Region:Asia

Author(s):Geetanshi

Product Code:KRAD1133

Pages:100

Published On:November 2025

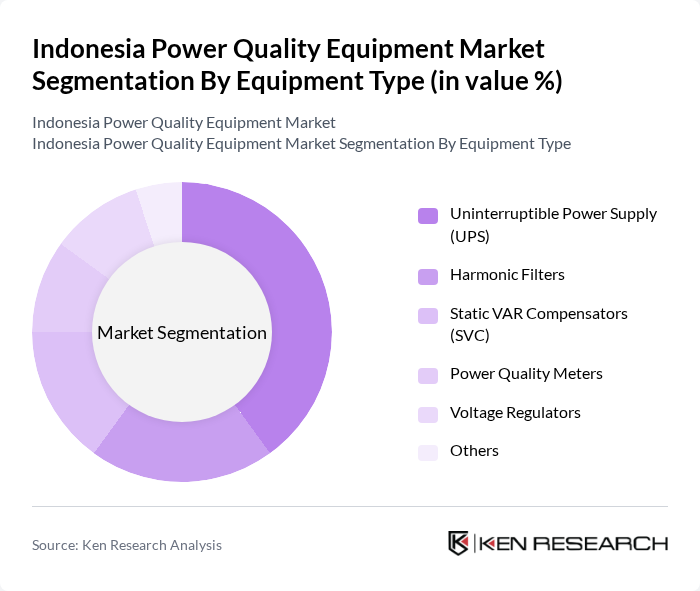

By Equipment Type:

The equipment type segmentation includes Uninterruptible Power Supply (UPS), Harmonic Filters, Static VAR Compensators (SVC), Power Quality Meters, Voltage Regulators, and Others. Among these, Uninterruptible Power Supply (UPS) systems dominate the market due to their critical role in providing backup power and ensuring operational continuity for businesses. The increasing reliance on technology and the need for uninterrupted power supply in sectors like IT, healthcare, and manufacturing have led to a surge in UPS adoption. Additionally, the growing awareness of power quality issues has driven demand for harmonic filters and voltage regulators, making them significant contributors to market growth.

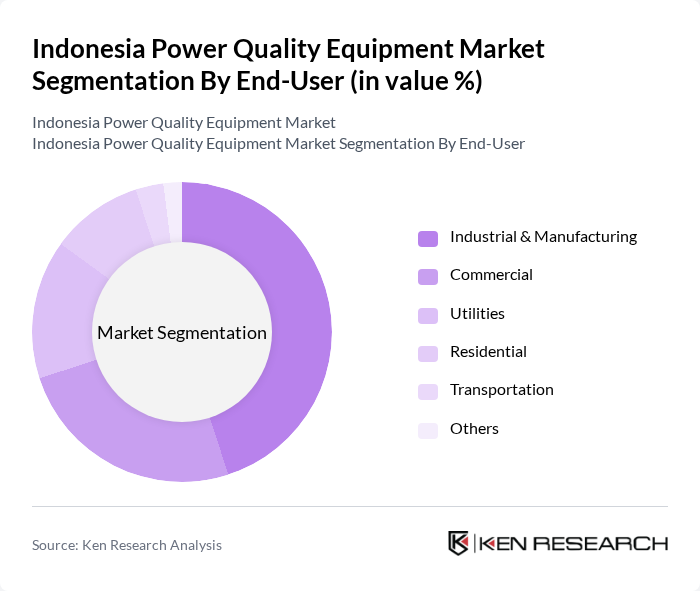

By End-User:

The end-user segmentation encompasses Industrial & Manufacturing, Commercial, Utilities, Residential, Transportation, and Others. The Industrial & Manufacturing sector leads the market, driven by the need for reliable power supply and quality assurance in production processes. Industries such as automotive, electronics, and food processing are increasingly investing in power quality equipment to minimize downtime and enhance operational efficiency. The commercial sector also shows significant growth, as businesses seek to protect their equipment and ensure uninterrupted service delivery.

The Indonesia Power Quality Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schneider Electric, Siemens AG, ABB Ltd., Eaton Corporation, General Electric, Mitsubishi Electric, Emerson Electric Co., Rockwell Automation, Honeywell International Inc., Schneider Electric Indonesia, PT. Fuji Electric Indonesia, PT. PLN (Persero), PT. ABB Sakti Industri, PT. Siemens Indonesia, PT. Indika Energy Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia power quality equipment market is poised for significant transformation as the country embraces sustainable energy solutions and smart grid technologies. With the government's commitment to renewable energy and the integration of IoT in power management, the demand for advanced power quality solutions is expected to rise. Additionally, the growing focus on energy efficiency and cost reduction will drive innovation, leading to the emergence of hybrid power systems that enhance reliability and performance in the energy sector.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type (UPS, Harmonic Filters, Static VAR Compensators, Power Quality Meters, Voltage Regulators, Others) | Uninterruptible Power Supply (UPS) Harmonic Filters Static VAR Compensators (SVC) Power Quality Meters Voltage Regulators Others |

| By End-User (Industrial & Manufacturing, Commercial, Utilities, Residential, Transportation, Others) | Industrial & Manufacturing Commercial Utilities Residential Transportation Others |

| By Phase (Single Phase, Three Phase) | Single Phase Three Phase |

| By Application (Power Distribution, Renewable Integration, Data Centers, Industrial Automation, Others) | Power Distribution Renewable Integration Data Centers Industrial Automation Others |

| By Region (Java, Sumatra, Kalimantan, Sulawesi, Bali, Nusa Tenggara) | Java Sumatra Kalimantan Sulawesi Bali Nusa Tenggara |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Power Quality Needs | 100 | Plant Managers, Electrical Engineers |

| Commercial Building Energy Management | 80 | Facility Managers, Energy Auditors |

| Utility Company Power Quality Solutions | 70 | Grid Managers, Technical Directors |

| Telecommunications Equipment Power Quality | 50 | Network Engineers, Operations Managers |

| Renewable Energy Integration Challenges | 90 | Project Managers, Renewable Energy Specialists |

The Indonesia Power Quality Equipment Market is valued at approximately USD 1.5 billion, driven by the increasing demand for reliable power supply in industrial and commercial sectors, as well as the adoption of renewable energy sources.