Region:Asia

Author(s):Dev

Product Code:KRAA8331

Pages:89

Published On:November 2025

By Type:The market can be segmented into various types, including Surf Resorts and Accommodations, Surf Tours and Expeditions, Surf Camps and Retreats, Surfing Equipment Rentals, Surfing Lessons, Surf Competitions and Events, Surfing Apparel and Accessories, and Others. Among these, Surf Resorts and Accommodations are the most dominant segment, driven by the increasing demand for comfortable lodging options that cater specifically to surfers. The trend of combining surfing with luxury and wellness experiences has led to a rise in high-end surf resorts, which offer tailored services, eco-friendly amenities, and curated packages for surfing enthusiasts .

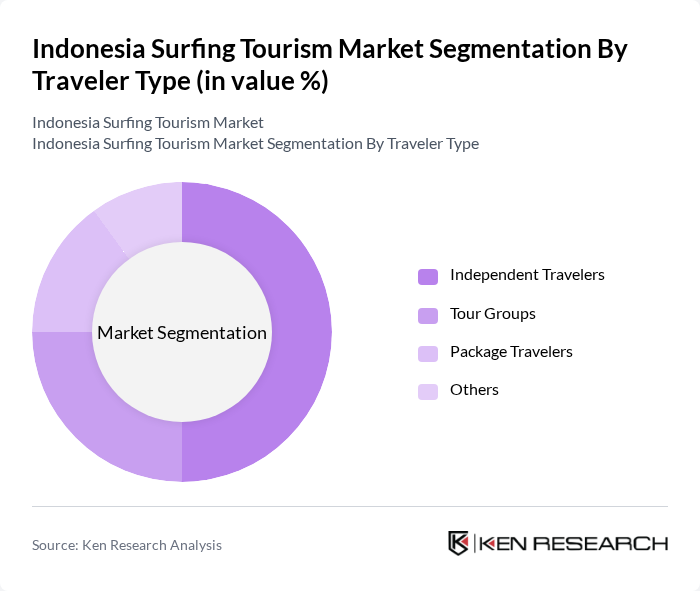

By Traveler Type:The market can also be segmented by traveler type, including Independent Travelers, Tour Groups, Package Travelers, and Others. Independent Travelers dominate this segment, as many surfers prefer to plan their own trips to explore various surf spots at their own pace. This trend is supported by the rise of online travel platforms and social media communities that facilitate easy booking of accommodations, surf guides, and activities, enabling a more personalized and flexible surfing experience .

The Indonesia Surfing Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as World Surfaris Indonesia, AWAVE Travel, The Perfect Wave Travel, Rip Curl School of Surf, Odyssey Surf School, Bali Surf School, Kima Surf, Surf Camp Lombok, Mentawai Surf Retreat, Surfing Life Bali, Bali Surf Tours, Surf Goddess Retreats, S-Resorts Hidden Valley Bali, Lakey Peak Haven (Sumbawa), Nusa Lembongan Surf School contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's surfing tourism market appears promising, driven by increasing global interest and a focus on sustainable practices. As digital marketing strategies evolve, surf schools and local businesses are expected to leverage online platforms to attract a broader audience. Additionally, the integration of technology in surf tourism services, such as mobile apps for surf conditions and bookings, will enhance the overall visitor experience, ensuring that Indonesia remains a top destination for surfers worldwide.

| Segment | Sub-Segments |

|---|---|

| By Type | Surf Resorts and Accommodations Surf Tours and Expeditions Surf Camps and Retreats Surfing Equipment Rentals Surfing Lessons Surf Competitions and Events Surfing Apparel and Accessories Others |

| By Traveler Type | Independent Travelers Tour Groups Package Travelers Others |

| By Tourist Origin | Domestic Tourists International Tourists |

| By Age Group | Below 25 Years –35 Years –45 Years Over 45 Years |

| By Gender | Male Female |

| By Region | Bali Sumatra (including Mentawai Islands) Java Sumbawa Lombok Others |

| By Seasonality | Peak Season (April–October) Off-Peak Season (November–March) Shoulder Season |

| By Surfing Skill Level | Beginner Intermediate Advanced Professional |

| By Accommodation Type | Surf Resorts Hotels Hostels Guesthouses Surf Camps Others |

| By Marketing Channel | Online Travel Agencies Direct Bookings Social Media Promotions Travel Agents Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Surf School Operations | 60 | Surf School Owners, Instructors |

| Tourist Experience Feedback | 100 | Domestic and International Surf Tourists |

| Surf Equipment Retail Insights | 40 | Retail Managers, Sales Associates |

| Local Business Impact Assessment | 50 | Local Business Owners, Community Leaders |

| Surfing Event Participation | 40 | Event Organizers, Participants |

The Indonesia Surfing Tourism Market is valued at approximately USD 5.7 billion, reflecting significant growth driven by the increasing popularity of surfing, Indonesia's reputation for premier surf destinations, and a rise in international tourist arrivals seeking adventurous experiences.