Region:Global

Author(s):Geetanshi

Product Code:KRAC0133

Pages:80

Published On:August 2025

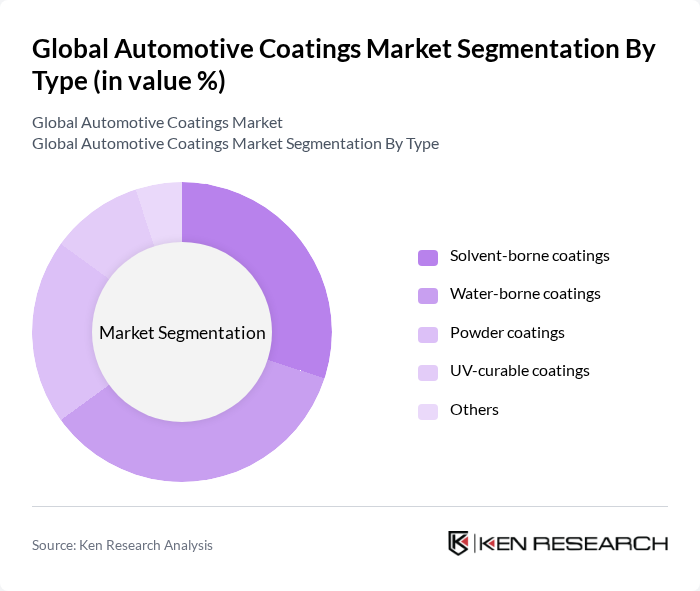

By Type:The automotive coatings market is segmented into solvent-borne coatings, water-borne coatings, powder coatings, UV-curable coatings, and others. Water-borne coatings are gaining traction due to lower environmental impact and compliance with stringent regulations. Solvent-borne coatings, while still significant, are gradually being replaced by more sustainable options. Demand for powder coatings is also increasing, particularly in the OEM segment, due to their durability, corrosion resistance, and high-quality finish .

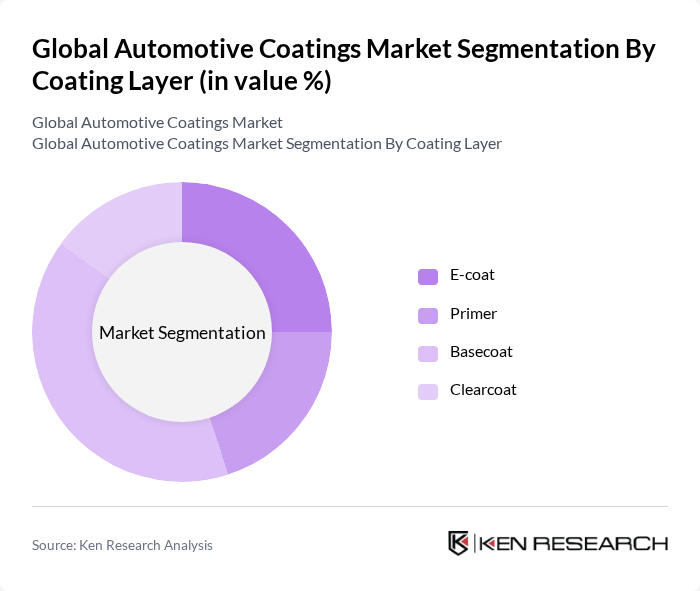

By Coating Layer:The market is also segmented by coating layers, including E-coat, primer, basecoat, and clearcoat. The basecoat segment is dominant, providing the primary color and finish of the vehicle, which is crucial for aesthetic appeal. Clearcoats are essential for protecting the basecoat and enhancing gloss, while primers serve as a foundation for adhesion. E-coat technology is gaining popularity due to its corrosion resistance, uniform coverage, and environmental benefits .

The Global Automotive Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as PPG Industries, Inc., Axalta Coating Systems Ltd., BASF SE, The Sherwin-Williams Company, AkzoNobel N.V., Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., RPM International Inc., Valspar Corporation (now part of Sherwin-Williams), KCC Corporation, Jotun A/S, Covestro AG, Henkel AG & Co. KGaA, Solvay S.A., and Tikkurila Oyj contribute to innovation, geographic expansion, and service delivery in this space .

The future of the automotive coatings market appears promising, driven by ongoing innovations and shifts in consumer preferences. As electric vehicle production accelerates, the demand for specialized coatings that enhance performance and aesthetics will likely increase. Additionally, the trend towards sustainable practices will push manufacturers to develop eco-friendly coatings, aligning with global environmental goals. The integration of automation in manufacturing processes is expected to enhance efficiency, further supporting market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Solvent-borne coatings Water-borne coatings Powder coatings UV-curable coatings Others |

| By Coating Layer | E-coat Primer Basecoat Clearcoat |

| By Application | OEM coatings Refinish coatings |

| By Vehicle Type | Passenger cars Light commercial vehicles Heavy commercial vehicles Two-wheelers |

| By Resin Type | Polyurethane Acrylic Epoxy Others |

| By Distribution Channel | OEM Aftermarket |

| By Texture/Finish | Solid Metallic Matte Satin Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEM Automotive Coatings | 100 | Product Managers, R&D Directors |

| Aftermarket Coatings | 60 | Sales Managers, Distribution Heads |

| Coating Technology Providers | 50 | Technical Directors, Application Engineers |

| Regulatory Bodies | 40 | Policy Makers, Environmental Compliance Officers |

| End-User Feedback | 80 | Fleet Managers, Vehicle Maintenance Supervisors |

The Global Automotive Coatings Market is valued at approximately USD 23 billion, driven by increasing demand for vehicle aesthetics, durability, and protection against environmental factors. This valuation is based on a five-year historical analysis of market trends.