Region:Africa

Author(s):Geetanshi

Product Code:KRAD3954

Pages:100

Published On:December 2025

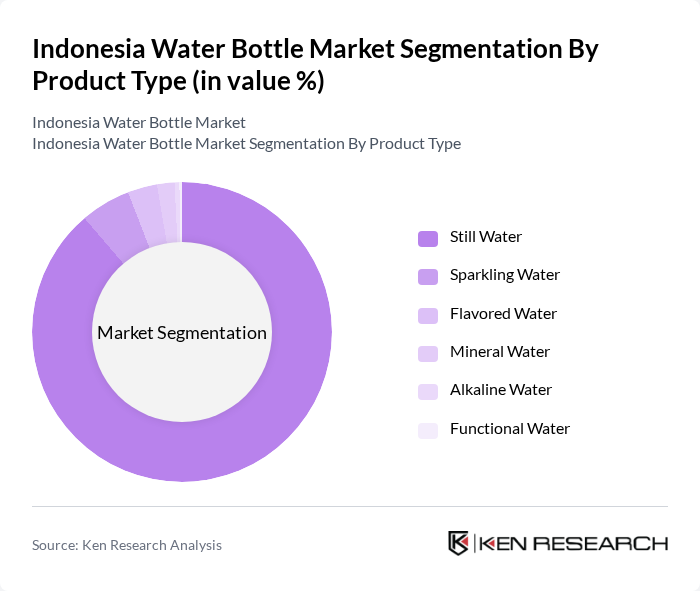

By Product Type:The product type segmentation includes various categories such as Still Water, Sparkling Water, Flavored Water, Mineral Water, Alkaline Water, and Functional Water. Still Water is the most dominant segment, commanding an 88.72% market share in 2024, driven by its widespread acceptance and preference among consumers for hydration. The increasing health awareness and the need for safe drinking water have further propelled the demand for Still Water, making it a staple in households and on-the-go consumption. Functional and flavored water segments are experiencing rapid growth at an 8.46% CAGR through 2030, fueled by health-conscious millennials and Gen Z consumers seeking added nutritional benefits.

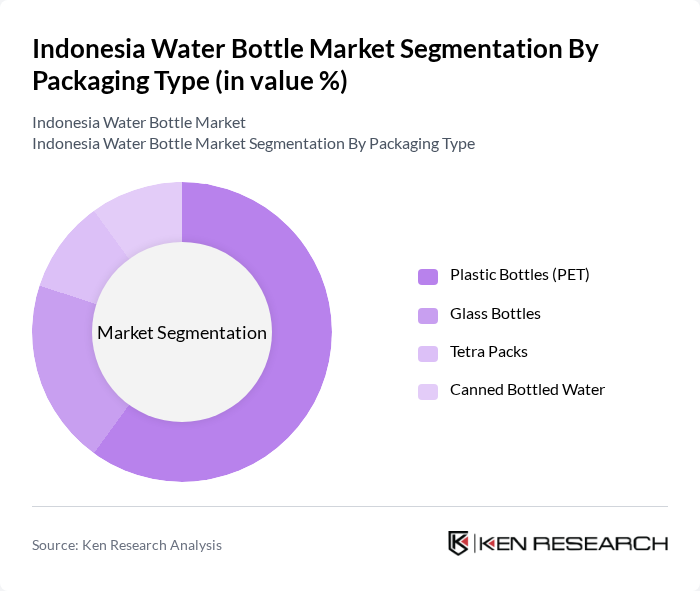

By Packaging Type:The packaging type segmentation includes Plastic Bottles (PET), Glass Bottles, Tetra Packs, and Canned Bottled Water. Plastic Bottles (PET) dominate the market due to their lightweight, convenience, and cost-effectiveness, with PET bottles ranging from small single-serve sizes to large gallon containers for household use. The growing trend of on-the-go consumption and the preference for single-serve packaging have further solidified the position of PET bottles as the leading choice among consumers. Glass bottles, while smaller in market share, are gaining traction in the premium segment and high-end hospitality sector, driven by environmental consciousness and perceived quality.

The Indonesia Water Bottle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aqua (Danone), Nestlé Waters Indonesia, Ades (Coca-Cola), Le Minerale, VIT (Danone), Pristine, Indomaret (Distribution Partner), Alfamart (Distribution Partner), Sinar Mas Group, Mayora Indah, Indofood Sukses Makmur, Kalbe Farma contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia water bottle market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, the demand for innovative and sustainable products will shape market dynamics. Companies are likely to invest in eco-friendly packaging and smart water bottle technologies, enhancing user experience. Additionally, the expansion of e-commerce platforms will facilitate greater access to diverse bottled water options, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Still Water Sparkling Water Flavored Water Mineral Water Alkaline Water Functional Water |

| By Packaging Type | Plastic Bottles (PET) Glass Bottles Tetra Packs Canned Bottled Water |

| By Price Range | Economy Mid-Range Premium Luxury |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail HoReCa (Hotels, Restaurants, Cafés) Vending Machines Direct Sales |

| By End-User | Residential Commercial Hospitality Events and Catering |

| By Brand Positioning | Luxury Brands Mass Market Brands Niche Brands |

| By Geographic Region | Java Sumatra Kalimantan Sulawesi Bali Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Urban Areas | 120 | Health-conscious Consumers, Young Professionals |

| Retail Distribution Insights | 85 | Retail Managers, Store Owners |

| Environmental Impact Awareness | 65 | Sustainability Advocates, Eco-conscious Consumers |

| Market Trends in E-commerce | 95 | eCommerce Managers, Digital Marketing Specialists |

| Industry Expert Opinions | 45 | Industry Analysts, Market Researchers |

The Indonesia Water Bottle Market is valued at approximately USD 3.9 billion, reflecting significant growth driven by health consciousness, urbanization, and the demand for convenient hydration solutions among consumers.