Region:Middle East

Author(s):Rebecca

Product Code:KRAD7463

Pages:82

Published On:December 2025

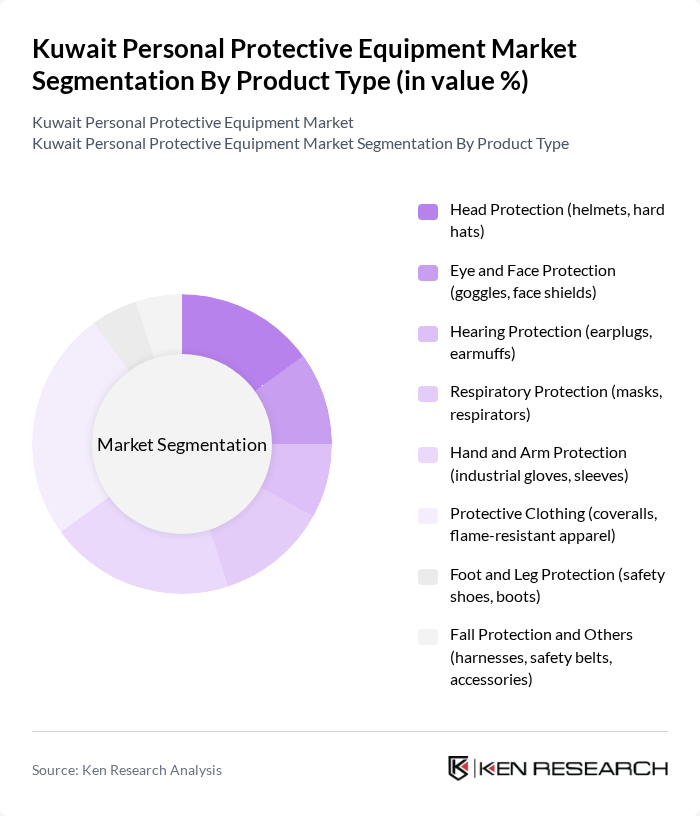

By Product Type:

The product type segmentation of the Kuwait Personal Protective Equipment market includes various categories such as Head Protection, Eye and Face Protection, Hearing Protection, Respiratory Protection, Hand and Arm Protection, Protective Clothing, Foot and Leg Protection, and Fall Protection and Others. Among these, Respiratory Protection is the leading sub-segment, driven by the increasing need for safety in hazardous work environments, particularly in construction and oil & gas sectors. The demand for masks and respirators has surged as companies prioritize worker safety and compliance with regulations.

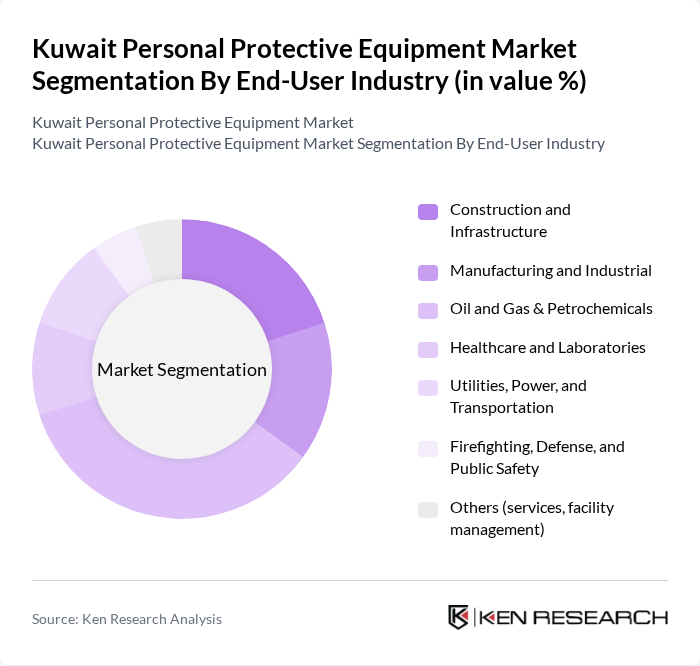

By End-User Industry:

The end-user industry segmentation of the Kuwait Personal Protective Equipment market includes Construction and Infrastructure, Manufacturing and Industrial, Oil and Gas & Petrochemicals, Healthcare and Laboratories, Utilities, Power, and Transportation, Firefighting, Defense, and Public Safety, and Others. The Construction sector is the dominant segment, driven by the high-risk nature of operations in this industry. The stringent safety regulations and the need for specialized protective gear have led to increased investments in PPE, making it a critical component of operational safety in this sector.

The Kuwait Personal Protective Equipment market is characterized by a dynamic mix of regional and international players. Leading participants such as Alshaya Group, Gulf Safety & Security Co. W.L.L., Al Bahar & Bardawil Co. for Technical Equipment, Al Dhow for Environmental Projects Company (PPE supply & safety services), 3M Company (3M Gulf), Honeywell International Inc. (Honeywell Safety Products), DuPont de Nemours, Inc. (DuPont Personal Protection), Ansell Limited, MSA Safety Incorporated, Lakeland Industries, Inc., Radians, Inc., JSP Limited, Bullard Company, Uvex Safety Group, Delta Plus Group, Kimberly-Clark Corporation, Cordova Safety Products, Ergodyne Corporation, PIP Global (Protective Industrial Products) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait personal protective equipment market appears promising, driven by increasing regulatory compliance and a growing emphasis on workplace safety. As the construction and industrial sectors expand, the demand for innovative and high-quality PPE is expected to rise. Additionally, the integration of smart technology and sustainable materials into PPE products will likely enhance user experience and safety, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Head Protection (helmets, hard hats) Eye and Face Protection (goggles, face shields) Hearing Protection (earplugs, earmuffs) Respiratory Protection (masks, respirators) Hand and Arm Protection (industrial gloves, sleeves) Protective Clothing (coveralls, flame-resistant apparel) Foot and Leg Protection (safety shoes, boots) Fall Protection and Others (harnesses, safety belts, accessories) |

| By End-User Industry | Construction and Infrastructure Manufacturing and Industrial Oil and Gas & Petrochemicals Healthcare and Laboratories Utilities, Power, and Transportation Firefighting, Defense, and Public Safety Others (services, facility management) |

| By Application | Industrial Safety Construction Site Safety Oil & Gas and Chemical Handling Healthcare and Infection Control Emergency Response and Firefighting Others |

| By Distribution Channel | Direct Sales and Key Accounts (oil & gas, large contractors) Specialized Safety Distributors Industrial and Hardware Retail Stores Online and E-commerce Platforms Government and Institutional Tenders |

| By Material Type | Fabric-based (cotton, aramid, non-wovens) Plastic-based (polycarbonate, PVC, ABS) Rubber and Latex Leather and Metal Components Composite and Advanced Materials |

| By Certification / Standards Compliance | EN / CE Marked (EU standards) ANSI / OSHA Compliant ISO and NFPA Certified Products Gulf / Kuwait-specific Standards and Approvals Others |

| By Region | Kuwait City Hawalli Al Ahmadi Al Jahra Farwaniya, Mubarak Al-Kabeer and Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil and Gas Industry PPE Usage | 70 | Safety Managers, Operations Supervisors |

| Construction Sector Safety Equipment | 100 | Site Managers, Procurement Officers |

| Healthcare PPE Requirements | 60 | Healthcare Administrators, Infection Control Officers |

| Manufacturing Industry Safety Gear | 50 | Production Managers, Safety Compliance Officers |

| Retail Sector PPE Insights | 40 | Store Managers, Safety Coordinators |

The Kuwait Personal Protective Equipment market is valued at approximately USD 140 million, reflecting a significant growth driven by increased awareness of workplace safety regulations and rising industrial activities, particularly in construction and oil & gas sectors.