Region:North America

Author(s):Geetanshi

Product Code:KRAD0006

Pages:99

Published On:August 2025

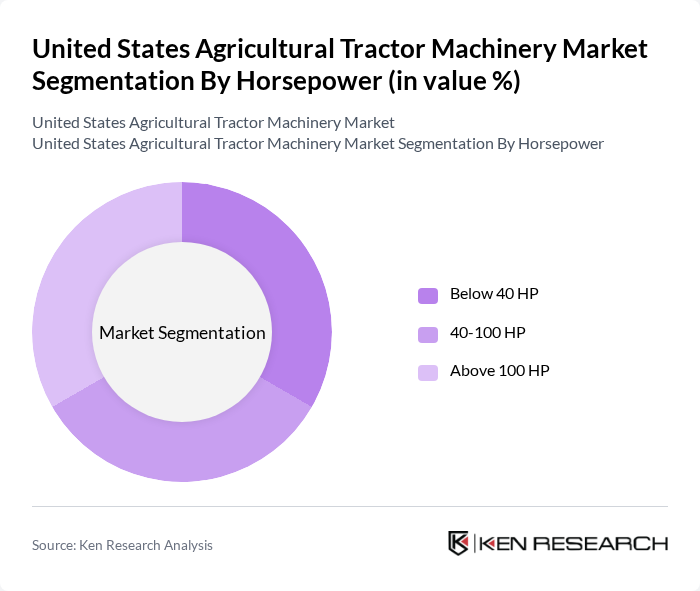

By Horsepower:The horsepower segmentation includes various categories that cater to different farming needs. The subsegments are Below 40 HP, 40-100 HP, and Above 100 HP. Each category serves distinct agricultural applications, with smaller tractors being ideal for gardens, orchards, and small-scale farming, while larger tractors are suited for extensive row crop and commercial farming operations .

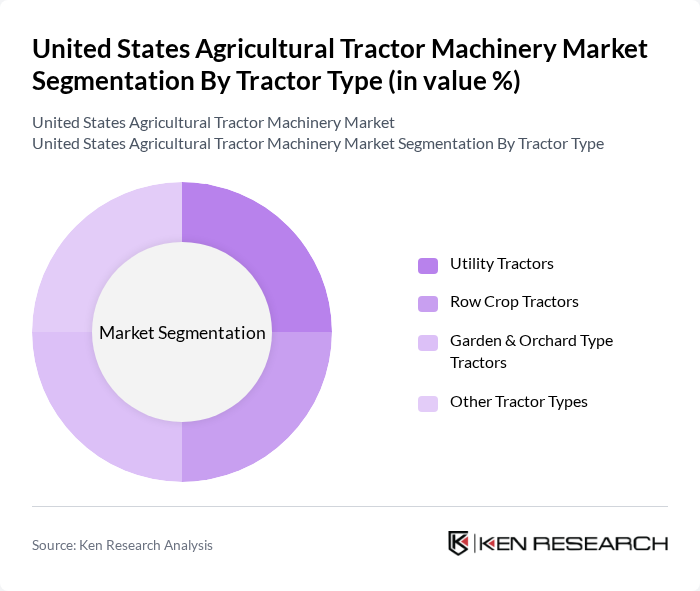

By Tractor Type:This segmentation encompasses Utility Tractors, Row Crop Tractors, Garden & Orchard Type Tractors, and Other Tractor Types. Each type is designed for specific agricultural tasks, with utility tractors being versatile for a range of applications, row crop tractors specialized for large-scale row farming, garden and orchard tractors for specialty crops, and other types serving niche or emerging needs .

The United States Agricultural Tractor Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as John Deere, Caterpillar Inc., AGCO Corporation, CNH Industrial N.V., Kubota Corporation, Mahindra & Mahindra Ltd., Case IH, New Holland Agriculture, Trimble Inc., Trelleborg AB, Yanmar Co., Ltd., Bobcat Company, Landini Tractors, Deutz-Fahr, Claas Group, Monarch Tractor contribute to innovation, geographic expansion, and service delivery in this space .

The future of the United States agricultural tractor machinery market appears promising, driven by ongoing technological advancements and increasing demand for sustainable practices. As farmers continue to adopt precision agriculture and automation, the market is expected to evolve significantly. Additionally, government support for sustainable farming initiatives will likely encourage further investment in modern machinery. The integration of IoT and smart technologies will enhance operational efficiency, positioning the market for robust growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Horsepower | Below 40 HP 100 HP Above 100 HP |

| By Tractor Type | Utility Tractors Row Crop Tractors Garden & Orchard Type Tractors Other Tractor Types |

| By Propulsion Type | Internal Combustion Engine Tractors Electric Tractors Hybrid Tractors |

| By Drive Type | WD Tractors WD Tractors |

| By Application | Crop Production Livestock Management Land Preparation Harvesting |

| By End-User | Large-Scale Farms Small and Medium-Sized Farms Agricultural Cooperatives Government and Public Sector |

| By Distribution Channel | Direct Sales Dealers and Distributors Online Sales Auctions |

| By Price Range | Low-End Tractors Mid-Range Tractors High-End Tractors |

| By Brand | Major Brands Regional Brands Emerging Brands |

| By Technology | Conventional Tractors Electric Tractors Autonomous Tractors Hybrid Tractors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Tractor Sales and Usage | 120 | Farm Owners, Equipment Managers |

| Harvesting Machinery Insights | 90 | Agricultural Engineers, Crop Consultants |

| Market Trends in Precision Agriculture | 60 | Agri-tech Innovators, Farm Technology Specialists |

| Regional Machinery Adoption Rates | 100 | State Agricultural Extension Agents, Local Farmers |

| Impact of Sustainability on Machinery Choices | 70 | Sustainability Officers, Agricultural Policy Makers |

The United States Agricultural Tractor Machinery Market is valued at approximately USD 17 billion, reflecting a significant growth driven by advancements in agricultural technology and increasing demand for efficient farming practices.