Region:Asia

Author(s):Rebecca

Product Code:KRAD1327

Pages:99

Published On:November 2025

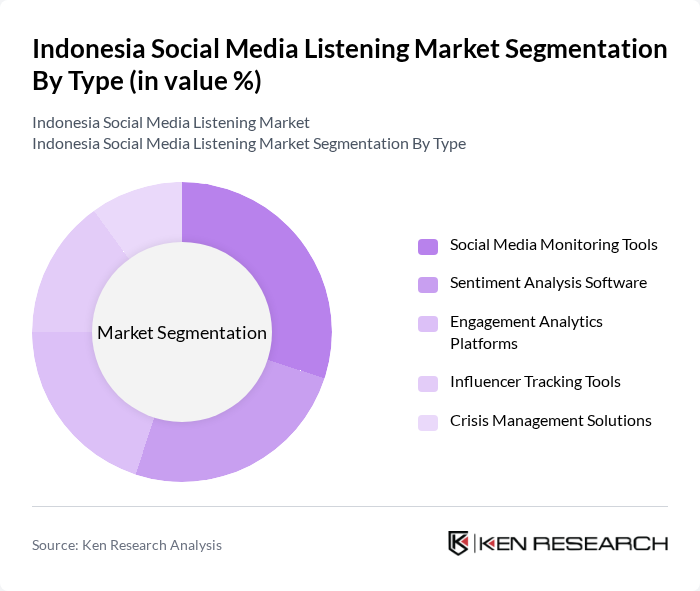

By Type:The market is segmented into various types of social media listening tools, including Social Media Monitoring Tools, Sentiment Analysis Software, Engagement Analytics Platforms, Influencer Tracking Tools, and Crisis Management Solutions. Each of these sub-segments plays a crucial role in helping businesses understand consumer behavior, monitor brand health, manage online reputation, and respond proactively to emerging issues .

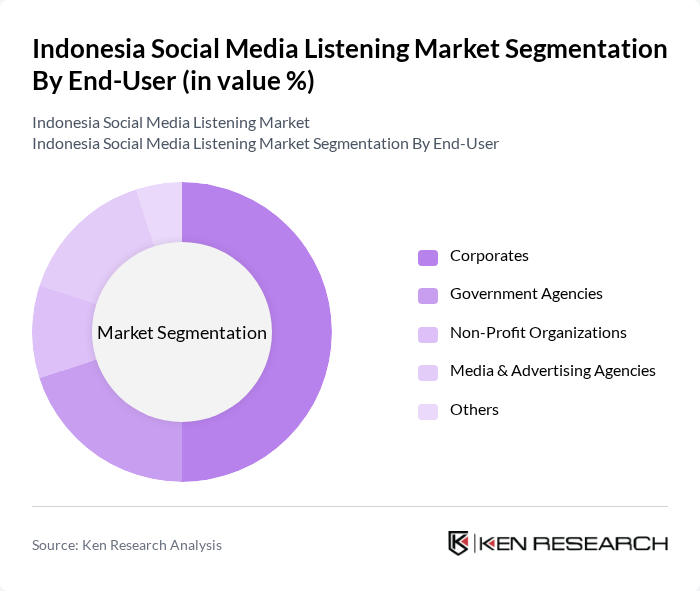

By End-User:The end-user segmentation includes Corporates, Government Agencies, Non-Profit Organizations, Media & Advertising Agencies, and Others. Corporates are the leading end-users, leveraging social media listening tools to optimize marketing strategies, manage brand reputation, and enhance customer engagement. Government agencies increasingly utilize these platforms for public sentiment analysis and crisis response, while media and advertising agencies use them to refine campaign effectiveness .

The Indonesia Social Media Listening Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sprinklr, Brandwatch, Hootsuite, Meltwater, Talkwalker, NetBase Quid, Mention, Synthesio, Cision, BuzzSumo, Socialbakers, Falcon.io, Digimind, Keyhole, Awario, NoLimit Indonesia, Sonar Platform, MediaWave, Drone Emprit, Isentia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia social media listening market appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly recognize the value of data-driven insights, the integration of artificial intelligence and machine learning into social media analytics tools is expected to enhance predictive capabilities. Furthermore, the growing emphasis on personalized customer experiences will likely propel the demand for sophisticated listening solutions that can provide actionable insights in real-time.

| Segment | Sub-Segments |

|---|---|

| By Type | Social Media Monitoring Tools Sentiment Analysis Software Engagement Analytics Platforms Influencer Tracking Tools Crisis Management Solutions |

| By End-User | Corporates Government Agencies Non-Profit Organizations Media & Advertising Agencies Others |

| By Industry | Retail & E-commerce Telecommunications Financial Services FMCG (Fast-Moving Consumer Goods) Travel & Hospitality Healthcare Others |

| By Deployment Mode | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions |

| By Geography | Java Sumatra Bali Kalimantan Sulawesi Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises |

| By Service Type | Subscription Services Consulting Services Training Services Managed Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Social Media Marketing Agencies | 45 | Agency Owners, Digital Marketing Managers |

| Brand Managers in Consumer Goods | 38 | Brand Managers, Marketing Directors |

| SMEs Utilizing Social Media Listening | 42 | Business Owners, Marketing Executives |

| Social Media Analysts | 35 | Data Analysts, Social Media Strategists |

| Influencers and Content Creators | 40 | Content Creators, Social Media Influencers |

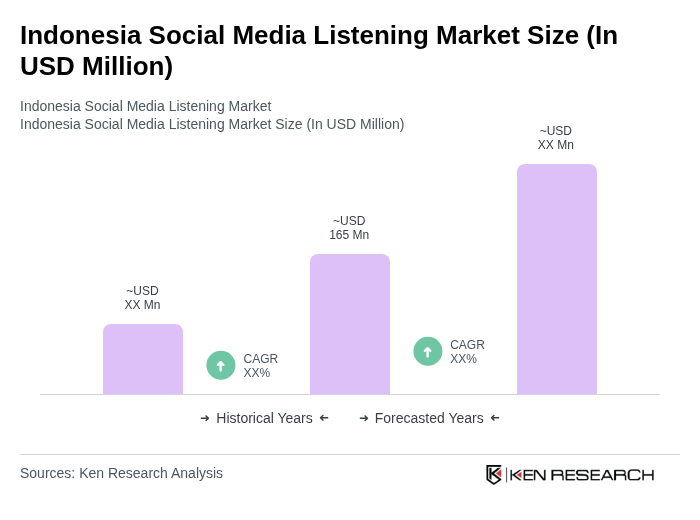

The Indonesia Social Media Listening Market is valued at approximately USD 165 million, reflecting significant growth driven by increased smartphone penetration and internet access, with over 143 million social media users in the country as of early 2025.