Global Personal Protective Equipment Market Overview

- The Global Personal Protective Equipment Market is valued at USD 80 billion, based on a five-year historical analysis. Growth is primarily driven by increasing awareness of workplace safety, stringent regulations regarding occupational health, and the rising incidence of workplace accidents across various industries. The demand for personal protective equipment (PPE) has surged as organizations prioritize employee safety, compliance with safety standards, and the adoption of advanced protective technologies. Recent trends include the integration of smart PPE, improved material technologies, and a focus on sustainability in product design, further accelerating market expansion .

- Key players in this market include the United States, Germany, and China, which dominate due to their robust industrial sectors and stringent safety regulations. The United States leads in innovation and technology adoption, particularly in smart PPE and advanced materials. Germany is recognized for its high-quality manufacturing standards and engineering excellence. China benefits from vast production capabilities and cost-effective manufacturing processes, making it a significant player in the global PPE market .

- The Personal Protective Equipment Regulation (EU) 2016/425, issued by the European Parliament and the Council in 2016, mandates that all PPE sold in the European Union must meet specific safety standards. This regulation requires conformity assessment procedures, CE marking, and strict quality control measures for manufacturers and importers, ensuring that products provide adequate protection and are manufactured under rigorous oversight .

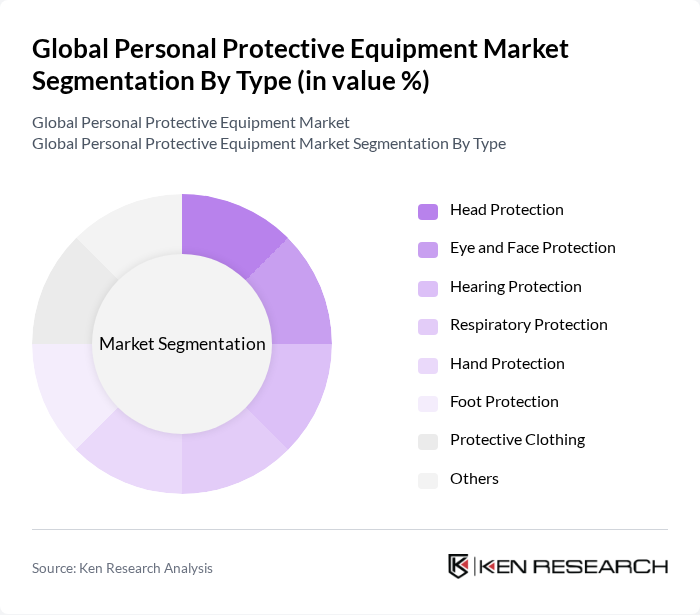

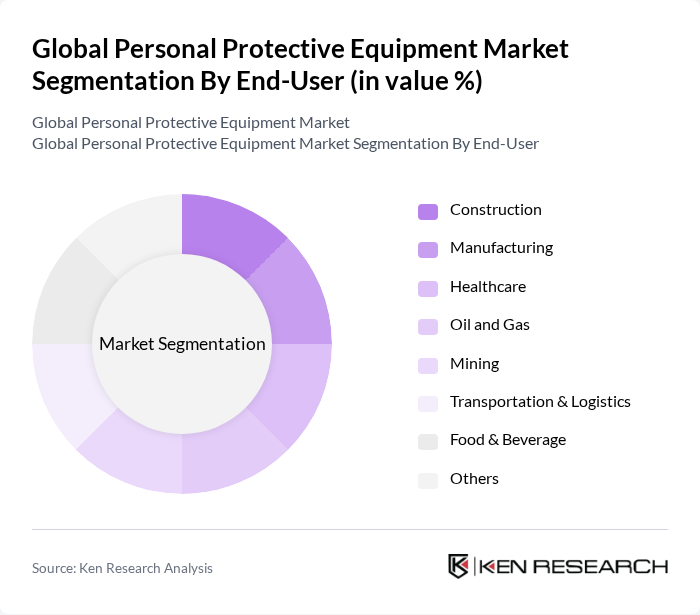

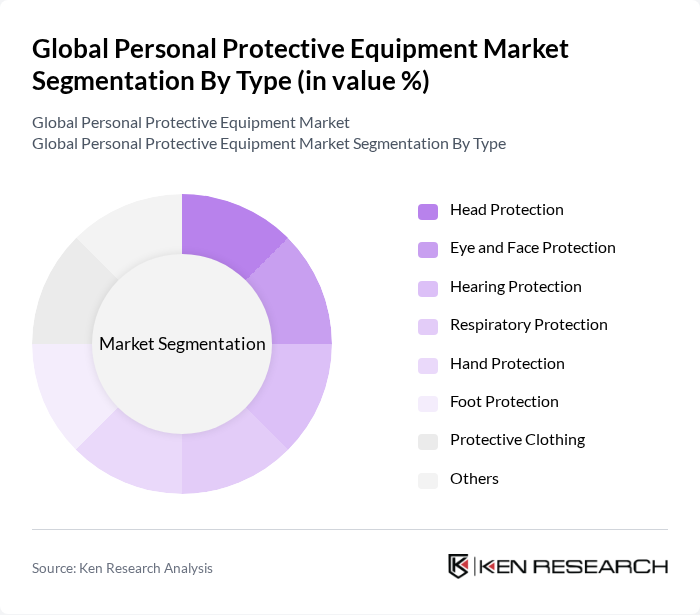

Global Personal Protective Equipment Market Segmentation

By Type:The market is segmented into various types of personal protective equipment, including head protection, eye and face protection, hearing protection, respiratory protection, hand protection, foot protection, protective clothing, and others. Among these, protective clothing and footwear collectively represent the largest segment, driven by their essential role in hazardous environments such as construction, manufacturing, and oil & gas. The increasing focus on workplace safety, regulatory compliance, and technological advancements in material science have led to heightened demand for advanced, comfortable, and durable protective gear .

By End-User:The end-user segmentation includes construction, manufacturing, healthcare, oil and gas, mining, transportation & logistics, food & beverage, and others. The manufacturing and construction sectors are the largest consumers of PPE, reflecting the high-risk nature of their operations and the strict enforcement of safety standards. The healthcare sector also represents a significant share, particularly following increased demand for PPE in medical and laboratory settings. Ongoing global emphasis on regulatory compliance and workplace safety continues to drive demand across all major end-user segments .

Global Personal Protective Equipment Market Competitive Landscape

The Global Personal Protective Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Company, Honeywell International Inc., DuPont de Nemours, Inc., Ansell Limited, MSA Safety Incorporated, Kimberly-Clark Corporation, Lakeland Industries, Inc., Alpha Pro Tech, Ltd., Radians, Inc., Bullard, JSP Limited, Delta Plus Group, Medline Industries, Inc., Protective Industrial Products, Inc., Uvex Safety Group, Top Glove Corporation Bhd, COFRA S.r.l., Lindström Group, Mallcom India Limited, Polison Corp., and FallTech contribute to innovation, geographic expansion, and service delivery in this space.

Global Personal Protective Equipment Market Industry Analysis

Growth Drivers

- Increasing Workplace Safety Regulations:The enforcement of stringent workplace safety regulations is a significant driver for the PPE market. The U.S. Occupational Safety and Health Administration (OSHA) reports over 2.8 million workplace injuries annually, prompting stricter compliance measures. Countries like Germany and Japan have also implemented rigorous safety standards, leading to a projected increase in PPE demand by approximately 15% in these regions. This regulatory environment compels industries to invest in high-quality protective gear to ensure employee safety and avoid penalties.

- Rising Awareness of Occupational Hazards:The growing awareness of occupational hazards is driving the demand for PPE across various sectors. The World Health Organization (WHO) estimates that over 1.1 million workers die annually due to work-related accidents and diseases. This alarming statistic has led to increased training and education initiatives, resulting in a rise in PPE usage in high-risk industries such as construction and manufacturing. Companies are now prioritizing employee safety, further boosting the PPE market.

- Technological Advancements in PPE Materials:Innovations in PPE materials are enhancing product performance and safety, driving market growth. The introduction of lightweight, breathable fabrics and smart textiles is increasing user comfort and functionality. For instance, the development of self-cleaning materials and integrated sensors for monitoring health metrics is attracting significant investment, with an estimated $1.5 billion allocated for R&D in advanced PPE technologies. This trend is expected to elevate the overall market value significantly.

Market Challenges

- High Cost of Advanced PPE:The high cost associated with advanced PPE remains a significant barrier to market growth. The average price of high-quality PPE is estimated to be around $150 per unit, which can be prohibitive for small and medium-sized enterprises (SMEs). This financial strain often leads to inadequate safety measures, particularly in developing regions where budget constraints are prevalent. Consequently, many companies may opt for lower-quality alternatives, undermining safety standards.

- Supply Chain Disruptions:Ongoing supply chain disruptions continue to challenge the PPE market. Global logistics issues, exacerbated by geopolitical tensions and the aftermath of the COVID-19 pandemic, are delaying the delivery of essential PPE materials. The International Monetary Fund (IMF) reports that global shipping costs have surged by approximately 30% since the pandemic, impacting manufacturers' ability to maintain inventory levels. This instability can lead to shortages and increased prices, hindering market growth.

Global Personal Protective Equipment Market Future Outlook

The future of the PPE market appears promising, driven by technological advancements and increasing regulatory pressures. As industries continue to prioritize worker safety, the demand for innovative and customized PPE solutions is expected to rise. Furthermore, the integration of smart technologies and sustainable materials will likely reshape product offerings. Companies that adapt to these trends and invest in R&D will be well-positioned to capture market share and meet evolving consumer expectations in future.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present significant growth opportunities for the PPE industry. Countries like India and Brazil are projected to experience a 25% increase in PPE demand due to rapid industrialization and urbanization. This growth is driven by increased investments in infrastructure and manufacturing, necessitating enhanced safety measures to protect workers in these expanding sectors.

- Development of Smart PPE:The development of smart PPE is a burgeoning opportunity within the market. The introduction of connected devices that monitor health metrics and environmental conditions is expected to revolutionize worker safety. With an estimated $500 million investment in smart PPE technologies, companies can enhance safety protocols and improve compliance, making this a lucrative area for innovation and growth.