Region:Africa

Author(s):Geetanshi

Product Code:KRAA0239

Pages:80

Published On:August 2025

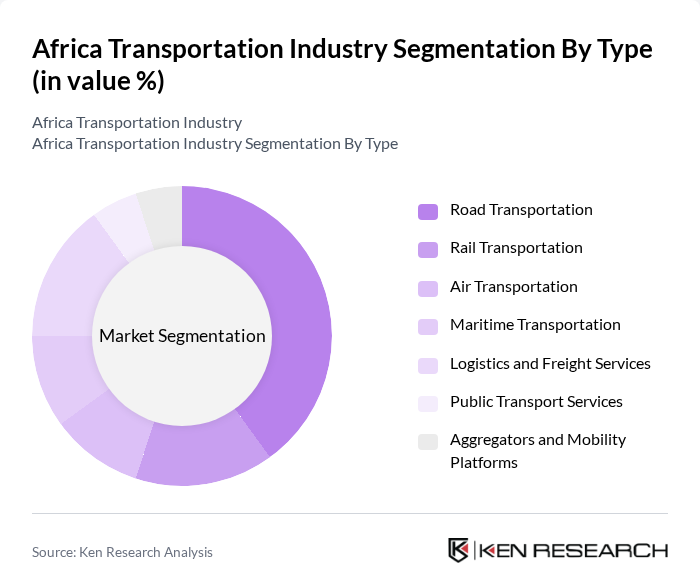

By Type:The Africa Transportation Industry can be segmented into road transportation, rail transportation, air transportation, maritime transportation, logistics and freight services, public transport services, and aggregators and mobility platforms. Road transportation remains the dominant mode due to the continent’s extensive road networks and the need for last-mile connectivity. Rail and maritime transport are critical for bulk and cross-border freight, while air transport serves high-value and time-sensitive goods. Logistics and freight services are increasingly digitized, supporting the rise of e-commerce and efficient supply chains. Public transport services and mobility platforms are expanding, especially in urban centers, to address growing commuter demand .

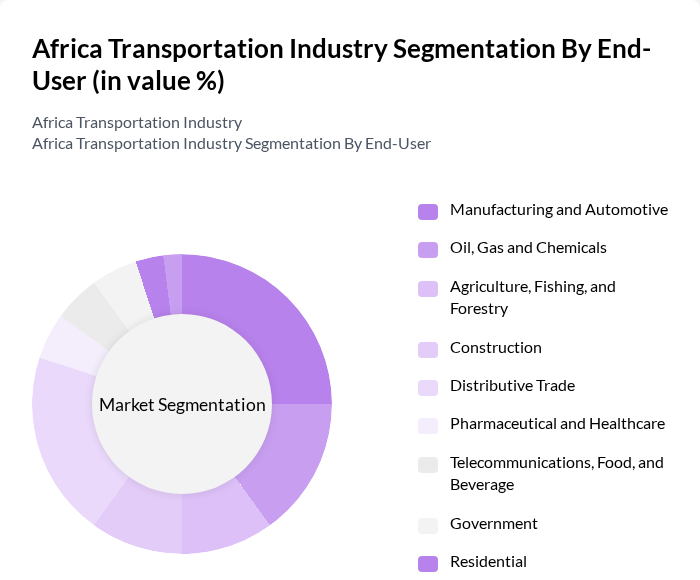

By End-User:The end-user segmentation of the Africa Transportation Industry includes manufacturing and automotive, oil, gas and chemicals, agriculture, fishing, and forestry, construction, distributive trade, pharmaceutical and healthcare, telecommunications, food, and beverage, government, residential, and others. Manufacturing and distributive trade sectors are the largest consumers, driven by industrialization and expanding intra-African trade. The agriculture and construction sectors also generate significant demand for freight and logistics, while healthcare and food sectors increasingly require temperature-controlled and time-sensitive transport solutions .

The Africa Transportation Industry market is characterized by a dynamic mix of regional and international players. Leading participants such as Transnet, Kenya Railways, Ethiopian Airlines, South African Airways, Maersk Line, DHL Supply Chain, GIG Logistics, UPS Africa, Bidvest Panalpina Logistics, SAA Cargo, Imperial Logistics, Bolloré Transport & Logistics, APM Terminals, Roadlink Africa, Africa Logistics Properties, DSV Panalpina, Unitrans Supply Chain Solutions, Deutsche Post DHL Group contribute to innovation, geographic expansion, and service delivery in this space.

The Africa transportation industry is poised for transformative growth driven by urbanization, technological advancements, and government initiatives. As infrastructure investments increase, the sector will likely see enhanced connectivity and efficiency. However, challenges such as infrastructure deficiencies and regulatory hurdles must be addressed to fully capitalize on growth opportunities. The focus on sustainable transport solutions and regional integration will shape the industry's future, fostering economic development and improving trade across the continent.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Transportation Rail Transportation Air Transportation Maritime Transportation Logistics and Freight Services Public Transport Services Aggregators and Mobility Platforms |

| By End-User | Manufacturing and Automotive Oil, Gas and Chemicals Agriculture, Fishing, and Forestry Construction Distributive Trade Pharmaceutical and Healthcare Telecommunications, Food, and Beverage Government Residential Others |

| By Region | North Africa West Africa East Africa Southern Africa |

| By Mode of Transport | Freight Transport Passenger Transport Intermodal Transport Others |

| By Service Type | Freight Forwarding Warehousing and Storage Supply Chain Management Scheduled Services Charter Services On-Demand Services Others |

| By Infrastructure Type | Road Infrastructure Rail Infrastructure Airport Infrastructure Port Infrastructure Others |

| By Investment Type | Private Investment Public Investment Foreign Direct Investment (FDI) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Transportation | 120 | Logistics Managers, Fleet Operators |

| Rail Transport Services | 60 | Railway Operations Managers, Infrastructure Planners |

| Air Cargo Operations | 50 | Airline Cargo Managers, Airport Logistics Coordinators |

| Maritime Shipping and Logistics | 40 | Shipping Line Executives, Port Authority Officials |

| Urban Public Transport Systems | 70 | City Transport Planners, Public Transit Managers |

The Africa Transportation Industry is valued at approximately USD 161 billion, driven by rapid urbanization, significant infrastructure investments, and the growth of e-commerce, which has enhanced logistics and freight services across the continent.