Region:North America

Author(s):Geetanshi

Product Code:KRAA3243

Pages:95

Published On:September 2025

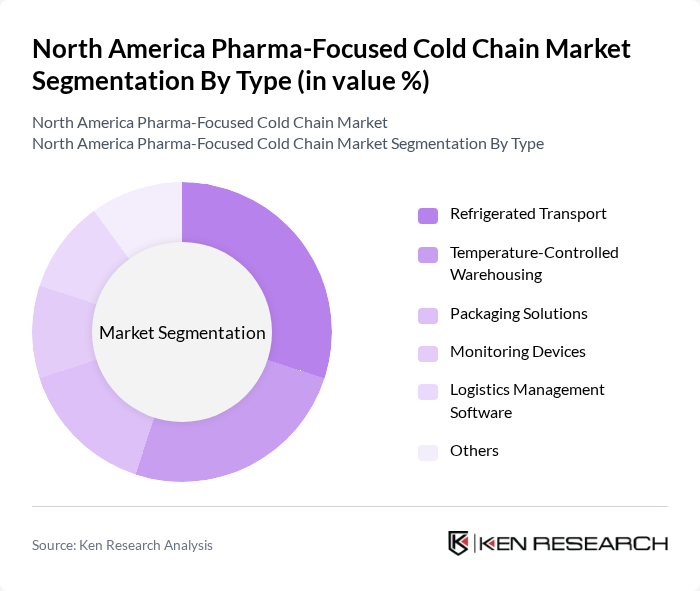

By Type:The market is segmented into Refrigerated Transport, Temperature-Controlled Warehousing, Packaging Solutions, Monitoring Devices, Logistics Management Software, and Others. Each segment is essential for maintaining the quality and safety of temperature-sensitive pharmaceuticals throughout the supply chain.Refrigerated transportandtemperature-controlled warehousingare particularly critical for biologics and vaccines, whilepackaging solutionsandmonitoring devicesaddress the need for compliance and real-time temperature assurance.

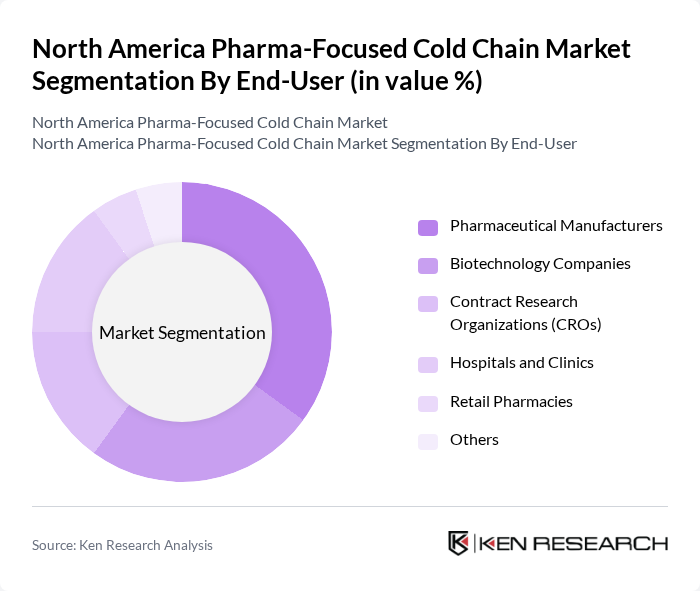

By End-User:The end-user segmentation includes Pharmaceutical Manufacturers, Biotechnology Companies, Contract Research Organizations (CROs), Hospitals and Clinics, Retail Pharmacies, and Others.Pharmaceutical manufacturersandbiotechnology companiesare the largest consumers of cold chain logistics, driven by the surge in biologics and personalized medicine.Hospitals, clinics, and retail pharmaciesare increasingly reliant on cold chain solutions to meet the growing demand for specialty drugs and vaccines.

The North America Pharma-Focused Cold Chain Market is characterized by a dynamic mix of regional and international players. Leading participants such as AmerisourceBergen Corporation, Cardinal Health, Inc., DHL Supply Chain, FedEx Corporation, UPS Healthcare, Thermo Fisher Scientific Inc., Lineage Logistics, Cold Chain Technologies, Pelican BioThermal, BioLife Solutions, Inc., Envirotainer, Cryoport, Inc., Inmark, Inc., Softbox Systems, NewCold, CSafe Global, VersaCold Logistics Services, Sonoco ThermoSafe, and World Courier (an AmerisourceBergen company) contribute to innovation, geographic expansion, and service delivery in this space.

The North America Pharma-Focused Cold Chain Market is poised for significant evolution, driven by technological advancements and increasing regulatory scrutiny. Companies are expected to adopt more sustainable practices, integrating renewable energy sources into their operations. Additionally, the rise of personalized medicine will necessitate more sophisticated cold chain solutions, ensuring product integrity. As the market adapts to these trends, investments in infrastructure and technology will be crucial for maintaining competitive advantage and meeting consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Temperature-Controlled Warehousing Packaging Solutions Monitoring Devices Logistics Management Software Others |

| By End-User | Pharmaceutical Manufacturers Biotechnology Companies Contract Research Organizations (CROs) Hospitals and Clinics Retail Pharmacies Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Cold Storage Facilities Others |

| By Payload Capacity | Small Payload (<100 kg) Medium Payload (100-1000 kg) Large Payload (>1000 kg) |

| By Application | Vaccines Blood Products Biologics Clinical Trials Cell & Gene Therapies Others |

| By Sales Channel | Online Sales Offline Sales Distributors Direct Sales |

| By Regulatory Compliance | FDA Compliance EU-GMP Standards WHO Guidelines Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 120 | Supply Chain Managers, Quality Control Officers |

| Cold Chain Logistics Providers | 90 | Operations Managers, Logistics Coordinators |

| Healthcare Institutions | 70 | Pharmacy Directors, Procurement Specialists |

| Regulatory Bodies | 40 | Compliance Officers, Policy Analysts |

| Technology Providers for Cold Chain | 60 | Product Managers, R&D Engineers |

The North America Pharma-Focused Cold Chain Market is valued at approximately USD 7 billion, reflecting a specialized segment dedicated to the logistics of temperature-sensitive pharmaceuticals, including vaccines and biologics, driven by increasing healthcare demands and chronic disease prevalence.