Region:Middle East

Author(s):Dev

Product Code:KRAC3353

Pages:86

Published On:October 2025

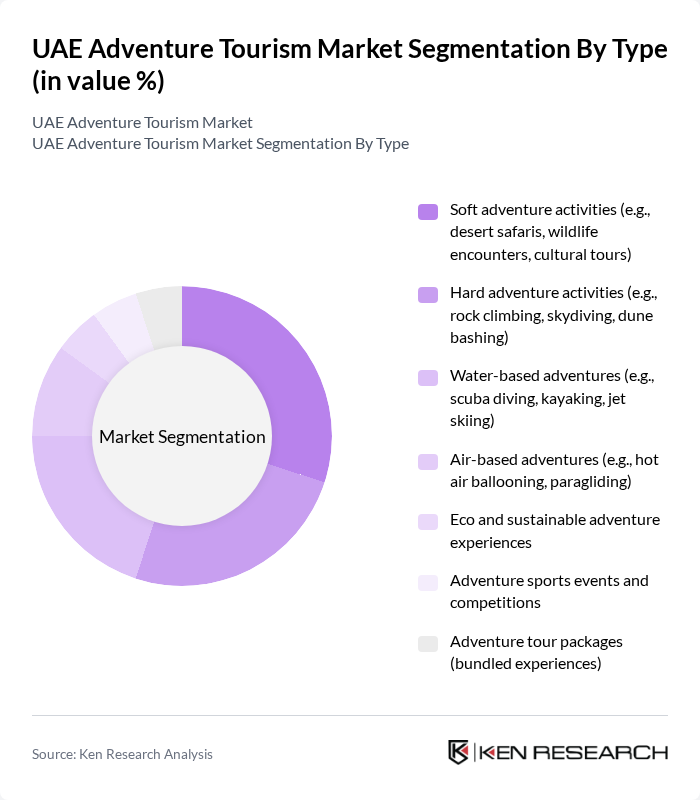

By Type:The adventure tourism market can be segmented into various types, including soft adventure activities, hard adventure activities, water-based adventures, air-based adventures, eco and sustainable adventure experiences, adventure sports events and competitions, and adventure tour packages. Each of these segments caters to different consumer preferences and activity levels, contributing to the overall growth of the market.

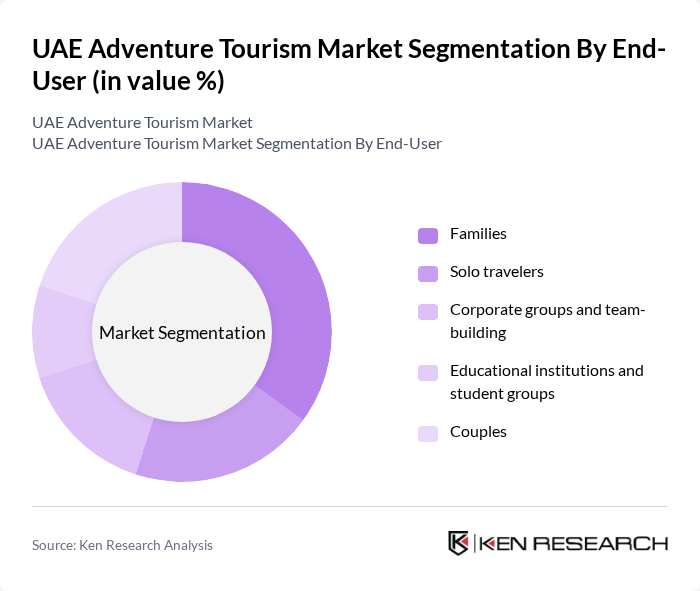

By End-User:The market can also be segmented based on the end-user, which includes families, solo travelers, corporate groups and team-building, educational institutions and student groups, and couples. Each segment has distinct preferences and requirements, influencing the types of adventure experiences they seek.

The UAE Adventure Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adventure HQ, Arabian Adventures, Desert Adventures Tourism, Platinum Heritage, OceanAir Travels, Rayna Tours, Explorer Tours, Hero Experiences Group, Big Red Adventure Tours, Lama Tours, Extreme Arabia, Balloon Adventures Dubai, Skydive Dubai, SeaYou Watersports, Hatta Adventures contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE adventure tourism market appears promising, driven by increasing disposable incomes and a growing interest in outdoor activities. As the government continues to invest in infrastructure and marketing, the sector is likely to attract a diverse range of tourists seeking unique experiences. Additionally, the integration of technology in adventure tourism, such as virtual reality experiences and mobile apps, will enhance customer engagement and satisfaction, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Soft adventure activities (e.g., desert safaris, wildlife encounters, cultural tours) Hard adventure activities (e.g., rock climbing, skydiving, dune bashing) Water-based adventures (e.g., scuba diving, kayaking, jet skiing) Air-based adventures (e.g., hot air ballooning, paragliding) Eco and sustainable adventure experiences Adventure sports events and competitions Adventure tour packages (bundled experiences) |

| By End-User | Families Solo travelers Corporate groups and team-building Educational institutions and student groups Couples |

| By Activity Level | High-intensity activities Moderate-intensity activities Low-intensity activities |

| By Duration | Day trips Weekend getaways Week-long adventures |

| By Seasonality | Peak season Off-peak season |

| By Booking Channel | Direct bookings (operator websites, call centers) Online travel agencies (OTAs) and digital platforms Traditional travel agents Marketplace platforms (e.g., Viator, GetYourGuide) |

| By Price Range | Budget Mid-range Luxury |

| By Tourist Type | Domestic tourists International tourists |

| By Age Group | –28 years –40 years –50 years –60 years + years |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Desert Safari Experiences | 100 | Adventure Tourists, Tour Operators |

| Water Sports Activities | 80 | Water Sports Enthusiasts, Beach Resort Managers |

| Mountain Climbing and Hiking | 60 | Outdoor Enthusiasts, Adventure Guides |

| Cultural Adventure Tours | 50 | Travel Bloggers, Cultural Tour Operators |

| Adventure Tourism Infrastructure | 40 | Local Government Officials, Tourism Developers |

The UAE Adventure Tourism Market is valued at approximately USD 16.8 billion, reflecting significant growth driven by increasing interest in unique travel experiences and government initiatives to diversify the economy through tourism.