Region:Asia

Author(s):Shubham

Product Code:KRAB4406

Pages:95

Published On:October 2025

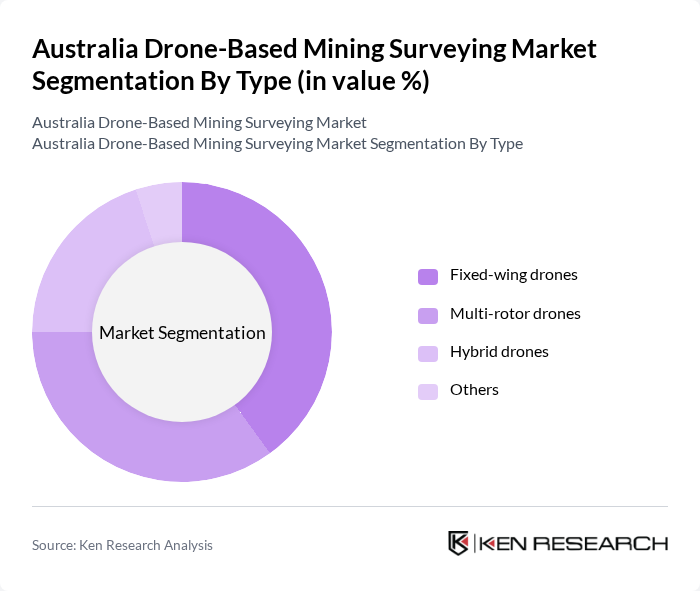

By Type:The market is segmented into various types of drones, including fixed-wing drones, multi-rotor drones, hybrid drones, and others. Each type serves specific operational needs, with fixed-wing drones being preferred for large area coverage and multi-rotor drones for detailed inspections. The hybrid drones combine the advantages of both types, catering to diverse surveying requirements.

By End-User:The end-user segmentation includes mining companies, surveying firms, government agencies, and others. Mining companies are the primary users, leveraging drone technology for exploration, monitoring, and operational efficiency. Surveying firms utilize drones for precise mapping, while government agencies focus on regulatory compliance and environmental monitoring.

The Australia Drone-Based Mining Surveying Market is characterized by a dynamic mix of regional and international players. Leading participants such as DJI Technology Co., Ltd., senseFly SA, Delair, Airobotics, Parrot Drones, Quantum Systems GmbH, Flyability, Kespry, Airware, Skycatch, PrecisionHawk, DroneDeploy, 3D Robotics, Vantage Robotics, Wingtra contribute to innovation, geographic expansion, and service delivery in this space.

The future of the drone-based mining surveying market in Australia appears promising, driven by technological advancements and increasing operational efficiency. As mining companies continue to embrace automation and data analytics, the integration of drones with AI and machine learning will enhance decision-making processes. Furthermore, the focus on sustainability will likely lead to the development of eco-friendly drone solutions, aligning with global environmental standards and improving operational practices in the mining sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Fixed-wing drones Multi-rotor drones Hybrid drones Others |

| By End-User | Mining companies Surveying firms Government agencies Others |

| By Application | Topographic mapping Mineral exploration Environmental monitoring Others |

| By Payload Capacity | Light payload drones Medium payload drones Heavy payload drones Others |

| By Sales Channel | Direct sales Distributors Online sales Others |

| By Region | Western Australia Queensland New South Wales Others |

| By Policy Support | Government subsidies Tax incentives Research grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Drone Service Providers | 100 | Business Development Managers, Technical Directors |

| Mining Operations Utilizing Drones | 80 | Site Managers, Operations Directors |

| Regulatory Bodies on Drone Usage | 50 | Policy Makers, Compliance Officers |

| Technology Developers in Drone Solutions | 70 | Product Managers, R&D Engineers |

| Industry Experts and Consultants | 60 | Market Analysts, Industry Advisors |

The Australia Drone-Based Mining Surveying Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the adoption of advanced technologies in mining operations, enhancing efficiency and safety in resource extraction.