Region:Middle East

Author(s):Dev

Product Code:KRAB7565

Pages:99

Published On:October 2025

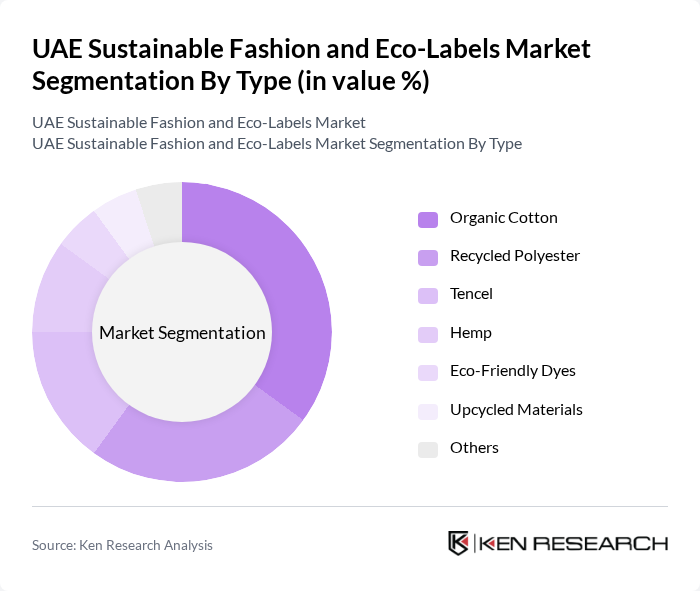

By Type:The market is segmented into various types of sustainable materials, including Organic Cotton, Recycled Polyester, Tencel, Hemp, Eco-Friendly Dyes, Upcycled Materials, and Others. Among these, Organic Cotton is currently the leading sub-segment due to its widespread acceptance and demand among eco-conscious consumers. The increasing awareness of the harmful effects of conventional cotton farming practices has driven consumers towards organic alternatives, making it a preferred choice in sustainable fashion.

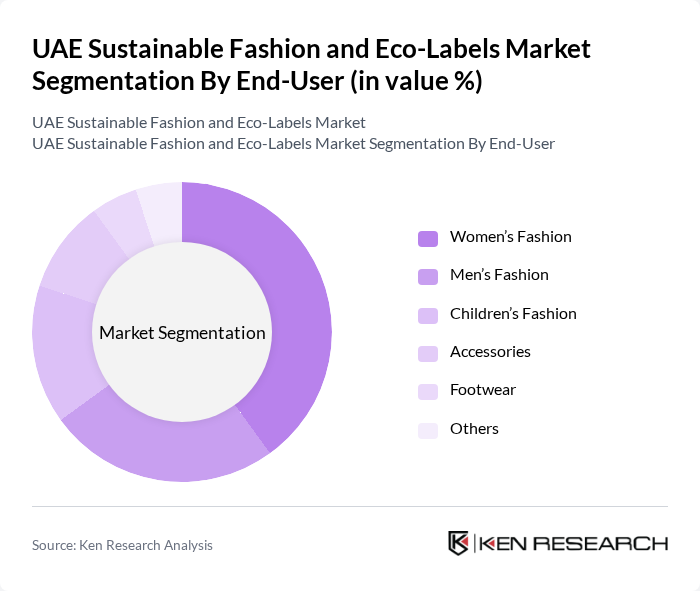

By End-User:The end-user segmentation includes Women’s Fashion, Men’s Fashion, Children’s Fashion, Accessories, Footwear, and Others. Women’s Fashion is the dominant segment, driven by a growing trend of sustainable clothing among female consumers who are increasingly seeking eco-friendly options. This demographic is more likely to invest in sustainable brands, leading to a significant market share for women’s fashion in the sustainable segment.

The UAE Sustainable Fashion and Eco-Labels Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stella McCartney, Reformation, Eileen Fisher, Veja, Amour Vert, People Tree, Patagonia, Thought Clothing, Toms, Allbirds, Outerknown, Nudie Jeans, Girlfriend Collective, Rapanui, PACT contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE sustainable fashion market appears promising, driven by increasing consumer demand for eco-friendly products and supportive government policies. As the market matures, brands are expected to innovate further, focusing on transparency and ethical practices. The rise of digital platforms will facilitate greater access to sustainable fashion, allowing brands to reach a broader audience. Additionally, collaborations with local artisans and eco-activists will enhance brand authenticity and consumer trust, fostering a more sustainable fashion ecosystem in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Cotton Recycled Polyester Tencel Hemp Eco-Friendly Dyes Upcycled Materials Others |

| By End-User | Women’s Fashion Men’s Fashion Children’s Fashion Accessories Footwear Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Pop-Up Shops Wholesale Distributors Others |

| By Price Range | Premium Mid-Range Budget Others |

| By Brand Positioning | Luxury Sustainable Brands Mass Market Sustainable Brands Niche Sustainable Brands Others |

| By Material Source | Locally Sourced Materials Imported Sustainable Materials Recycled Materials Others |

| By Consumer Demographics | Millennials Gen Z Working Professionals Eco-Conscious Consumers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Insights on Eco-Labels | 150 | Fashion Consumers, Eco-conscious Shoppers |

| Retailer Perspectives on Sustainable Fashion | 100 | Store Managers, Brand Representatives |

| Designer Views on Eco-Friendly Practices | 80 | Fashion Designers, Product Developers |

| Industry Expert Opinions on Market Trends | 60 | Sustainability Consultants, Fashion Analysts |

| Government and NGO Insights on Regulations | 50 | Policy Makers, Environmental Advocates |

The UAE Sustainable Fashion and Eco-Labels Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer awareness and demand for ethically produced fashion items.