India Tractor Market Outlook to 2025

By Vehicle Category (Agriculture and Commercial), Registration by Region (North, East, West, South) and Registration by State

Region:Asia

Author(s):Harsh Mittal

Product Code:KR1082

September 2021

6

About the Report

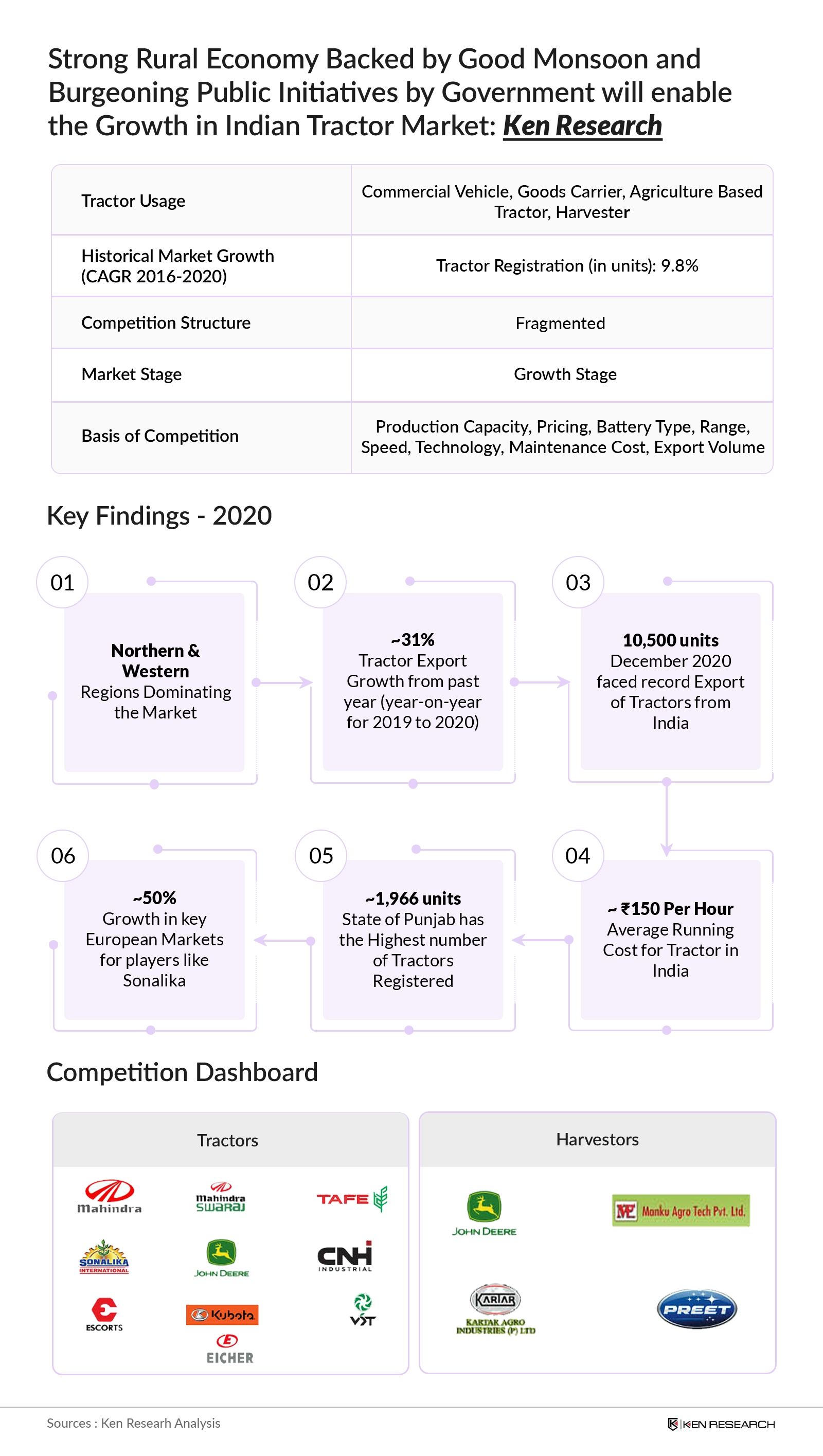

The report titled “India Tractor Market Outlook to 2025- By Vehicle Category (Agriculture and Commercial), Registration by Region (North, East, West, South) and Registration by State” provides a comprehensive analysis of growth of Tractor Market in the India. The report covers various aspects including the Tractor registrations (in units), market segmentation by, By Vehicle Category (Agriculture, Commercial), Registration by Region (North, East, West, South) and Registration by State. The report also covers Tractor industry dynamics with focus of registration volume, vehicle type, market share, registration by region etc. in India. Moreover, the report also covers the overall competitive landscape and growth drivers and trends and government role and regulations. The report concludes with market projection for future, Covid-19 impact, analysts’ take on the future and case studies highlighting the major opportunities.

India Tractor Market Overview and Size

The continuous technological advancement, along with the strong support from Central and State Government for farm mechanization, the market for the Tractors in India has been on rise. Additionally, Tractors require low maintenance & have lower cost of ownership, contributing to the increased share of the in India. With the ambition to match the international market in farm and agri-products there is an urgent need for farm mechanization. Additionally, the market is primarily driven by strict regulations, government incentives, and increasing environmental awareness. Currently, the Tractor market is dominated by agricultural tractors as compared to commercial tractors.

India Tractor Market Segmentations

By Vehicle Category: Tractors in India are mainly categorized under two segment vehicles i.e. they are mainly agricultural or commercial. Commercial tractors are those tractors that are used for carrying luggage or transporting the loads.

Registration by Region & State: Northern & Western regions accounts for majority of the Tractor registrations in India. These regions are the fastest-growing market as many automotive industries are setting up their manufacturing units in this region.

Additionally these are the agrarian majority states and thus support the demand. Apart from the measures at the national level, several state governments are also committed to promoting farm mechanization in their states to drive market growth. Government of Uttar Pradesh, Punjab, Haryana, Maharashtra, Bihar and West Bengal has taken several initiatives to promote the usage for Tractors.

Competitive Landscape of India Tractor Market:

The competition in the Tractor market in India is highly concentrated where leading manufacturers around ~40% share in the market. The major Tractor OEM include Mahindra & Mahindra Ltd, International Tractors Limited, Tafe. Limited, Escorts Limited (Agri Machinery Group), John Deere India Pvt. Ltd(Tractor Devision), Eicher Tractors, Cnh Industrial (India) Pvt. Ltd, Kubota Agricultural Machinery India Pvt.Ltd and few other. Production Capacity, Pricing, Battery Type, Range, Speed, Technology, Maintenance Cost, Export Volume are the key competing parameters for the Tractor manufactures.

India Electric Tractor Market Future Outlook and Projections

The market of tractors in India is close to one of the largest markets worldwide with rapid expansion and extensive farm mechanization. Normal and suffice monsoon growth has been the foundational driver for this growth over the years. The new found confidence in the Indian agricultural ecosystem has boasted the extensive mechanization on the wave of Green Revolution. It now constitutes one-third of the total production worldwide. On the average over the years, it has seen positive growth and promises the same healthy future. What distinguishes the Indian Tractor Market is the fact that Market Leader are of the Indian origin and are produced here only. Agricoop and NABARD have taken various initiatives to push forward the growth of the Industry.

Key Topics Covered in the Report

- India Tractor Registration Volume

- India Tractor Type (in Units)

- India Tractor Vehicle Category (in Units)

- India Tractor Vehicle Registration by Region

- India Tractor Vehicle Registration by State

- India Tractor Maker Market Share

- India Tractor Registration Volume

- India Tractor Type (in Units)

- India Tractor Vehicle Category (in Units)

- India Tractor Vehicle Registration by Region

- India Tractor Vehicle Registration by State

- India Tractor Maker Market Share

- Future Market Size and Segmentations, 2020-2025F

Products

Key Target Audience

Tractor OEMs

Consultancy Companies

Industry Associations

Regulatory Bodies

Time Period Captured in the Report:-

Historical Period – 2016-2020

Forecast Period – 2020-2025

Companies

Key Segments Covered

By Vehicle Category

Agricultural

Commercial

Registration by Region

North

East

West

South

Registration by State

Tractor Makers Covered

Mahindra & Mahindra Limited (Tractor)

Mahindra & Mahindra Limited (Swaraj Division)

International Tractors Limited

Tafe Limited

Escorts Limited (Agri Machinery Group)

John Deere India Pvt Ltd(Tractor Devision)

Eicher Tractors

Cnh Industrial (India) Pvt Ltd

Kubota Agricultural Machinery India Pvt.Ltd.

V.S.T. Tillers Tractors Limited

Force Motors Limited, A Firodia Enterprise

Captain Tractors Pvt. Ltd.

Indo Farm Equipment Limited

Vani Electric Vehicles Pvt Ltd

Harvestor Makers Covered

John Deere India Pvt Ltd

Manku Agro Tech Pvt Ltd

Kartar Agro Industries Pvt Ltd

Preet Agro Industries Pvt Ltd

Mahindra & Mahindra Limited

Malkit Agro Tech Pvt. Ltd

Guru Nanak Agri Engg Works

Dasmesh Pvt.Ltd

Cnh Industrial (India) Pvt Ltd

K.S. Agrotech Pvt Ltd

Surindera Agro Insdustries

K.S. Agricultural Industries Pvt. Ltd

Hind Agro Industries

Hira Agro Industries

Claas India P Ltd

Sonalika Industries

New Hind Agro Pvt Ltd

Punjab Agro Implements Industries

Table of Contents

1. Tractor Market Review

2. Tractor Vehicle Registration Volume (in units), 2016 - 2020

3. By Category (Commercial, Agriculture, Harvestor)

3.1 Tractor Market Size By Region (North, East, West and South), 2016 - 2020

3.2 Tractor Market Size By States (32 States), 2016 - 2020

4. Commercial Tractor Market Size, 2016 - 2020

4.1 By States (32 States)

4.2 By Region (North, East, West and South)

5. Agriculture Tractor Market Size, 2016 - 2020

5.1 By States (32 States)

5.2 By Region (North, East, West and South)

6. Harvestor Market Size, 2016 - 2020

6.1 By States (32 States)

6.2 By Region (North, East, West and South)

6.3 Key participant and their respective roles

6.4 Margin at each level

6.5 Pricing Analysis of Major Brands (Tractor and Harvestor), 2020

6.6 Marketing Strategies of Major Brands in India Agricultural Machinery Market

6.7 Leasing and Hire-Purchase for Agricultural Machinery

6.8 List of Leasing and Hire-Purchase Companies for Agricultural Machinery in India, 2020

6.9 Business Model of Leasing and Hire-purchase for Agricultural Machinery Market in India

6.10 Snapshot on India's Second Hand Tractor Market

6.11 Competitive Landscape of India's Agriculture Machinery Market

6.12 Strength and Weakness of Major Players

6.13 Heat Map Analysis

7. Market Share Analysis, 2016 - 2020

7.1 Tractor Market Market Share - National, 2016 - 2020

7.2 Tractor Market Market Share - Top 10 States , 2016 - 2020

7.3 Commercial Tractor Market Share - National, 2016 - 2020

7.4 Commercial Tractor Market Share - Top 10 States, 2016 - 2020

7.5 Agriculture Tractor Market Share - National, 2016 - 2020

7.6 Agriculture Tractor Market Share - Top 10 States, 2016 - 2020

7.7 Harvestor Market Share - National, 2016 - 2020

8. Future Tractor Market Outlook

9. Tractor Vehicle Registration Volume (in units), 2020 - 2025

10. By Category (Commercial, Agriculture, Harvestor)

10.1 Tractor Market Size By Region (North, East, West and South), 2020 - 2025

10.2 Tractor Market Size By States (32 States), 2020 - 2025

11. Analyst Recommendations

Disclaimer

Contact US

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.