Region:Middle East

Author(s):Shubham

Product Code:KRAD0917

Pages:80

Published On:November 2025

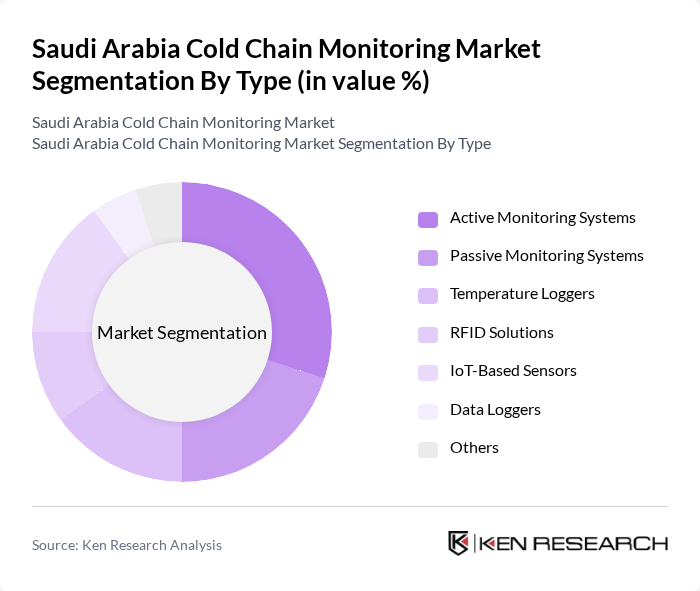

By Type:The market is segmented into various types of cold chain monitoring systems, including Active Monitoring Systems, Passive Monitoring Systems, Temperature Loggers, RFID Solutions, IoT-Based Sensors, Data Loggers, and Others. Each of these sub-segments plays a crucial role in ensuring the integrity of temperature-sensitive products throughout the supply chain. Active and IoT-based solutions are increasingly favored due to real-time tracking and compliance requirements .

TheActive Monitoring Systemssub-segment is currently dominating the market due to their ability to provide real-time data and alerts regarding temperature fluctuations. This capability is crucial for industries such as pharmaceuticals and food and beverage, where maintaining specific temperature ranges is essential for product safety and compliance. The increasing adoption of IoT technology further enhances the effectiveness of these systems, making them a preferred choice among businesses looking to optimize their cold chain operations .

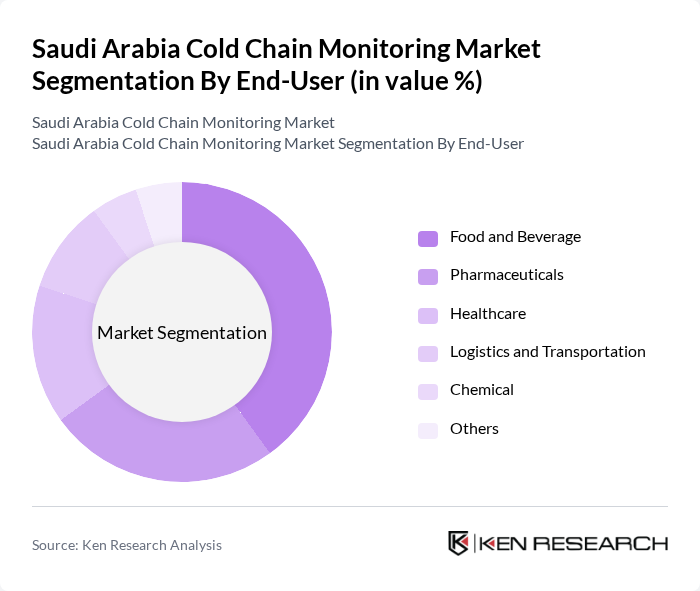

By End-User:The market is segmented by end-users, including Food and Beverage, Pharmaceuticals, Healthcare, Logistics and Transportation, Chemical, and Others. Each sector has unique requirements for cold chain monitoring, influencing the demand for specific monitoring solutions. The food and pharmaceutical industries are the largest adopters, driven by strict regulatory requirements and the need to ensure product integrity .

TheFood and Beveragesector is the leading end-user in the cold chain monitoring market, driven by the need to maintain product quality and safety during transportation and storage. The increasing consumer demand for fresh and perishable goods, combined with the growth of e-commerce and home delivery services, has prompted companies to invest in advanced monitoring solutions to ensure compliance with safety regulations and minimize spoilage. The pharmaceutical sector is also experiencing rapid growth due to the expansion of biopharmaceuticals and personalized medicine, both of which require stringent temperature control .

The Saudi Arabia Cold Chain Monitoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as United Warehousing & Distribution Services, Almarai Company, Cold Chain Technologies, Controlant, Sensitech, Zest Labs, Monnit Corporation, Berlinger & Co. AG, Elpro-Buchs AG, Tive Inc., ORBCOMM, Emerson, Digi International, TempGenius, LogTag Recorders, Gulf Warehousing Company (GWC), GFH Logistics, Agility Logistics, RMT contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain monitoring market in Saudi Arabia appears promising, driven by technological advancements and increasing consumer expectations for food safety. The integration of IoT and AI technologies is expected to enhance real-time monitoring capabilities, improving efficiency and reducing waste. Additionally, the expansion of e-commerce and online food delivery services will further necessitate robust cold chain solutions, ensuring that temperature-sensitive products are delivered safely and efficiently to consumers across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Active Monitoring Systems Passive Monitoring Systems Temperature Loggers RFID Solutions IoT-Based Sensors Data Loggers Others |

| By End-User | Food and Beverage Pharmaceuticals Healthcare Logistics and Transportation Chemical Others |

| By Temperature Range | Chilled (2°C to 8°C) Frozen (-18°C and below) Ambient (15°C to 25°C) Ultra-Low (-80°C and below) Others |

| By Component | Hardware Software Services Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Application | Food Storage Transportation Retail Pharmaceuticals & Life Sciences Meat, Fish & Poultry Dairy & Horticulture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Cold Chain Management | 60 | Supply Chain Managers, Quality Assurance Officers |

| Food and Beverage Cold Storage | 90 | Operations Managers, Logistics Coordinators |

| Retail Cold Chain Solutions | 50 | Retail Managers, Inventory Control Specialists |

| Technology Providers in Cold Chain Monitoring | 40 | Product Managers, Technical Sales Representatives |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Compliance Officers |

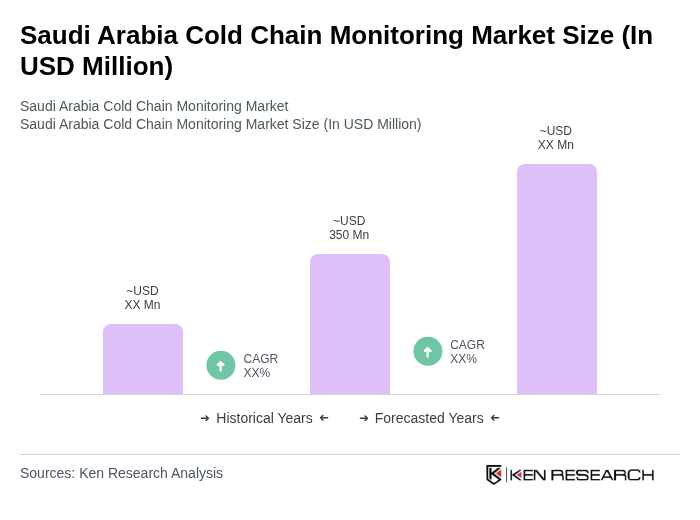

The Saudi Arabia Cold Chain Monitoring Market is valued at approximately USD 350 million, driven by the increasing demand for temperature-sensitive products in sectors like food and pharmaceuticals, along with advancements in logistics infrastructure and monitoring technologies.