Region:Asia

Author(s):Shubham

Product Code:KRAA8478

Pages:91

Published On:November 2025

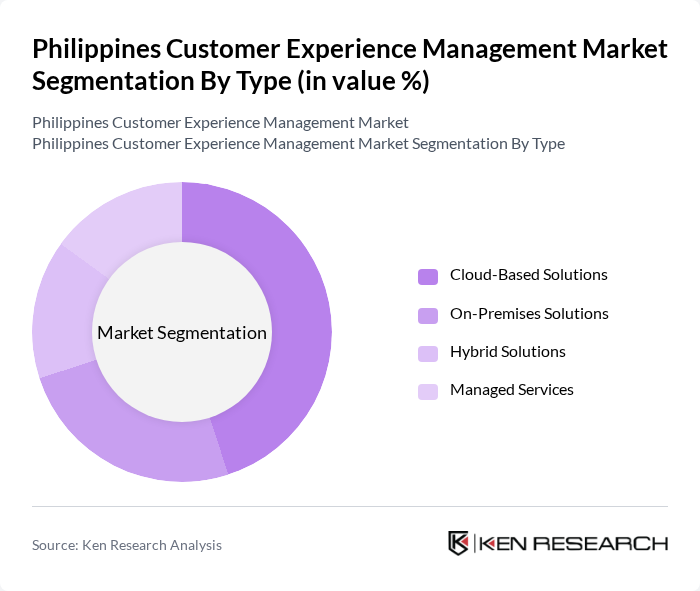

By Type:The market is segmented into Cloud-Based Solutions, On-Premises Solutions, Hybrid Solutions, and Managed Services. Cloud-based solutions are gaining significant traction due to their scalability, cost-effectiveness, and ease of integration with emerging technologies such as artificial intelligence and analytics. On-premises and hybrid solutions remain relevant for organizations with specific regulatory or security requirements, while managed services are increasingly adopted by businesses seeking to outsource complex customer experience operations .

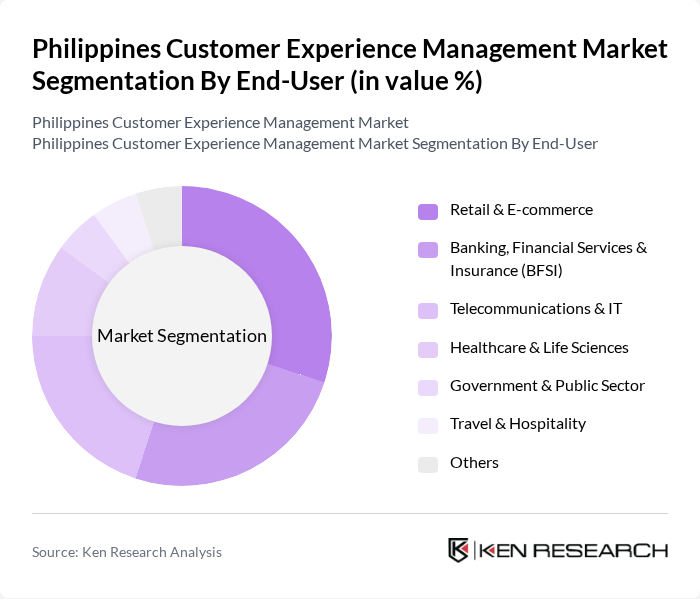

By End-User:The end-user segmentation includes Retail & E-commerce, Banking, Financial Services & Insurance (BFSI), Telecommunications & IT, Healthcare & Life Sciences, Government & Public Sector, Travel & Hospitality, and Others. Retail and BFSI sectors are the most prominent due to their high customer interaction volumes and the critical need for personalized, responsive service. Telecommunications and IT are rapidly adopting advanced CXM solutions to manage large-scale customer bases, while healthcare, government, and travel sectors are increasingly leveraging digital platforms to enhance service delivery and engagement .

The Philippines Customer Experience Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Accenture, IBM, SAP, Salesforce, Oracle, Zendesk, Freshworks, HubSpot, Verint Systems, NICE Ltd., Qualtrics, Medallia, Talkdesk, Genesys, Sitecore, Concentrix, Teleperformance, Sitel Group, Alorica, and Datamatics contribute to innovation, geographic expansion, and service delivery in this space. These companies are at the forefront of deploying omnichannel platforms, automation, and analytics to enhance customer engagement and operational efficiency .

The future of the Philippines customer experience management market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt AI and automation, they will enhance their ability to deliver personalized experiences. Furthermore, the focus on omnichannel engagement will likely grow, allowing companies to interact seamlessly with customers across various platforms. This shift will foster greater customer loyalty and satisfaction, positioning businesses for long-term success in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based Solutions On-Premises Solutions Hybrid Solutions Managed Services |

| By End-User | Retail & E-commerce Banking, Financial Services & Insurance (BFSI) Telecommunications & IT Healthcare & Life Sciences Government & Public Sector Travel & Hospitality Others |

| By Industry Vertical | Automotive Education Manufacturing Media & Entertainment Energy & Utilities Others |

| By Customer Interaction Channel | Social Media Platforms Phone/Call Center Live Chat & Messaging Mobile Apps Website/Portal Virtual Assistants/Chatbots Others |

| By Technology Used | CRM Software Feedback Management Tools Analytics Platforms (Speech, Text, Web, Sentiment) Digital Experience Platforms Personalization Engines Others |

| By Deployment Mode | Public Cloud Private Cloud Hybrid Cloud On-Premises Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups B2B B2C Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Customer Experience | 100 | Store Managers, Customer Service Representatives |

| Banking Sector Experience Management | 100 | Branch Managers, Customer Relationship Officers |

| Telecommunications User Experience | 100 | Product Managers, Customer Support Leads |

| Hospitality Industry Feedback | 80 | Hotel Managers, Guest Relations Officers |

| E-commerce Customer Insights | 90 | eCommerce Managers, Digital Marketing Specialists |

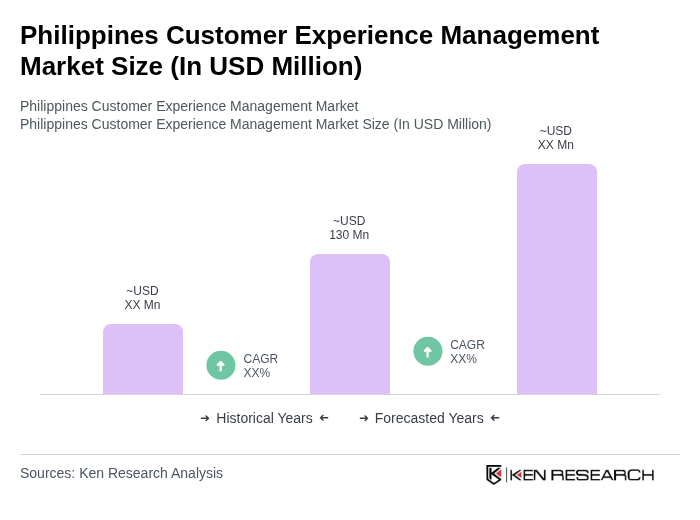

The Philippines Customer Experience Management Market is valued at approximately USD 130 million, reflecting its rapid growth as a specialized segment within the broader business process management and contact center software markets in the country.