Region:Asia

Author(s):Dev

Product Code:KRAD5131

Pages:91

Published On:December 2025

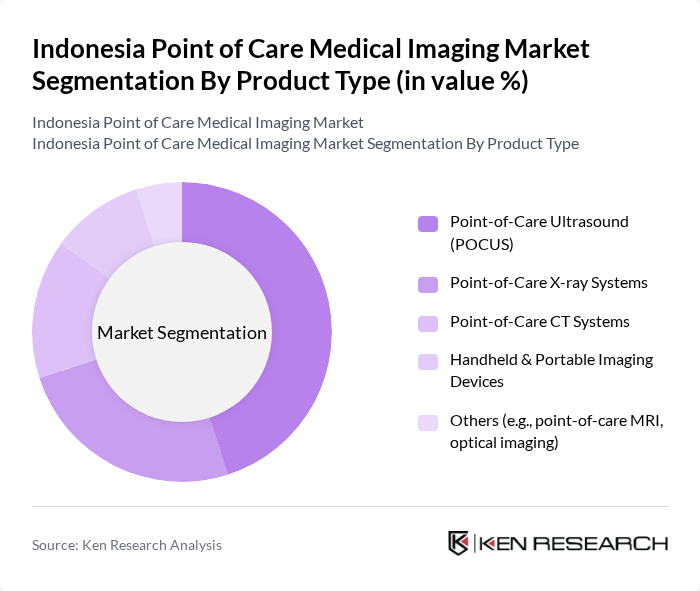

By Product Type:The product type segmentation includes various imaging technologies that cater to different diagnostic needs. Among these, Point-of-Care Ultrasound (POCUS) is leading the market due to its portability, relatively lower cost, lack of ionizing radiation, ease of use at the bedside, and ability to provide immediate results, making it essential in emergency, critical care, obstetrics, and primary care settings. Point-of-Care X-ray Systems and CT Systems are also gaining traction, particularly in hospitals and larger clinics, as they offer quick imaging solutions for trauma, chest, and orthopedic indications and are increasingly available in mobile and portable configurations. Handheld and portable imaging devices, especially handheld ultrasound, are increasingly popular for their convenience in remote and rural areas and for use in outreach programs, telemedicine-supported services, and mobile clinics. Other technologies like point-of-care MRI and optical imaging are emerging globally but still represent a smaller share of the Indonesian market, mainly in specialized centers and pilot deployments.

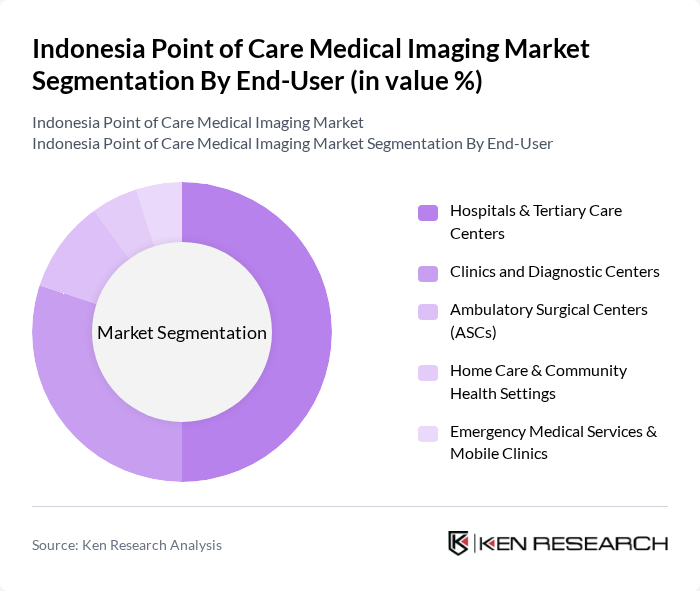

By End-User:The end-user segmentation highlights the various healthcare settings utilizing point-of-care imaging technologies. Hospitals and tertiary care centers are the largest consumers, driven by the need for rapid diagnostics in emergency departments, intensive care units, perioperative care, and specialized services such as cardiology and oncology. Clinics and diagnostic centers follow closely, as they increasingly adopt portable ultrasound and mobile X?ray systems to enhance workflow efficiency, reduce patient wait times, and support outpatient imaging. Ambulatory Surgical Centers (ASCs) are also emerging as significant users, particularly for orthopedics, day surgeries, and interventional procedures that require quick intra?operative imaging support. Home care and community health settings are gaining traction due to the growing trend of at-home diagnostics, mobile health programs, and telemedicine, where handheld ultrasound and portable X?ray help extend services to patients outside traditional facilities. Emergency medical services and mobile clinics are vital for providing immediate care in remote and underserved areas, leveraging compact ultrasound and portable radiography to support pre-hospital triage and disaster or outreach responses.

The Indonesia Point of Care Medical Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as GE HealthCare Technologies Inc., Siemens Healthineers AG, Canon Medical Systems Corporation, FUJIFILM Healthcare Corporation, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Samsung Medison Co., Ltd., Hitachi, Ltd. (Hitachi Healthcare/Aloka), Esaote S.p.A., Terumo Indonesia (Terumo Corporation), PT Kalbe Farma Tbk (Medical Devices & Diagnostics Division), PT Sarana Medika Lestari (local imaging distributor), PT Philips Indonesia Commercial, PT Siemens Healthineers Indonesia, PT GE Operations Indonesia contribute to innovation, geographic expansion, and service delivery in this space, with major global vendors actively promoting ultrasound, CT, X?ray, and portable imaging platforms tailored for Indonesia through hospital partnerships and participation in events such as Indonesia Hospital Expo.

The future of the point of care medical imaging market in Indonesia appears promising, driven by ongoing technological advancements and increasing healthcare investments. The integration of artificial intelligence in imaging devices is expected to enhance diagnostic accuracy and efficiency. Additionally, the expansion of telemedicine services will facilitate remote consultations, further driving the demand for portable imaging solutions. As healthcare infrastructure improves, the market is poised for significant growth, addressing the needs of both urban and rural populations.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Point-of-Care Ultrasound (POCUS) Point-of-Care X-ray Systems Point-of-Care CT Systems Handheld & Portable Imaging Devices Others (e.g., point-of-care MRI, optical imaging) |

| By End-User | Hospitals & Tertiary Care Centers Clinics and Diagnostic Centers Ambulatory Surgical Centers (ASCs) Home Care & Community Health Settings Emergency Medical Services & Mobile Clinics |

| By Clinical Application | Cardiology Obstetrics & Gynecology Orthopedics & Musculoskeletal Emergency & Critical Care Others (e.g., oncology, neurology, vascular) |

| By Technology | D Imaging D/4D Imaging AI-enabled & Advanced Visualization Systems Wireless & Battery-powered Systems |

| By Distribution Channel | Direct Sales by OEMs Local Distributors & Importers E-commerce & Digital Platforms Group Purchasing & Tender-based Procurement |

| By Region | Java Sumatra Kalimantan Sulawesi Papua & Other Regions (incl. Bali, Nusa Tenggara, Maluku) |

| By Policy & Payment Environment | Government Procurement & BPJS Reimbursement Public–Private Partnership (PPP) Initiatives International Aid & Donor-funded Programs Local Manufacturing & Import Duty Incentives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Technologists |

| Private Clinics Utilizing Point of Care Imaging | 100 | Clinic Owners, General Practitioners |

| Medical Device Distributors | 80 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 50 | Health Administrators, Government Officials |

| Telemedicine Providers | 90 | Telehealth Coordinators, IT Managers |

The Indonesia Point of Care Medical Imaging Market is valued at approximately USD 0.42 billion, reflecting its growth driven by increasing demand for rapid diagnostic solutions and advancements in imaging technologies.