Region:Middle East

Author(s):Shubham

Product Code:KRAA8785

Pages:85

Published On:November 2025

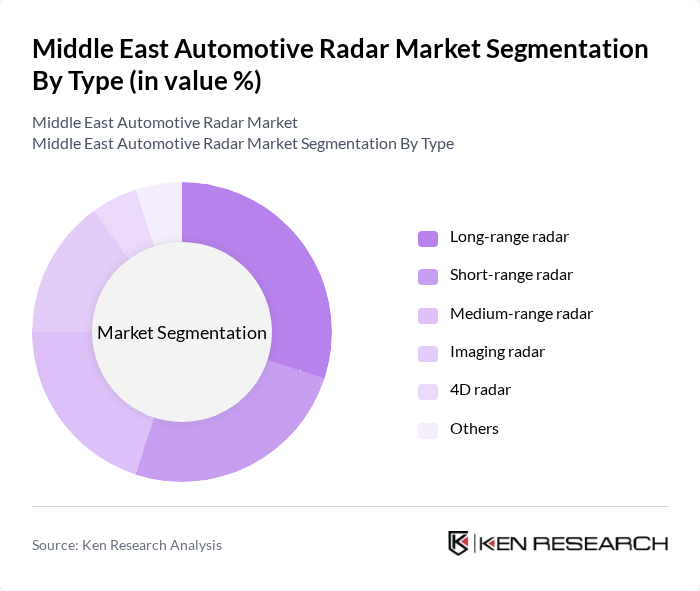

By Type:The market is segmented into various types of radar technologies, including Long-range radar, Short-range radar, Medium-range radar, Imaging radar, 4D radar, and Others. Each type serves specific applications in automotive safety and automation, with long-range radar primarily supporting adaptive cruise control and collision avoidance, while short- and medium-range radars are integral to blind spot detection, lane change assist, and parking assistance. Imaging and 4D radars are increasingly utilized in higher-level autonomous driving and complex urban scenarios .

The Long-range radar segment is currently dominating the market due to its critical role in enabling advanced safety features such as adaptive cruise control and collision avoidance systems. This technology is increasingly being integrated into new vehicle models, driven by consumer demand for enhanced safety and automation. The growing trend towards autonomous driving further propels the adoption of long-range radar systems, making it a key focus area for manufacturers and automotive developers .

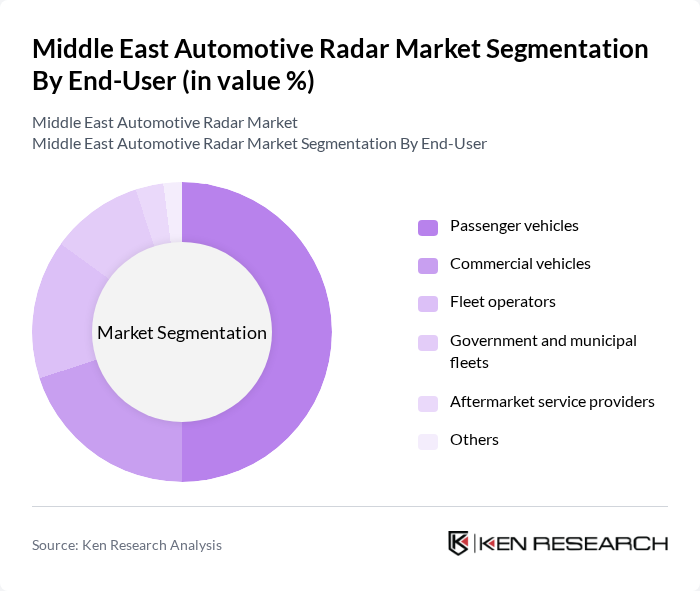

By End-User:The market is segmented by end-users, including Passenger vehicles, Commercial vehicles, Fleet operators, Government and municipal fleets, Aftermarket service providers, and Others. Each segment has unique requirements and applications for radar technology. Passenger vehicles are the primary adopters due to consumer demand for safety and convenience, while commercial and fleet operators are increasingly integrating radar for operational safety and regulatory compliance. Government and municipal fleets are focusing on radar for public safety and smart mobility initiatives .

The Passenger vehicles segment leads the market, driven by the increasing consumer preference for safety features and advanced driver assistance systems. As more consumers prioritize safety in their purchasing decisions, manufacturers are compelled to integrate radar technologies into their vehicles. This trend is further supported by government regulations mandating safety features, solidifying the passenger vehicle segment's dominance in the automotive radar market .

The Middle East Automotive Radar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Robert Bosch GmbH, Continental AG, Denso Corporation, Valeo S.A., NXP Semiconductors N.V., Texas Instruments Incorporated, Infineon Technologies AG, ZF Friedrichshafen AG, Aisin Corporation, HELLA GmbH & Co. KGaA, Autoliv Inc., LeddarTech Inc., Renesas Electronics Corporation, STMicroelectronics N.V., Qualcomm Technologies, Inc., Arbe Robotics Ltd., Smart Radar System Inc., Uhnder Inc., Aptiv PLC, Veoneer Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East automotive radar market appears promising, driven by technological advancements and increasing regulatory support. As vehicle safety becomes a priority, the integration of radar systems with other sensor technologies is expected to enhance functionality and reliability. Additionally, the shift towards electric and autonomous vehicles will further stimulate demand for radar solutions, creating a robust ecosystem for innovation and collaboration among automotive manufacturers and technology providers in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Long-range radar Short-range radar Medium-range radar Imaging radar D radar Others |

| By End-User | Passenger vehicles Commercial vehicles Fleet operators Government and municipal fleets Aftermarket service providers Others |

| By Application | Adaptive cruise control (ACC) Autonomous emergency braking (AEB) Blind spot detection (BSD) Forward collision warning (FCW) Intelligent park assist Traffic sign recognition Lane change assist Others |

| By Vehicle Type | Passenger cars Light commercial vehicles (LCVs) Heavy commercial vehicles (HCVs) Buses Electric vehicles (EVs) Others |

| By Technology | Frequency-modulated continuous wave (FMCW) Pulsed radar Millimeter-wave radar (24 GHz, 77 GHz, 79 GHz) D imaging radar Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Israel, Jordan, Lebanon, etc.) North Africa (Egypt, Morocco, Algeria, etc.) Others |

| By Market Segment | OEMs Aftermarket Tier 1 suppliers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEMs and Tier 1 Suppliers | 60 | Product Development Managers, Engineering Leads |

| Automotive Technology Providers | 40 | R&D Directors, Technology Strategists |

| Regulatory Bodies and Industry Associations | 45 | Policy Makers, Compliance Officers |

| Automotive Aftermarket Services | 50 | Service Managers, Parts Distribution Heads |

| Consumer Insights and Market Research Firms | 40 | Market Analysts, Consumer Behavior Researchers |

The Middle East Automotive Radar Market is valued at approximately USD 5.4 billion, driven by the increasing demand for advanced driver assistance systems (ADAS) and government initiatives aimed at enhancing road safety through radar technology integration in vehicles.