:Middle East

Author(s):Shubham

Product Code:KRAB7465

Pages:89

Published On:October 2025

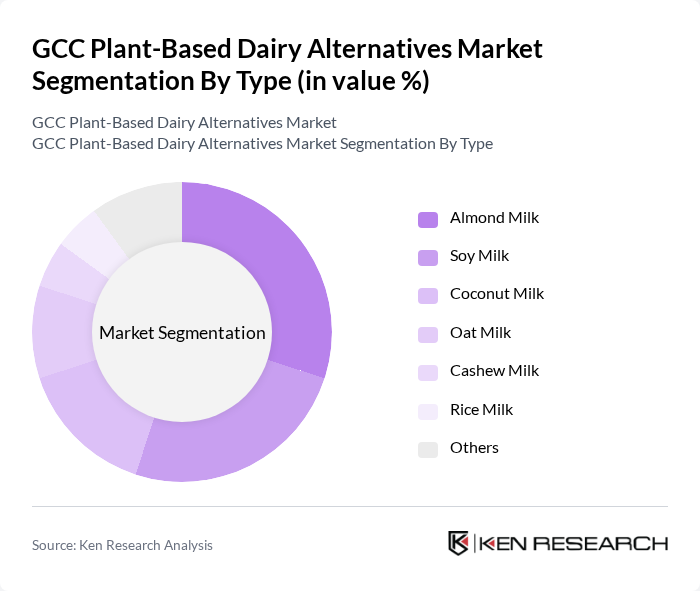

By Type:The market is segmented into various types of plant-based dairy alternatives, including almond milk, soy milk, coconut milk, oat milk, cashew milk, rice milk, and others. Among these, almond milk and soy milk are the most popular due to their versatility and nutritional benefits. Almond milk is favored for its low calorie content, while soy milk is recognized for its protein content, making them staples in many households and foodservice establishments.

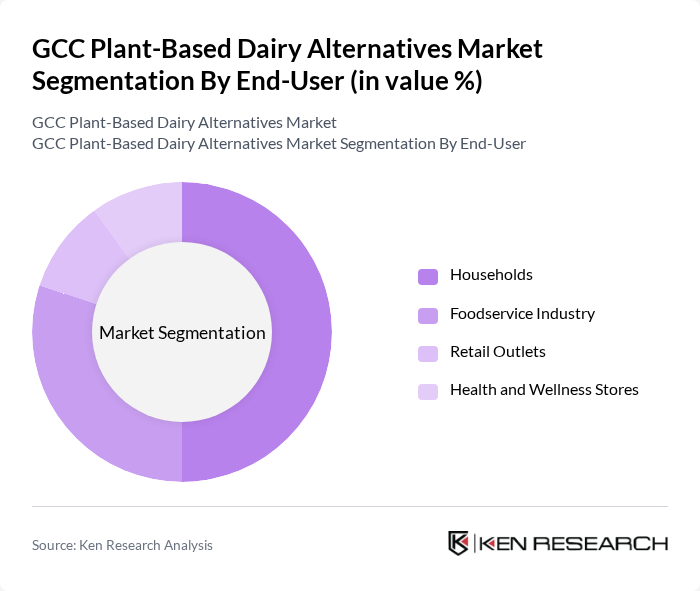

By End-User:The end-user segmentation includes households, the foodservice industry, retail outlets, and health and wellness stores. Households represent the largest segment as more consumers incorporate plant-based dairy alternatives into their daily diets for health benefits. The foodservice industry is also growing, with restaurants and cafes increasingly offering plant-based options to cater to the rising demand from health-conscious consumers.

The GCC Plant-Based Dairy Alternatives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alpro, Oatly, Silk, So Delicious, Califia Farms, Ripple Foods, Nutpods, Elmhurst 1925, Vitasoy, Tofutti Brands, Daiya Foods, Follow Your Heart, Good Karma Foods, Chobani, Plant-Based Foods Association contribute to innovation, geographic expansion, and service delivery in this space.

The future of the GCC plant-based dairy alternatives market appears promising, driven by increasing health consciousness and a shift towards sustainable consumption. Innovations in product development are expected to enhance flavor profiles and nutritional benefits, attracting a wider consumer base. Additionally, the rise of e-commerce platforms will facilitate easier access to these products, further boosting market penetration. As consumer preferences evolve, companies that adapt to these trends will likely thrive in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Almond Milk Soy Milk Coconut Milk Oat Milk Cashew Milk Rice Milk Others |

| By End-User | Households Foodservice Industry Retail Outlets Health and Wellness Stores |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores |

| By Packaging Type | Cartons Bottles Pouches Tetra Packs |

| By Flavor | Original Vanilla Chocolate Fruit Flavors |

| By Price Range | Premium Mid-Range Budget |

| By Brand Positioning | Organic Non-GMO Conventional Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Plant-Based Milk | 150 | Health-conscious Consumers, Vegan Diet Adopters |

| Market Insights from Retailers | 100 | Store Managers, Category Buyers |

| Product Development Feedback | 80 | Food Scientists, R&D Managers |

| Nutritionist Perspectives on Plant-Based Dairy | 60 | Registered Dietitians, Nutrition Consultants |

| Consumer Purchase Behavior Analysis | 120 | Frequent Shoppers, Online Grocery Buyers |

The GCC Plant-Based Dairy Alternatives Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health consciousness, lactose intolerance, and a shift towards veganism and vegetarianism among consumers in the region.