Region:Middle East

Author(s):Dev

Product Code:KRAD1781

Pages:98

Published On:November 2025

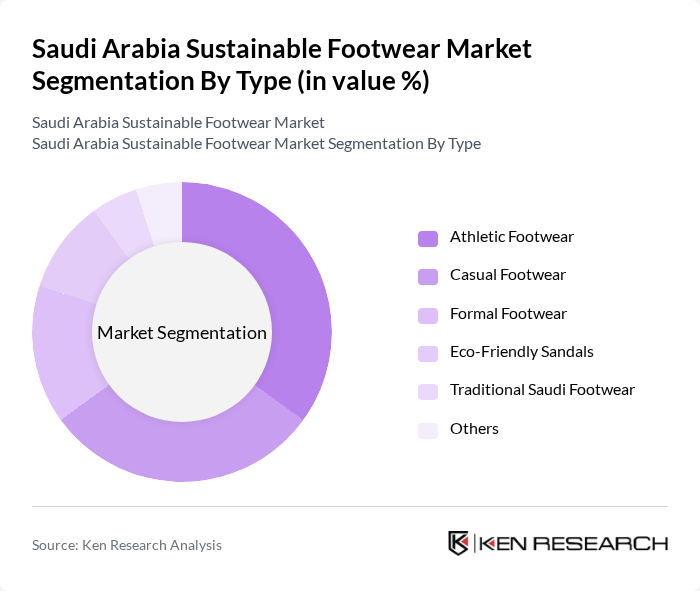

By Type:The market is segmented into various types of footwear, including Athletic Footwear, Casual Footwear, Formal Footwear, Eco-Friendly Sandals, Traditional Saudi Footwear (e.g., Najdi sandals, locally-made eco-friendly slippers), and Others. Among these, Athletic Footwear is gaining traction due to the increasing focus on health and fitness among consumers, as well as the popularity of sports and active lifestyles. Casual Footwear also holds a significant share, catering to the everyday needs of consumers and reflecting a trend towards comfort, versatility, and contemporary style preferences .

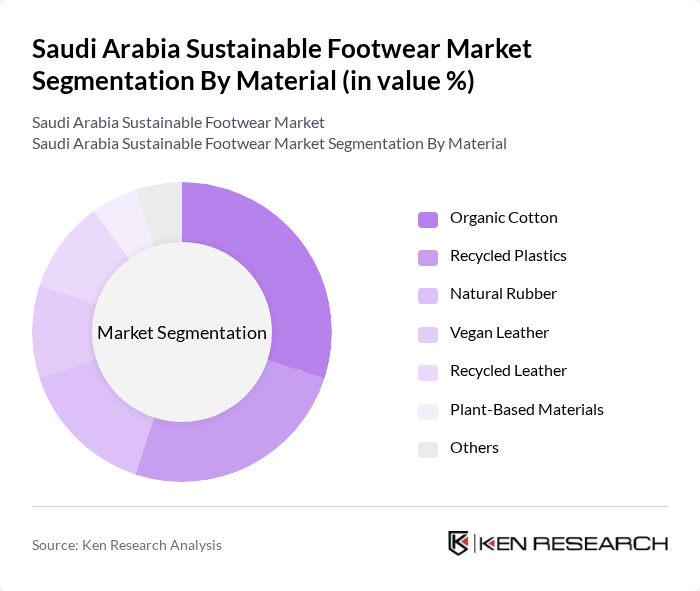

By Material:The market is also segmented by material, including Organic Cotton, Recycled Plastics, Natural Rubber, Vegan Leather, Recycled Leather, Plant-Based Materials (e.g., cactus leather, date palm fibers), and Others. Organic Cotton and Recycled Plastics are leading materials due to their eco-friendly properties and strong consumer preference for sustainable options. The adoption of Plant-Based Materials is increasing, driven by innovation and the desire for biodegradable and renewable alternatives in footwear manufacturing .

The Saudi Arabia Sustainable Footwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ecoalf, Veja, Allbirds, TOMS, Rothy's, Native Shoes, Nisolo, Oliberté, Saola Shoes, BIRKENSTOCK, PUMA (Sustainable Line), Adidas (Sustainable Line), Nike (Sustainable Line), Reebok (Sustainable Line), Timberland (Sustainable Line), Fyunka (Saudi Arabia), Namshi (Private Label Sustainable Footwear), Shoemart (Landmark Group, Sustainable Collections), Sela (Saudi-based, eco-friendly initiatives), Skechers (Sustainable Line, Saudi Market) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the sustainable footwear market in Saudi Arabia appears promising, driven by increasing consumer demand for eco-friendly products and supportive government policies. As awareness of sustainability continues to grow, brands are likely to innovate and adapt their offerings to meet consumer preferences. Additionally, the integration of technology in production processes will enhance efficiency and reduce costs, making sustainable footwear more accessible. The market is poised for significant growth as these trends converge, creating a robust landscape for sustainable brands.

| Segment | Sub-Segments |

|---|---|

| By Type | Athletic Footwear Casual Footwear Formal Footwear Eco-Friendly Sandals Traditional Saudi Footwear (e.g., Najdi sandals, locally-made eco-friendly slippers) Others |

| By Material | Organic Cotton Recycled Plastics Natural Rubber Vegan Leather Recycled Leather Plant-Based Materials (e.g., cactus leather, date palm fibers) Others |

| By Gender | Men's Footwear Women's Footwear Children's Footwear Unisex Footwear Others |

| By Distribution Channel | Online Retail Specialty Stores Department Stores Direct Sales Hypermarkets & Supermarkets Others |

| By Price Range | Budget Footwear Mid-Range Footwear Premium Footwear Luxury Footwear Others |

| By Age Group | Children (0-12 years) Teenagers (13-19 years) Adults (20-60 years) Seniors (60+ years) Others |

| By Usage | Everyday Wear Sports and Fitness Formal Occasions Outdoor Activities Religious/Traditional Occasions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Awareness of Sustainable Footwear | 120 | General Consumers, Eco-conscious Shoppers |

| Retailer Insights on Sustainable Product Offerings | 60 | Store Managers, Product Buyers |

| Manufacturer Perspectives on Sustainability Practices | 40 | Production Managers, Sustainability Officers |

| Market Trends and Consumer Preferences | 80 | Fashion Industry Experts, Trend Analysts |

| Impact of Government Policies on Sustainable Footwear | 50 | Policy Makers, Environmental Consultants |

The Saudi Arabia Sustainable Footwear Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer awareness of environmental sustainability and the demand for eco-friendly products.