Region:Global

Author(s):Shubham

Product Code:KRAC0589

Pages:87

Published On:August 2025

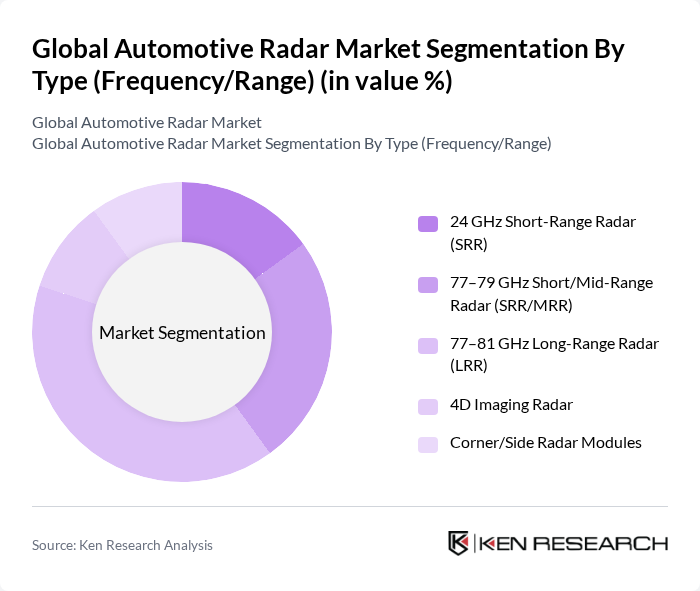

By Type (Frequency/Range):The automotive radar market is segmented into 24 GHz Short-Range Radar (SRR), 77–79 GHz Short/Mid-Range Radar (SRR/MRR), 77–81 GHz Long-Range Radar (LRR), 4D Imaging Radar, and Corner/Side Radar Modules. 77–81 GHz radars have become the mainstream for long-range applications owing to higher bandwidth, finer angular resolution, and better interference robustness—supporting functions like adaptive cruise control and forward collision warning. Industry momentum toward 4D imaging radar further elevates high?frequency adoption for advanced perception and autonomy features .

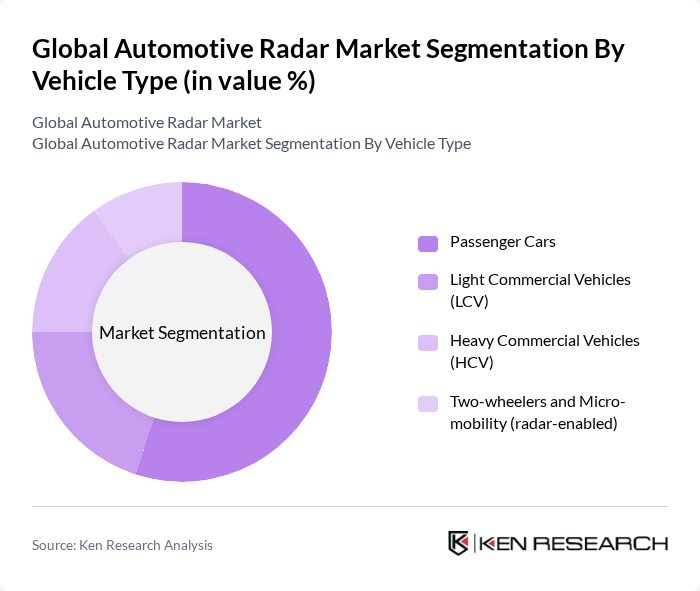

By Vehicle Type:The market is segmented into Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), and Two-wheelers and Micro-mobility (radar-enabled). Passenger Cars lead due to OEM fitment of radar in mainstream ADAS packages (AEB, ACC, BSD) and regulatory pressure across major markets. Electrification and the rollout of higher?level ADAS in volume C/D?segment vehicles are expanding radar penetration beyond premium segments .

The Global Automotive Radar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Continental AG, DENSO Corporation, Valeo SE, NXP Semiconductors N.V., Texas Instruments Incorporated, Infineon Technologies AG, HELLA GmbH & Co. KGaA (FORVIA HELLA), ZF Friedrichshafen AG, Aisin Corporation, Autoliv, Inc., Mitsubishi Electric Corporation, STMicroelectronics N.V., Analog Devices, Inc., Arbe Robotics Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the automotive radar market appears promising, driven by technological advancements and increasing regulatory support for safety features. As manufacturers invest in next-generation radar systems, the market is likely to witness a shift towards more compact and efficient solutions. Additionally, the growing trend of smart transportation infrastructure will further enhance the integration of radar technologies, paving the way for improved vehicle safety and the proliferation of autonomous driving capabilities in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type (Frequency/Range) | GHz Short-Range Radar (SRR) –79 GHz Short/Mid-Range Radar (SRR/MRR) –81 GHz Long-Range Radar (LRR) D Imaging Radar Corner/Side Radar Modules |

| By Vehicle Type | Passenger Cars Light Commercial Vehicles (LCV) Heavy Commercial Vehicles (HCV) Two-wheelers and Micro-mobility (radar-enabled) |

| By Application | Adaptive Cruise Control (ACC) Autonomous Emergency Braking (AEB) / Forward Collision Warning (FCW) Blind Spot Detection (BSD) / Rear Cross-Traffic Alert (RCTA) Lane Change Assist (LCA) / Lane Keep Assist (LKA) support Park Assist / Automated Parking Traffic Jam Assist (TJA) / Highway Pilot |

| By Component | RF Front-End (Transceivers/Transmitter/Receiver) Antenna-in-Package (AiP) / Antenna Modules Baseband & Signal Processors (MCU/SoC) Power Management & Clocks Software/Algorithms (Perception & Sensor Fusion) |

| By Sales Channel | OEM Fitment Aftermarket Retrofits |

| By Distribution Mode | Direct to OEM/Tier-1 Distributors/Value-Added Resellers Online B2B Platforms |

| By Price/Integration Level | Entry-Level ADAS Radar (Cost-optimized) Mid-Range ADAS Radar Premium/Imaging Radar (High-resolution) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Radar Systems | 140 | Automotive Engineers, Product Development Managers |

| Commercial Vehicle Safety Technologies | 100 | Fleet Managers, Safety Compliance Officers |

| Radar Technology Suppliers | 80 | Sales Directors, Technical Support Engineers |

| Automotive Regulatory Bodies | 60 | Policy Makers, Regulatory Affairs Specialists |

| Automotive Research Institutions | 70 | Research Analysts, Academic Professors |

The Global Automotive Radar Market is valued at approximately USD 6.5 billion, driven by the increasing demand for advanced driver-assistance systems (ADAS) and the rising adoption of autonomous vehicles, alongside technological advancements in radar systems.