Region:Asia

Author(s):Dev

Product Code:KRAC2717

Pages:92

Published On:October 2025

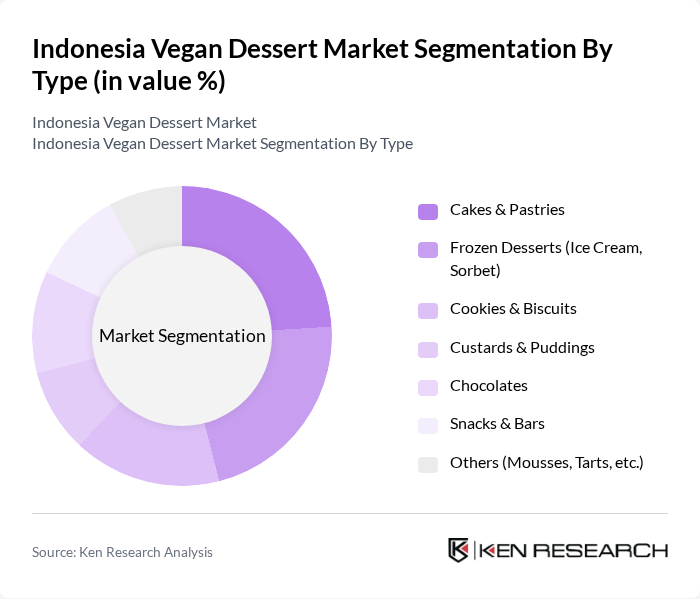

By Type:The market is segmented into cakes & pastries, frozen desserts, cookies & biscuits, custards & puddings, chocolates, snacks & bars, and others. Each sub-segment addresses distinct consumer preferences and dietary needs, fueling overall market growth. Cakes & pastries are especially popular for their indulgent yet healthier positioning, while frozen desserts are gaining traction due to innovation in plant-based ice cream and sorbet formulations .

The cakes & pastries segment leads the market, reflecting strong consumer interest in indulgent yet health-oriented dessert options. This segment benefits from the expansion of vegan bakeries and cafés, as well as the introduction of innovative recipes and customizable flavor profiles that appeal to both vegan and mainstream consumers. Frozen desserts are also rapidly growing, supported by new product launches and the rising popularity of dairy-free ice creams .

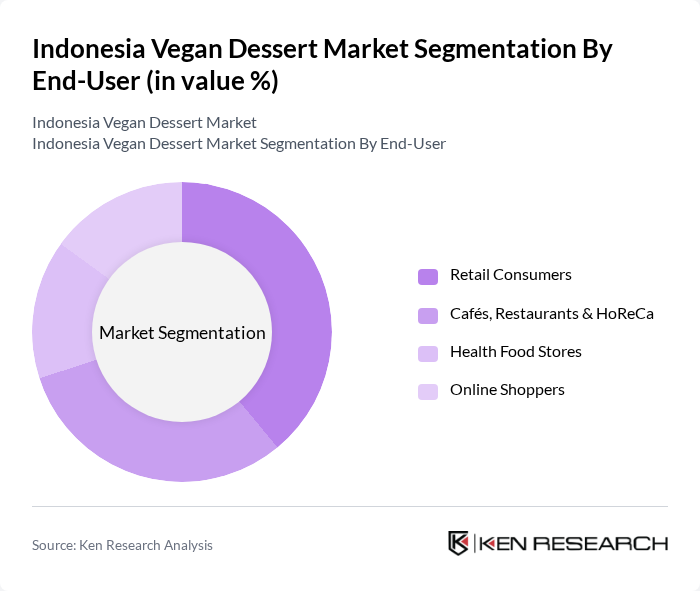

By End-User:The market is segmented by end-users: retail consumers, cafés, restaurants & HoReCa, health food stores, and online shoppers. Each category plays a pivotal role in the distribution and consumption of vegan desserts, with retail and foodservice channels driving the bulk of sales .

Retail consumers remain the largest end-user group, supported by the increasing availability of vegan dessert options in supermarkets and specialty stores. The foodservice sector, including cafés and restaurants, is also a significant contributor, reflecting the trend of vegan menu expansion and the popularity of plant-based desserts among urban diners. Online channels are experiencing robust growth, as consumers seek convenience and access to a wider variety of vegan dessert products .

The Indonesia Vegan Dessert Market is characterized by a dynamic mix of regional and international players. Leading participants such as Burgreens, Dharma Kitchen, Loving Hut Indonesia, Smoo Bowl, Vegan Cake Jakarta, Kynd Community, Plant Baked, The Vegan Baker, Namelaka Patisserie, Fedwell, Goola, Sayurbox (Vegan Dessert Category), Almond Bakery, Veganicious, and Satu Bumi contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian vegan dessert market appears promising, driven by increasing health awareness and a growing consumer base seeking plant-based options. As e-commerce continues to expand, more consumers will have access to a variety of vegan desserts, enhancing market penetration. Additionally, innovative product development and collaborations with health influencers are expected to further boost market visibility and acceptance, paving the way for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cakes & Pastries Frozen Desserts (Ice Cream, Sorbet) Cookies & Biscuits Custards & Puddings Chocolates Snacks & Bars Others (Mousses, Tarts, etc.) |

| By End-User | Retail Consumers Cafés, Restaurants & HoReCa Health Food Stores Online Shoppers |

| By Distribution Channel | Supermarkets/Hypermarkets Specialty Stores E-commerce Platforms Direct Sales (Brand Outlets, Pop-ups) |

| By Price Range | Premium Mid-Range Budget |

| By Ingredient Type | Coconut-Based Almond-Based Soy-Based Oat-Based Others (Cashew, Rice, etc.) |

| By Occasion | Festivals Birthdays Weddings Everyday Consumption |

| By Packaging Type | Eco-Friendly Packaging Plastic Packaging Glass Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vegan Dessert Consumers | 100 | Health-conscious individuals, Vegan lifestyle advocates |

| Retailers of Vegan Products | 60 | Store Managers, Product Buyers |

| Food Service Industry Professionals | 50 | Chefs, Restaurant Owners |

| Health and Wellness Influencers | 40 | Bloggers, Social Media Influencers |

| Nutritionists and Dietitians | 40 | Health Professionals, Dietary Consultants |

The Indonesia Vegan Dessert Market is valued at approximately USD 120 million, reflecting a significant growth trend driven by increasing health consciousness and a rising population of vegans and flexitarians seeking plant-based alternatives.