Region:Middle East

Author(s):Dev

Product Code:KRAA8365

Pages:92

Published On:November 2025

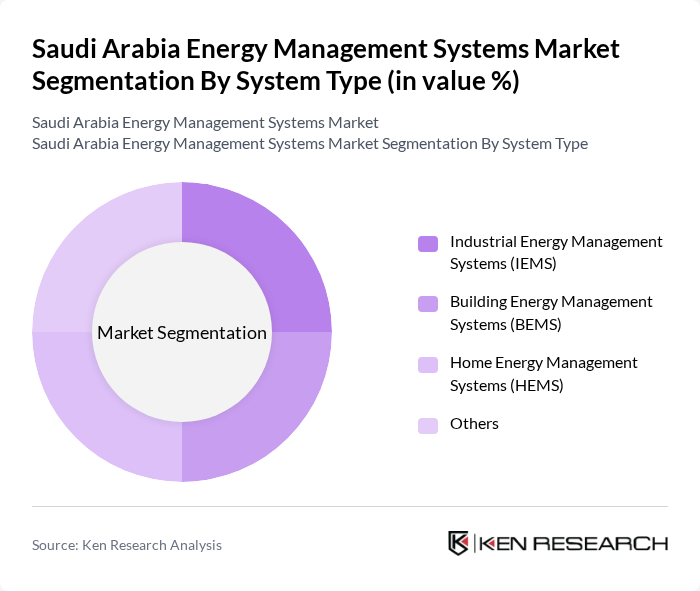

By System Type:The market is segmented into Industrial Energy Management Systems (IEMS), Building Energy Management Systems (BEMS), Home Energy Management Systems (HEMS), and Others. Among these, Industrial Energy Management Systems (IEMS) currently hold the largest market share, driven by the industrial sector’s need for optimized energy usage and cost reduction. However, Building Energy Management Systems (BEMS) are the fastest-growing segment, supported by the increasing number of smart buildings and the growing emphasis on energy efficiency in commercial spaces .

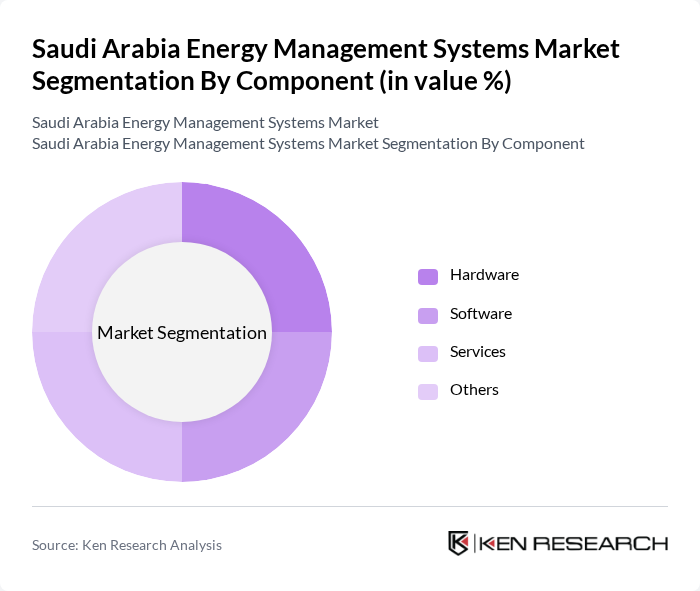

By Component:The market is categorized into Hardware, Software, Services, and Others. The Hardware segment currently dominates due to the widespread installation of energy management devices and sensors across industrial and commercial sectors. Software solutions are rapidly gaining traction as organizations leverage data analytics and cloud-based platforms for enhanced energy management, while Services are essential for system integration, maintenance, and compliance with regulatory standards .

The Saudi Arabia Energy Management Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric SE, Honeywell International Inc., ABB Ltd., General Electric Company, Emerson Electric Co., Johnson Controls International plc, Mitsubishi Electric Corporation, Rockwell Automation, Inc., Enel X, Eaton Corporation plc, Itron, Inc., Trane Technologies plc, DNV GL, First Solar, Inc., Saudi Electricity Company (SEC), ACWA Power, Advanced Electronics Company (AEC), Alfanar Group, NESMA Renewable Energy contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Saudi Arabia energy management systems market appears promising, driven by ongoing government initiatives and technological advancements. As the nation continues to invest in renewable energy and smart grid technologies, the demand for sophisticated energy management solutions is expected to rise. Furthermore, the integration of artificial intelligence and machine learning will enhance system capabilities, enabling more efficient energy usage and management. This evolving landscape presents significant opportunities for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By System Type (Industrial, Building, Home Energy Management Systems) | Industrial Energy Management Systems (IEMS) Building Energy Management Systems (BEMS) Home Energy Management Systems (HEMS) Others |

| By Component (Hardware, Software, Services) | Hardware Software Services Others |

| By Deployment Type (On-premises, Cloud-based) | On-premises Cloud-based Others |

| By End-User (Manufacturing, Power & Energy, Commercial/Buildings, Residential/Households, IT & Telecom, Government & Utilities, Others) | Manufacturing Power & Energy Commercial/Buildings Residential/Households IT & Telecom Government & Utilities Others |

| By Region (Central, Eastern, Western, Southern) | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Energy Management | 100 | Energy Managers, Operations Directors |

| Manufacturing Energy Efficiency Programs | 80 | Facility Managers, Sustainability Coordinators |

| Utilities Energy Management Systems | 90 | Regulatory Affairs Managers, Technical Directors |

| Commercial Building Energy Solutions | 60 | Building Managers, Energy Consultants |

| Renewable Energy Integration | 50 | Project Managers, Renewable Energy Analysts |

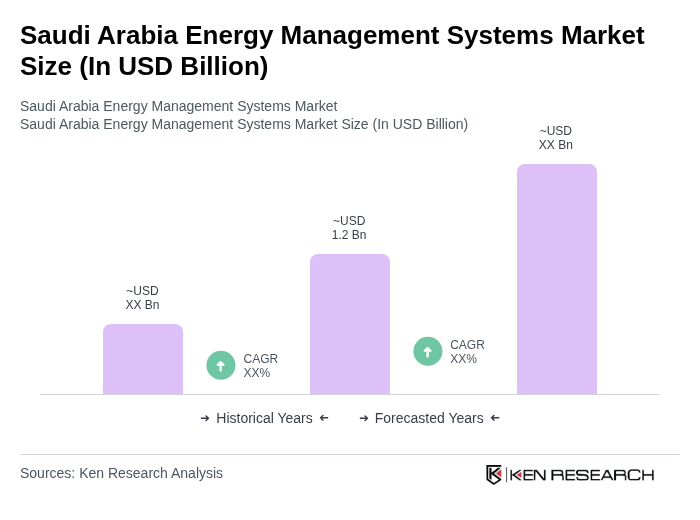

The Saudi Arabia Energy Management Systems Market is valued at approximately USD 1.2 billion, driven by increasing energy efficiency initiatives, government support for renewable energy, and the demand for smart grid technologies.