Region:Europe

Author(s):Dev

Product Code:KRAA4630

Pages:100

Published On:September 2025

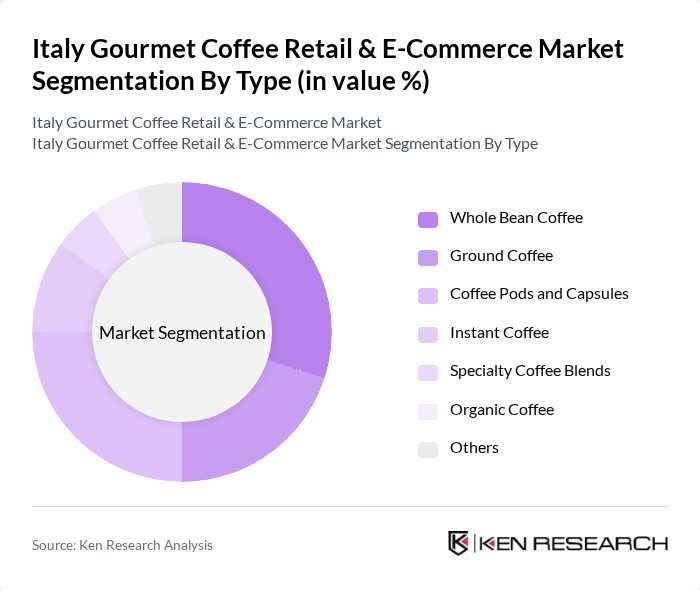

By Type:The market is segmented into various types of coffee products, including Whole Bean Coffee, Ground Coffee, Coffee Pods and Capsules, Instant Coffee, Specialty Coffee Blends, Organic Coffee, and Others. Among these, Whole Bean Coffee and Coffee Pods and Capsules are particularly popular due to their convenience and freshness, catering to the evolving preferences of consumers who seek quality and ease of preparation.

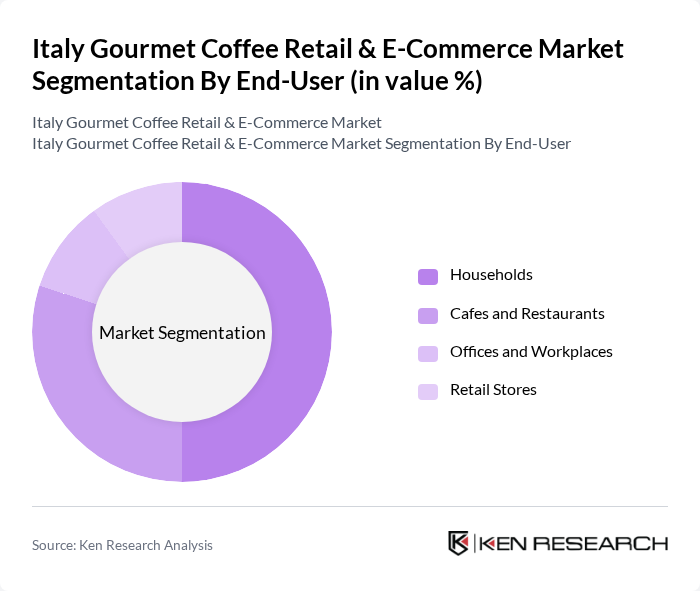

By End-User:The end-user segmentation includes Households, Cafes and Restaurants, Offices and Workplaces, and Retail Stores. Households represent the largest segment as more consumers are brewing gourmet coffee at home, driven by the growing trend of home brewing and the desire for high-quality coffee experiences.

The Italy Gourmet Coffee Retail & E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lavazza S.p.A., Illycaffè S.p.A., Segafredo Zanetti S.p.A., Kimbo S.p.A., Caffè Nero, Caffè Pascucci, Caffè Vergnano, Hausbrandt Trieste 1892 S.p.A., Ditta Artigianale, Caffè Moak, Caffè Kimbo, Caffè Bonomi, Caffè Cagliari, Caffè Guglielmo, Caffè Lavazza contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy gourmet coffee market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands focusing on ethical sourcing and eco-friendly practices are likely to gain traction. Additionally, the integration of digital marketing strategies will enhance brand visibility and consumer engagement. The anticipated growth in subscription services and personalized coffee experiences will further cater to the evolving tastes of consumers, ensuring a dynamic market landscape in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Bean Coffee Ground Coffee Coffee Pods and Capsules Instant Coffee Specialty Coffee Blends Organic Coffee Others |

| By End-User | Households Cafes and Restaurants Offices and Workplaces Retail Stores |

| By Sales Channel | Online Retail Supermarkets and Hypermarkets Specialty Coffee Shops Convenience Stores |

| By Price Range | Premium Coffee Mid-Range Coffee Budget Coffee |

| By Packaging Type | Bags Boxes Tins |

| By Flavor Profile | Dark Roast Medium Roast Light Roast |

| By Region | Northern Italy Central Italy Southern Italy Islands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Gourmet Coffee Retailers | 100 | Store Owners, Retail Managers |

| E-commerce Coffee Sales | 80 | Online Retail Managers, Digital Marketing Specialists |

| Consumer Preferences in Coffee | 150 | Coffee Enthusiasts, Regular Consumers |

| Supply Chain Stakeholders | 70 | Distributors, Importers |

| Baristas and Coffee Shop Staff | 60 | Baristas, Shop Managers |

The Italy Gourmet Coffee Retail & E-Commerce Market is valued at approximately USD 3.5 billion, reflecting a significant growth trend driven by consumer preferences for high-quality coffee and the expansion of e-commerce platforms.