Region:Asia

Author(s):Shubham

Product Code:KRAD6695

Pages:94

Published On:December 2025

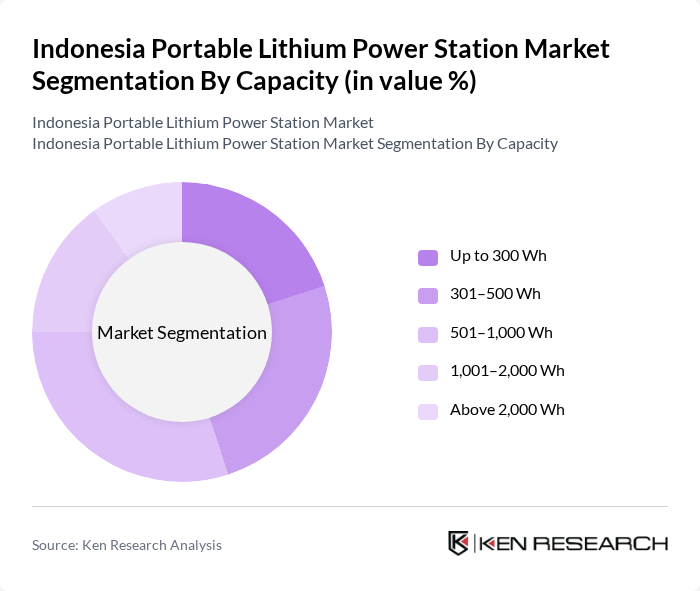

By Capacity:The capacity of portable lithium power stations is a crucial factor influencing consumer choice. The market is segmented into various capacity ranges, including up to 300 Wh, 301–500 Wh, 501–1,000 Wh, 1,001–2,000 Wh, and above 2,000 Wh. The demand for higher capacity units is driven by the increasing need for power in outdoor activities, work-at-site applications, and emergency situations, with Indonesian users in remote and island regions often preferring units above 1 kWh to support essential loads during outages and off-grid use.

The 501–1,000 Wh capacity segment is currently dominating the market due to its versatility and suitability for a wide range of applications, from camping and mobile work sites to emergency power supply. Consumers are increasingly opting for this capacity range as it provides a balance between portability and power output, making it ideal for both recreational and practical uses. The growing trend of outdoor activities, frequent localized power interruptions, and the need for reliable backup power solutions for electronic devices and small appliances are key drivers for this segment's leadership.

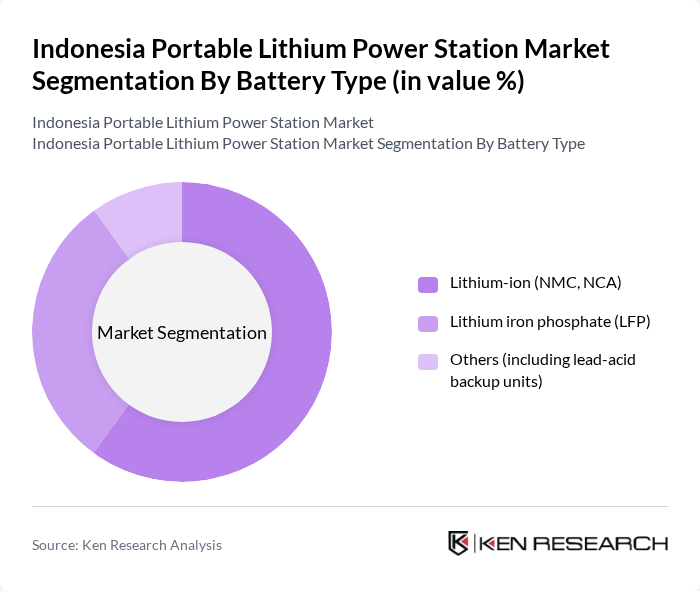

By Battery Type:The battery type is another significant factor in the portable lithium power station market, with segments including Lithium-ion (NMC, NCA), Lithium iron phosphate (LFP), and others (including lead-acid backup units). The choice of battery type affects performance, safety, and cost, influencing consumer preferences.

The Lithium-ion (NMC, NCA) battery type is leading the market due to its high energy density, longer lifespan, and lightweight characteristics, making it the preferred choice for consumers seeking efficient and portable power solutions. The increasing awareness of the benefits of lithium-ion technology in Indonesia, coupled with advancements in battery management systems and the country’s broader push for lithium-ion deployment in energy storage and mobility, has further solidified its dominance in the market.

The Indonesia Portable Lithium Power Station Market is characterized by a dynamic mix of regional and international players. Leading participants such as EcoFlow Inc., Jackery Inc., Goal Zero LLC, Shenzhen Poweroak Newener Co., Ltd. (Bluetti / PowerOak), Anker Innovations Co., Ltd., ALLPOWERS Industrial International Limited, Shenzhen Suaoki New Energy Co., Ltd., Renogy (Renogy Power / RNG Group Inc.), Aiper Energy Co., Ltd., MAXOAK Corporation, PT V2 Indonesia, PT Petrosea Tbk – portable power & site energy solutions, PT Panasonic Gobel Indonesia, PT Changhong Electric Indonesia, PT SolarKita Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the portable lithium power station market in Indonesia appears promising, driven by increasing environmental awareness and technological advancements. As the government continues to promote renewable energy initiatives, consumer interest in sustainable solutions is expected to rise. Additionally, the integration of smart energy management systems will enhance user experience, making these products more appealing. The market is likely to witness innovative financing models that will further facilitate access to these energy solutions, broadening their reach across various consumer segments.

| Segment | Sub-Segments |

|---|---|

| By Capacity | Up to 300 Wh –500 Wh –1,000 Wh ,001–2,000 Wh Above 2,000 Wh |

| By Battery Type | Lithium-ion (NMC, NCA) Lithium iron phosphate (LFP) Others (including lead-acid backup units) |

| By Power Source / Charging Method | AC charging Solar charging Vehicle (DC / carport) charging Hybrid (multi?input) |

| By Application | Residential backup power Outdoor recreation & camping Construction & field operations Emergency & disaster preparedness Commercial & SOHO (small office / home office) |

| By Sales Channel | Online (marketplaces & brand webstores) Offline – modern retail & electronics chains Offline – specialty / outdoor & solar dealers B2B project & institutional sales |

| By Region | Java (incl. Greater Jakarta) Sumatra Bali & Nusa Tenggara Kalimantan Sulawesi Papua & Maluku Islands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Market for Portable Power Stations | 120 | Outdoor Enthusiasts, Homeowners |

| Commercial Applications in Construction | 100 | Project Managers, Site Supervisors |

| Emergency Services Utilization | 80 | Emergency Response Coordinators, Fire Department Officials |

| Retail Distribution Channels | 70 | Retail Managers, Supply Chain Coordinators |

| Technological Adoption in Renewable Energy | 60 | Energy Consultants, Sustainability Officers |

The Indonesia Portable Lithium Power Station Market is valued at approximately USD 0.7 million, reflecting a growing interest in renewable energy solutions and portable power sources for both residential and commercial applications.