Region:Global

Author(s):Geetanshi

Product Code:KRAA2313

Pages:84

Published On:August 2025

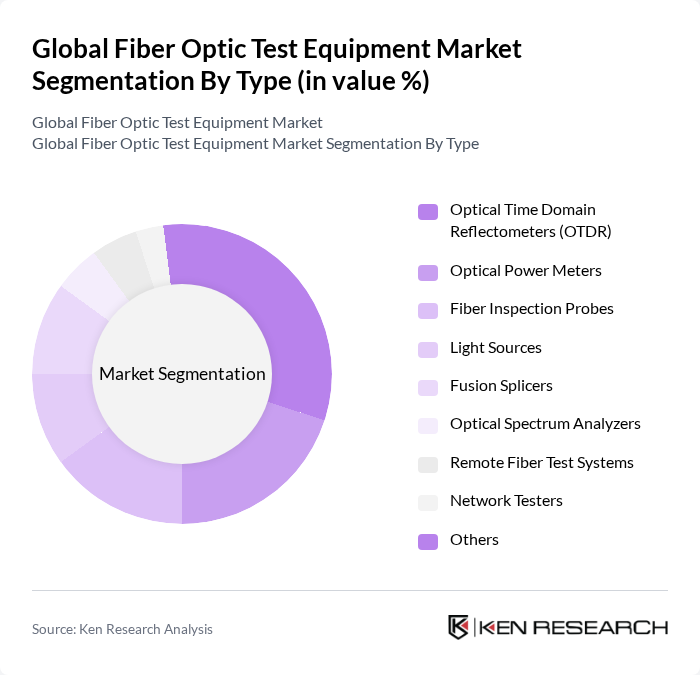

By Type:The market is segmented into various types of fiber optic test equipment, including Optical Time Domain Reflectometers (OTDR), Optical Power Meters, Fiber Inspection Probes, Light Sources, Fusion Splicers, Optical Spectrum Analyzers, Remote Fiber Test Systems, Network Testers, and Others. Among these, Optical Time Domain Reflectometers (OTDR) hold the largest share due to their critical role in diagnosing, troubleshooting, and certifying fiber optic networks, ensuring optimal performance and reliability across diverse applications .

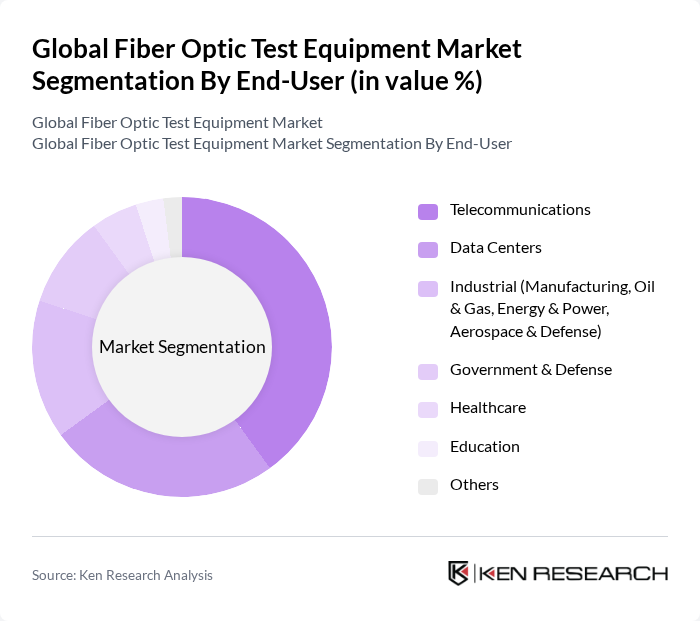

By End-User:The end-user segmentation includes Telecommunications, Data Centers, Industrial (Manufacturing, Oil & Gas, Energy & Power, Aerospace & Defense), Government & Defense, Healthcare, Education, and Others. The Telecommunications sector represents the largest end-user segment, driven by the ongoing expansion of high-speed internet, 5G network deployments, and the modernization of fiber optic networks globally. Data centers are also a significant segment, reflecting the surge in cloud computing and hyperscale data infrastructure .

The Global Fiber Optic Test Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fluke Networks, EXFO Inc., Viavi Solutions Inc., Anritsu Corporation, Yokogawa Electric Corporation, AFL (AFL Telecommunications LLC), Corning Incorporated, Keysight Technologies, Tektronix, Inc., Thorlabs, Inc., VIAVI Solutions (formerly JDS Uniphase Corporation), Optical Cable Corporation, Fiber Instruments Sales, Inc., Kingfisher International Pty Ltd, GAO Tek Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the fiber optic test equipment market appears promising, driven by technological advancements and increasing digitalization across sectors. As industries continue to embrace automation and integrated testing solutions, the demand for sophisticated testing equipment will rise. Furthermore, the push for sustainable practices will likely lead to innovations in eco-friendly testing technologies, enhancing market competitiveness. The ongoing expansion of telecommunications infrastructure in emerging markets will also create new opportunities for growth and development in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Optical Time Domain Reflectometers (OTDR) Optical Power Meters Fiber Inspection Probes Light Sources Fusion Splicers Optical Spectrum Analyzers Remote Fiber Test Systems Network Testers Others |

| By End-User | Telecommunications Data Centers Industrial (Manufacturing, Oil & Gas, Energy & Power, Aerospace & Defense) Government & Defense Healthcare Education Others |

| By Application | Network Installation Maintenance & Repair Quality Assurance Research & Development Monitoring & Troubleshooting Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America (U.S., Canada) Europe (Germany, U.K., France, Rest of Europe) Asia-Pacific (China, Japan, India, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Mexico, Rest of Latin America) Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA) Others |

| By Price Range | Low-End Mid-Range High-End |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecommunications Service Providers | 120 | Network Engineers, Operations Managers |

| Data Center Operators | 90 | Data Center Managers, IT Infrastructure Directors |

| Fiber Optic Equipment Manufacturers | 60 | Product Development Managers, Sales Directors |

| Installation and Maintenance Firms | 50 | Field Technicians, Project Managers |

| Government Regulatory Bodies | 40 | Policy Makers, Telecommunications Analysts |

The Global Fiber Optic Test Equipment Market is valued at approximately USD 1.1 billion, driven by the increasing demand for high-speed internet, data center expansion, and the adoption of fiber optic technology in telecommunications.