Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5824

Pages:88

Published On:December 2025

By Equipment Type:The equipment type segmentation includes various components essential for data center operations. The primary subsegments are Servers, Storage Systems, Networking Equipment (Switches, Routers), Power Distribution Units (PDUs), Uninterruptible Power Supply (UPS) Systems, Cooling Systems (CRAC/CRAH, Chillers, In-row, Liquid Cooling), Racks and Enclosures, Cabling and Structured Connectivity, and Others (Monitoring, DCIM, Fire Suppression). Among these, Servers and Cooling Systems are particularly significant due to the increasing deployment of high-density compute for cloud and AI workloads and the need for efficient thermal management to meet stringent uptime and efficiency requirements in the region’s hot climate.

By End-User Industry:The end-user industry segmentation encompasses various sectors utilizing data center equipment. This includes IT and Telecommunications, Banking, Financial Services and Insurance (BFSI), Government and Public Sector, Healthcare, Energy and Utilities, Retail and E-commerce, Manufacturing and Industrial, and Others. The IT and Telecommunications sector is the largest consumer, driven by rapid adoption of cloud services, increasing mobile and 5G data traffic, and the need for robust, low-latency data management and interconnection solutions.

The Middle East Data Center Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schneider Electric, Vertiv, Huawei Technologies, Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, IBM, Lenovo, NetApp, Arista Networks, Fujitsu, Hitachi Vantara, Pure Storage, Equinix, Khazna Data Centers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East data center equipment market appears promising, driven by technological advancements and increasing digitalization. As organizations prioritize data security and efficiency, the integration of AI and machine learning into data management systems will become essential. Furthermore, the shift towards sustainable practices will likely accelerate the adoption of energy-efficient technologies, aligning with global trends towards environmental responsibility and operational efficiency in data centers.

| Segment | Sub-Segments |

|---|---|

| By Equipment Type | Servers Storage Systems Networking Equipment (Switches, Routers) Power Distribution Units (PDUs) Uninterruptible Power Supply (UPS) Systems Cooling Systems (CRAC/CRAH, Chillers, In-row, Liquid Cooling) Racks and Enclosures Cabling and Structured Connectivity Others (Monitoring, DCIM, Fire Suppression) |

| By End-User Industry | IT and Telecommunications Banking, Financial Services and Insurance (BFSI) Government and Public Sector Healthcare Energy and Utilities Retail and E-commerce Manufacturing and Industrial Others |

| By Data Center Type | Colocation Data Centers Hyperscale Data Centers Enterprise / On-Premises Data Centers Edge and Micro Data Centers Others |

| By Tier Standard | Tier I Tier II Tier III Tier IV |

| By Country | Saudi Arabia United Arab Emirates Qatar Israel Turkey Kuwait, Oman, Bahrain Rest of Middle East |

| By Power Density | Up to 5 kW per rack –10 kW per rack –20 kW per rack Above 20 kW per rack |

| By Cooling Technology | Air-based Cooling Liquid and Immersion Cooling Free Cooling and Economizers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Data Center Operations | 120 | IT Managers, Data Center Administrators |

| Cloud Service Providers | 90 | Cloud Architects, Operations Directors |

| Telecommunications Infrastructure | 70 | Network Engineers, Infrastructure Managers |

| Data Center Equipment Suppliers | 60 | Sales Executives, Product Managers |

| Consulting Firms Specializing in IT Infrastructure | 50 | Consultants, Technology Advisors |

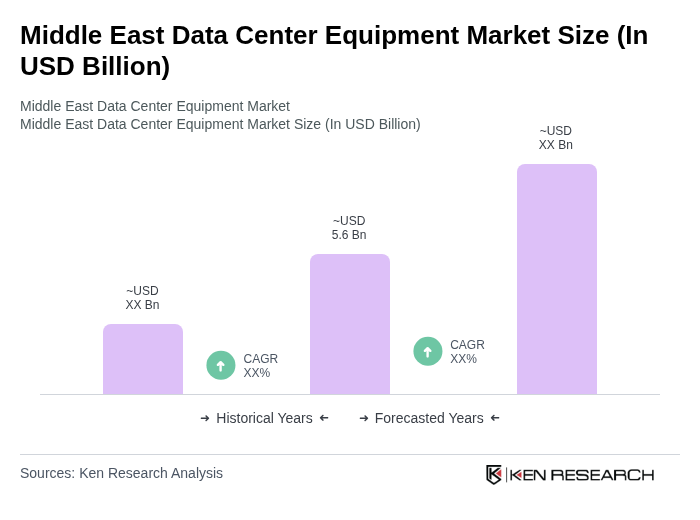

The Middle East Data Center Equipment Market is valued at approximately USD 5.6 billion, driven by significant investments in data center infrastructure and increasing demand for cloud services, digital transformation, and advanced technologies like AI and big data.