Region:Global

Author(s):Rebecca

Product Code:KRAA4603

Pages:80

Published On:September 2025

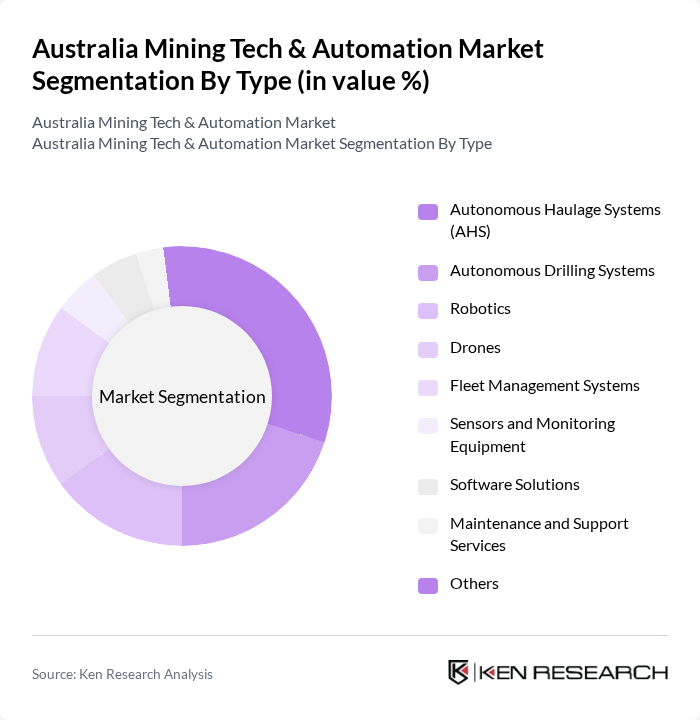

By Type:This segmentation includes various technological solutions that enhance mining operations. The subsegments are Autonomous Haulage Systems (AHS), Autonomous Drilling Systems, Robotics, Drones, Fleet Management Systems, Sensors and Monitoring Equipment, Software Solutions, Maintenance and Support Services, and Others. The market is witnessing a significant shift towards automation, with Autonomous Haulage Systems leading the way due to their ability to improve safety and efficiency in transporting materials. The adoption of AI-driven fleet management and predictive maintenance software is also rising, reflecting the broader digital transformation of mining operations.

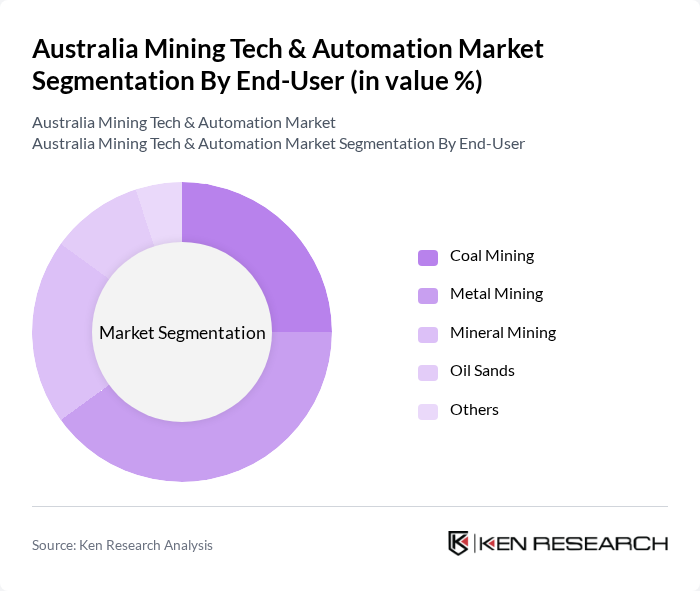

By End-User:This segmentation categorizes the market based on the primary sectors utilizing mining technologies. The subsegments include Coal Mining, Metal Mining, Mineral Mining, Oil Sands, and Others. The Metal Mining sector is currently the dominant end-user, driven by the increasing demand for metals such as gold, copper, and lithium, which are essential for various industries, including electronics and renewable energy. The push for critical minerals to support the global energy transition further accelerates automation adoption in metal mining.

The Australia Mining Tech & Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Caterpillar Inc., Komatsu Ltd., Sandvik AB, Epiroc AB, Hitachi Construction Machinery Co., Ltd., ABB Ltd., Siemens AG, Hexagon AB, Rockwell Automation, Inc., Trimble Inc., Atlas Copco AB, Deswik Pty Ltd., Fortescue Metals Group (FMG), BHP Group Limited, Rio Tinto Group, AJ Technology Services contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australian mining tech and automation market appears promising, driven by ongoing technological advancements and a strong focus on sustainability. As companies increasingly adopt automation and data analytics, operational efficiencies are expected to improve significantly. Additionally, the integration of renewable energy sources into mining operations will likely gain momentum, aligning with global sustainability trends. The industry's ability to adapt to these changes will be critical in maintaining competitiveness and meeting regulatory requirements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Autonomous Haulage Systems (AHS) Autonomous Drilling Systems Robotics Drones Fleet Management Systems Sensors and Monitoring Equipment Software Solutions Maintenance and Support Services Others |

| By End-User | Coal Mining Metal Mining Mineral Mining Oil Sands Others |

| By Application | Exploration Extraction Processing Transportation Waste Management Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Offline Online |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automation Technology Adoption | 100 | IT Managers, Operations Directors |

| AI and Data Analytics in Mining | 60 | Data Scientists, Mining Engineers |

| IoT Solutions for Equipment Monitoring | 50 | Maintenance Managers, Technology Officers |

| Safety and Compliance Technologies | 40 | Safety Managers, Compliance Officers |

| Remote Operations and Control Systems | 70 | Site Managers, Automation Engineers |

The Australia Mining Tech & Automation Market is valued at approximately USD 4.2 billion, driven by the increasing demand for automation technologies that enhance operational efficiency, safety, and productivity in mining operations.